U.S. Video Game Sales Rise 3% in January

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1 hour ago

0mins

Should l Buy SONY?

Source: seekingalpha

- Total Sales Growth: According to a report from Circana, total U.S. video game sales reached $4.70 billion in January 2023, reflecting a 3% year-over-year increase, indicating a stable recovery in the market, particularly in the demand for game content.

- Content Spending Increase: Game content sales amounted to $4.27 billion, also up 3%, with subscription spending rising by 23%, suggesting a growing consumer preference for ongoing content that could drive future revenue growth.

- Hardware Sales Rebound: Hardware sales rose 16% year-over-year to $248 million, primarily driven by the launch of the Nintendo Switch 2, which offset declines in PlayStation 5 and Xbox Series sales, demonstrating the positive impact of new hardware on the market.

- New Game Performance: In January's best-selling titles, Call of Duty: Black Ops 7 topped the charts again, while the newly released Code Vein II ranked 11th, highlighting the market potential and consumer interest in new game releases.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy SONY?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on SONY

Wall Street analysts forecast SONY stock price to rise

1 Analyst Rating

1 Buy

0 Hold

0 Sell

Moderate Buy

Current: 22.250

Low

34.00

Averages

34.00

High

34.00

Current: 22.250

Low

34.00

Averages

34.00

High

34.00

About SONY

Sony Group Corp is a Japan-based company engaged in the games & network services (G&NS), music, movies, entertainment technology & services (ET&S), imaging & sensing solutions (I&SS) and other businesses. It has seven business segments. G&NS segment is involved in network service business, the manufacture and sale of home video game consoles and software. The Music segment mainly includes music production, music publishing and video media platform businesses. The Movies segment mainly includes film production, television program production and media network businesses. The ET&S field mainly includes the television business, audio, video business, still image, video camera business, smartphone business and Internet-related service business. The I&SS segment mainly includes the image sensor business. The Financial segment is involved in the insurance business and banking business. The Other segment consists of activities such as disc manufacturing business and recording media business.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Total Sales Growth: According to a report from Circana, total U.S. video game sales reached $4.70 billion in January 2023, reflecting a 3% year-over-year increase, indicating a stable recovery in the market, particularly in the demand for game content.

- Content Spending Increase: Game content sales amounted to $4.27 billion, also up 3%, with subscription spending rising by 23%, suggesting a growing consumer preference for ongoing content that could drive future revenue growth.

- Hardware Sales Rebound: Hardware sales rose 16% year-over-year to $248 million, primarily driven by the launch of the Nintendo Switch 2, which offset declines in PlayStation 5 and Xbox Series sales, demonstrating the positive impact of new hardware on the market.

- New Game Performance: In January's best-selling titles, Call of Duty: Black Ops 7 topped the charts again, while the newly released Code Vein II ranked 11th, highlighting the market potential and consumer interest in new game releases.

See More

- Credit Ratings Affirmed: AM Best has affirmed PMG Assurance Ltd.'s Financial Strength Rating of A (Excellent) and Long-Term Issuer Credit Rating of 'a+' (Excellent) with a stable outlook, reflecting its strong balance sheet and operating performance.

- Strong Capitalization: PMG's risk-adjusted capitalization is assessed at the strongest level, with excellent liquidity, low underwriting leverage, and a conservative investment strategy supporting its very strong balance sheet, showcasing its competitive edge in the industry.

- Outstanding Operating Performance: PMG consistently outperforms industry averages in its combined and operating ratios, driven by favorable underwriting results and a low underwriting expense structure, despite potential earnings volatility from low-frequency, high-severity risks.

- Strategic Role: As Sony Group's only captive insurer, PMG plays a crucial role in meeting global insurance needs and providing risk management services, enhancing its strategic position within the Sony group.

See More

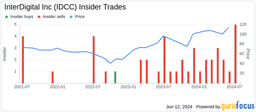

- Patent License Expansion: InterDigital's new patent license agreement with Sony covers all of Sony's end-user devices, involving wireless, video, and AI technologies, thereby expanding InterDigital's global patent portfolio.

- Long-term Partnership: Sony's renewal as a long-term licensee indicates its ongoing reliance on InterDigital's patents, although InterDigital's shares fell 2.4% in premarket trading following the announcement.

- Market Reaction: Following the announcement of the agreement, both InterDigital and Sony's stock prices declined, reflecting a cautious market sentiment that may impact investor confidence.

- Future Outlook: InterDigital aims to achieve $1 billion in annual recurring revenue by 2030, with expectations that this agreement will drive growth in its licensing business, despite the short-term stock performance being underwhelming.

See More

- Market Growth Forecast: According to Circana's latest projections, total spending in the U.S. video game industry is expected to rise 3% to $62.8 billion by 2026, indicating a strong recovery in the industry, especially following the all-time high of $61.7 billion set in 2021.

- Gaming Frenzy Drivers: Circana's video game industry advisor Mat Piscatella noted that the second year of Nintendo Switch 2 and unprecedented anticipation for Grand Theft Auto VI will drive demand for content and hardware, further invigorating the market.

- Consumer Behavior Shifts: It is estimated that about 38% of consumers would purchase fewer full-price games at launch due to tariffs or other factors, while 34% would wait longer for discounts, and 27% would spend more time on free-to-play games, reflecting increased price sensitivity in the market.

- Hardware Market Challenges: Piscatella warned that the hardware segment is expected to face challenges as surging costs for RAM, GPUs, CPUs, and storage driven by AI data center demand could limit availability and raise prices, impacting overall market performance.

See More

- Executive Shakeup Impact: PayPal's CEO Alex Chris is replaced after less than two years, resulting in a nearly 20% drop in stock price following earnings reports, indicating strong market reaction to management changes that could undermine investor confidence.

- Performance Decline Warning: While PayPal reported a 9% increase in total payment volume, a 5% drop in transactions per active account highlights challenges in user growth and profitability, potentially affecting future market competitiveness.

- New CEO Challenges: The appointment of Enrique Lores raises concerns due to his lackluster performance at HP, leading investors to question his ability to effectively drive PayPal's transformation, which may impact the company's strategic direction.

- Market Valuation Slump: With a current P/E ratio around 8.5, significantly below market averages, PayPal is seen as a value investment opportunity; however, investor concerns about future growth may lead to further stock price pressure.

See More

- Executive Shakeup Impact: PayPal's CEO Alex Chris is replaced after less than two years, leading to a nearly 20% drop in stock price, indicating investor unease about the company's future direction amidst challenges in the payment processing sector.

- Performance Decline Warning: Despite a 5% drop in transaction volume over the past year, PayPal is focusing on its most profitable products, yet skepticism about new CEO Enrique Lores' capabilities has resulted in significant stock volatility.

- Investor Confidence Eroded: PayPal's stock has fallen approximately 27% during Chris's tenure and nearly 43% from its peak, reflecting a decline in investor trust in management, particularly in a fiercely competitive market.

- Uncertain Future Outlook: Although PayPal's current P/E ratio is just 8.5, significantly below market levels, some analysts view this as a potential value trap, while others believe there are still growth opportunities under new leadership.

See More