CME: DELAY IN METAL SETTLEMENT PUBLICATION HAS BEEN ADDRESSED.

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1d ago

0mins

Should l Buy CME?

Source: moomoo

- Resolution of Delays: The issue causing the delayed public publication of metal settlements has been resolved.

- Impact on Stakeholders: This resolution is expected to positively impact stakeholders awaiting the publication of these settlements.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy CME?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on CME

Wall Street analysts forecast CME stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for CME is 285.90 USD with a low forecast of 209.00 USD and a high forecast of 320.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

10 Analyst Rating

4 Buy

4 Hold

2 Sell

Hold

Current: 297.380

Low

209.00

Averages

285.90

High

320.00

Current: 297.380

Low

209.00

Averages

285.90

High

320.00

About CME

CME Group Inc. provides a derivatives marketplace. The Company enables clients to trade futures, options, cash and over the counter (OTC) markets, optimize portfolios, and analyze data. It exchanges offer a range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange (FX), energy, agricultural products and metals. It offers futures and options on futures trading through the CME Globex platform, fixed income trading via BrokerTec and FX trading on the EBS platform. In addition, it operates central counterparty clearing provider, CME Clearing. Its products provide a means for hedging, speculation and asset allocation related to the risks associated with, among other things, interest rate sensitive instruments, and changes in the prices of agricultural, energy and metal commodities. It provides clearing and settlement services for a range of exchange-traded futures and options on futures contracts and OTC derivatives.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Resolution of Delays: The issue causing the delayed public publication of metal settlements has been resolved.

- Impact on Stakeholders: This resolution is expected to positively impact stakeholders awaiting the publication of these settlements.

See More

- Extreme Price Volatility: On Thursday, spot silver prices fell by 13% to $76.97 per ounce, while futures dropped over 8%, reflecting extreme market volatility that undermines investor confidence.

- Speculative Trading Impact: Analysts indicate that recent price swings are primarily driven by speculative flows and leveraged positions rather than physical demand, suggesting unstable market sentiment that could lead to further price corrections.

- Increased Margin Requirements: The CME Group raised margin requirements following last Friday's steep sell-off, a move that may suppress speculative activity and impact market liquidity, potentially exacerbating price volatility.

- Market Comparisons: The volatility in silver prices has drawn parallels to meme stocks like GameStop from 2021, with market watchers warning that silver prices have detached from sustainable levels, which could lead to increased speculative trading and market instability.

See More

- Own Cryptocurrency Exploration: CME Group CEO Terry Duffy confirmed during the latest earnings call that the company is exploring the potential launch of its own cryptocurrency, marking the first time CME has explicitly floated the idea of issuing a proprietary asset on a decentralized network, which could have significant implications for industry participants.

- Tokenized Cash Collaboration with Google: CME is working with Google on a 'tokenized cash' solution set to launch later this year, involving a depository bank facilitating transactions, which will provide essential infrastructure support for CME's cryptocurrency initiatives.

- Technical Breakthrough and Stock Movement: CME's stock rose by 1%, successfully breaking out from an inverse head and shoulders pattern with a target price of $320, and technical indicators show strong bullish signals, further solidifying the company's position in the crypto market.

- Record Trading Volume: CME's crypto trading volume hit records last year, with an average daily trading volume reaching $12 billion, and micro-ether and micro-bitcoin futures contracts were top performers, indicating strong growth potential for the company in the cryptocurrency finance sector.

See More

- Strong Performance: CME Group reported an adjusted EPS of $2.77 for Q4, exceeding analyst expectations of $2.74, and rising from $2.68 in the previous quarter and $2.52 a year ago, indicating sustained profitability growth.

- Revenue Growth: The company achieved $1.65 billion in revenue for Q4, slightly above the consensus of $1.64 billion, and up from $1.54 billion in Q3 and $1.53 billion in the same quarter last year, reflecting robust market demand.

- Increased Transaction Fees: Clearing and transaction fees rose to $1.33 billion in Q4, up from $1.23 billion in both Q3 and the previous year, demonstrating heightened trading activity and engagement.

- Market Expansion Plans: CME Group aims to enhance the $80 billion in average daily margin efficiencies through initiatives like U.S. Treasury clearing, 24/7 cryptocurrency trading, and prediction markets, showcasing a proactive approach to future market opportunities.

See More

- Volume Growth: CME Group achieved its fifth consecutive year of record trading volume in 2025, with average daily volume increasing by 6% to 28.1 million contracts, reflecting strong performance across interest rates, energy, metals, agriculture, and cryptocurrency markets.

- Significant Customer Savings: Customers' average daily margin savings reached $80 billion across six asset classes, representing an increase of approximately $20 billion over the past year, highlighting CME's success in reducing trading costs and enhancing client value.

- Innovative Product Launches: The upcoming launch of CME Securities Clearing is set to meet the SEC's U.S. Treasury clearing mandate, while over 68 million event contracts have traded in just six weeks since launch, indicating strong market acceptance and potential revenue generation from new products.

- Strong Financial Performance: In Q4 2025, CME Group reported revenue of $1.65 billion, an 8% increase year-over-year, with adjusted net income of $1 billion and adjusted diluted earnings per share of $2.77, reflecting ongoing improvements in profitability and market competitiveness.

See More

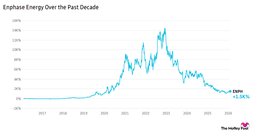

- Optimistic Earnings Outlook: Enphase Energy's stock surged over 20% in early trading despite a 24% year-over-year earnings drop to $0.71 in Q4, as the results exceeded expectations of $0.54, indicating strong market confidence in future growth.

- Strong Revenue Guidance: The company provided Q1 revenue guidance of $270-$300 million, which, while seen as a low point, reflects CEO Kothandarayanan's optimism about demand growth expected in the second half of 2026, suggesting a recovery trajectory.

- Dominance in U.S. Market: U.S. revenue accounted for 89% of total sales, driven by increased domestic solar and battery installations ahead of the expiring Section 25D tax credit, highlighting the significant impact of policy incentives on market demand.

- Stable Gross Margin: Enphase achieved a non-GAAP gross margin of 46% in Q4 despite a 5% impact from reciprocal tariffs, demonstrating resilience in cost management and profitability, which strengthens its competitive position in the renewable energy sector.

See More