Planet Labs Leverages AI to Unlock Earth Data Value

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 04 2026

0mins

Should l Buy GSAT?

Source: Yahoo Finance

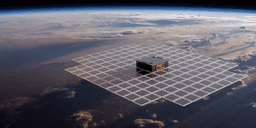

- Data-Driven AI Application: Planet Labs utilizes its Dove satellites to capture hundreds of thousands of images of Earth daily, accumulating over eight years of vast data, and through AI analysis, it achieves instant insights, enhancing data utilization efficiency and driving business growth.

- Global Connectivity Solution: Global Star is collaborating with Apple to provide global SMS services for iPhone 14 and above users, which is expected to significantly enhance user experience and has driven the company's stock price up over 100%.

- Lunar Exploration Opportunity: Intuitive Machines is making an acquisition to enter the satellite manufacturing sector and plans to launch its first satellite to the moon in 2026, supporting NASA's communication network, which is expected to yield long-term benefits for the company.

- Policy-Supported Space Development: Trump's space agenda emphasizes establishing a permanent presence on the moon by 2030, providing strategic opportunities for Intuitive Machines and further driving its investments and project developments in the space industry.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GSAT?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GSAT

Wall Street analysts forecast GSAT stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for GSAT is 67.00 USD with a low forecast of 60.00 USD and a high forecast of 75.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

5 Analyst Rating

3 Buy

2 Hold

0 Sell

Moderate Buy

Current: 54.130

Low

60.00

Averages

67.00

High

75.00

Current: 54.130

Low

60.00

Averages

67.00

High

75.00

About GSAT

Globalstar, Inc. is an international telecom infrastructure provider. It provides mobile satellite services, including voice and data communications and wholesale capacity services through its global satellite network. Its low earth orbit (LEO) satellite constellation ensures secure data transmission for connecting and protecting assets, transmitting critical operational data, and saving lives for consumers, businesses, and government agencies across the globe. Its terrestrial spectrum, Band 53, and its 5G variant, n53, offer carriers, cable companies, and system integrators a versatile, fully licensed channel for private networks to improve customer wireless connectivity, while its XCOM RAN product offers capacity gains in dense wireless deployments. In addition to SPOT GPS messengers, it offers Internet of things (IoT) hardware and software products for tracking and monitoring assets, processing smart data at the edge, and managing analytics with cloud-based telematics solutions.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Network Capability Enhancement: Globalstar announced a partnership with Boingo Wireless to integrate XCOM RAN into its private network infrastructure, aiming to enhance connectivity at critical locations such as airports and hospitals, thereby improving customer experience and addressing increasing security demands.

- Successful Technical Validation: Following a technical evaluation, Boingo confirmed that XCOM RAN delivers reliable private connectivity across multiple frequency bands and deployment models, showcasing its robust performance in high-traffic environments and further solidifying its market leadership.

- Innovative Private Network Architecture: The Supercell architecture of XCOM RAN not only increases network capacity by four times but also simplifies the deployment process, reducing the need for site surveys, enabling rapid and seamless integration in industrial environments, and enhancing operational efficiency.

- Industry Recognition and Future Outlook: Boingo's private networks recently won the 2025 TeckNexus Private Network Leadership Awards, highlighting their transformative connectivity capabilities in high-traffic environments, and they will continue to collaborate with Globalstar to promote the widespread adoption of private 5G solutions.

See More

- Broad User Coverage: According to an FCC report, SpaceX's first-generation service covers over 400 million people, with more than 6 million customers accessing it monthly, demonstrating its strong market appeal and user base.

- Intensifying Competition: The FCC noted that AST SpaceMobile plans to deploy 45 to 60 satellites and initiate commercial direct-to-device services in 2026, indicating that market competition is accelerating and SpaceX needs to strengthen its market position.

- Technology Upgrade Plans: SpaceX aims to launch its second-generation Starlink system in 2027, which is expected to significantly enhance its direct-to-device service capabilities, thereby strengthening its competitive edge against traditional providers like Verizon and AT&T.

- Market Sentiment Shifts: While retail sentiment on SpaceX remains in the 'bearish' territory, AST SpaceMobile's sentiment stays 'bullish', highlighting significant differences in investor expectations across different companies.

See More

- Contract Awarded: AST SpaceMobile has been awarded a contract for the MDA's SHIELD program, enabling participation in the development, testing, and maintenance of critical defense systems, thereby enhancing U.S. national security.

- Technology Utilization: The company will leverage its low-Earth orbit satellite network to provide secure communications, sensing, and command-and-control capabilities, improving the responsiveness and operational resilience of missile defense systems.

- Market Competition: AST SpaceMobile faces competition from Globalstar and Viasat, both of which are also providing secure satellite communication solutions for the U.S. military, highlighting the importance of commercial space in national security.

- Stock Performance: AST SpaceMobile's shares have skyrocketed 457.1% over the past year, significantly outpacing the industry's 29.8% growth, reflecting strong market confidence in its future prospects.

See More

- Stock Performance: AST SpaceMobile's stock experienced an increase early Friday, building on gains from the previous day.

- Investor Sentiment: There is growing excitement among investors regarding the company's potential expansion into the defense sector.

See More

- Stock Volatility: Globalstar shares surged 5% on Tuesday after Clear Street raised its price target to $71, but the stock fell 9.6% on Wednesday, indicating market concerns about its future prospects.

- Contract Advantage: Clear Street noted that Globalstar's contract with Apple de-risks the company; however, Scotiabank cautioned investors to consider its competitive disadvantages against SpaceX's Starlink.

- Market Competition: SpaceX launches over 3,000 satellites annually, while Globalstar has only 24 in orbit, a disparity that could significantly impact its market share and profitability.

- Profit Outlook: Globalstar has only turned a profit once in the past decade and is not expected to be profitable again until 2027, raising investor doubts about its long-term sustainability.

See More

- Stock Volatility: Globalstar's shares surged 5% after Clear Street raised its price target to $71, but subsequently plummeted 9.6% due to negative reports regarding rival AST SpaceMobile, indicating significant market sentiment fluctuations.

- Competitive Pressure: Analysts highlight that Globalstar lags behind SpaceX's Starlink in terms of satellite count and brand recognition, with Starlink launching over 3,000 satellites annually compared to Globalstar's approximately 24, which may hinder its market competitiveness.

- Uncertain Profit Outlook: Having only achieved full-year profitability once in the past decade, Globalstar is not expected to return to profitability until 2027, raising investor concerns about its future earnings potential, especially in a competitive landscape.

- Investment Recommendations: While Clear Street views Globalstar's contract with Apple as a risk mitigator, other analysts express caution regarding its future performance, as the Motley Fool's analyst team did not include it in their recommended stocks, reflecting market skepticism about its prospects.

See More