Microchip Technology Surges Ahead of Earnings Amid Chip Stock Gains

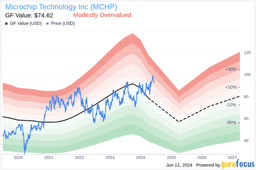

Microchip Technology Inc (MCHP) has seen a significant pre-market price increase of 6.11%, reaching a 52-week high, as investor confidence in tech stocks rises.

The surge in MCHP's stock price is attributed to a broader trend in the semiconductor sector, where companies like Nvidia and Intel have also reported gains, reflecting increased investor optimism ahead of upcoming earnings reports from major tech firms. This positive sentiment is further supported by expectations of a balanced supply-demand dynamic in the semiconductor market, as indicated by recent analyst reports.

The implications of this price movement suggest that Microchip Technology is well-positioned to capitalize on the anticipated earnings rebound in the semiconductor sector, which could enhance its market share and investor interest.

Trade with 70% Backtested Accuracy

Analyst Views on MCHP

About MCHP

About the author

- Earnings Downgrade: Microchip Technology forecasts adjusted earnings of approximately 40 cents per share for Q4, falling short of Wall Street's average estimate of 48 cents, indicating a negative impact on profitability due to memory supply constraints.

- Sales Outlook: The company anticipates net sales between $1.24 billion and $1.28 billion for Q4, slightly above the $1.23 billion estimate, suggesting some market demand despite ongoing challenges.

- Stock Reaction: Shares of Microchip fell over 5% in after-hours trading, reflecting investor concerns regarding the lowered profit expectations, which may affect future investment confidence.

- Industry Impact: The global memory supply shortage has severely impacted the personal electronics sector, forcing smartphone and PC manufacturers to cut back on orders, thereby affecting the performance of suppliers like Microchip Technology.

- Recovery Momentum: Microchip Technology's (MCHP) Q3 2026 results indicate a recovery trend, with revenues still 47% below peak levels; however, analysts note that growth is exceeding seasonal expectations, particularly in emerging sectors like automotive networking and data centers.

- Inventory Management: The company reported that inventory reserves are largely normalized, with over $50 million in underutilization in Q3, which is expected to modestly decrease in the coming quarters, thereby enhancing overall operational efficiency.

- Analyst Ratings: Morgan Stanley maintained an Equal-weight rating with a $69 price target for MCHP, while KeyBanc assigned an Overweight rating with an $85 price target, reflecting market confidence in the company's future growth prospects.

- Competitive Landscape: Despite a 3% decline in MCHP's stock price, competitors such as Texas Instruments (TXN) and Onsemi (ON) saw their stock prices rise, indicating an overall optimistic sentiment in the semiconductor industry.

- Significant Sales Growth: Microchip Technology reported net sales of $1.186 billion for Q3 2026, reflecting a 4% sequential increase and a 15.6% year-over-year growth, demonstrating strong performance in networking, data center, and FPGA business units, which further solidifies its market position.

- Design Wins Create New Opportunities: The company secured three design wins for the PCI Express Gen 6 switch, with one expected to generate over $100 million in revenue in 2027, indicating Microchip's ongoing investment in high-growth areas and robust market demand.

- Margin Improvement Continues: The non-GAAP gross margin for Q3 was 60.5%, up from 56.7% in the previous quarter, reflecting reduced inventory charges and sustained product mix strength, which is expected to support future profitability.

- Optimistic Outlook: Management anticipates net sales for Q4 2026 to reach $1.26 billion, representing a 6.2% sequential growth, with non-GAAP earnings per share projected between $0.48 and $0.52, showcasing the company's confidence in future growth.

- Net Income Recovery: Microchip Technology reported a net income of $34.9 million for Q3, translating to $0.06 per share, a significant turnaround from a net loss of $53.6 million in the same quarter last year, which enhances investor confidence in the company's financial health.

- Adjusted Income Growth: The adjusted net income for the third quarter reached $252.8 million, or $0.44 per share, compared to $107.3 million and $0.20 per share in the prior year's third quarter, indicating a robust performance amid recovering market demand.

- Sales Growth: The company achieved net sales of $1.186 billion in Q3, marking a 15.6% increase from $1.026 billion in the same quarter last year, reflecting Microchip's strengthening competitive position in the semiconductor market.

- Optimistic Outlook: Looking ahead, Microchip expects Q4 net sales between $1.240 billion and $1.280 billion, with earnings per share projected at $0.08 to $0.12, and adjusted earnings per share between $0.48 and $0.52, indicating a positive outlook for future performance.

- Amazon Earnings Miss: Amazon reported fourth-quarter earnings of $1.95 per share, falling short of the $1.97 consensus estimate, resulting in a 9% drop in shares, highlighting pressures in the competitive e-commerce landscape.

- Reddit Stock Surge: Reddit's stock rose 4% after its fourth-quarter earnings exceeded expectations, coupled with a $1 billion share buyback program, which is expected to boost investor confidence and enhance future shareholder returns.

- Molina Healthcare Loss: Molina Healthcare posted an adjusted loss of $2.75 per share, leading to a 33% decline in shares, primarily due to pressures from Medicaid premium adjustments and Medicare costs, with full-year revenue projected at $44.5 billion, below the $46.55 billion forecasted by analysts.

- Envista Strong Performance: Envista reported fourth-quarter earnings of 38 cents per share and revenue of $750.6 million, resulting in a 14% increase in shares, with expectations of 2% to 4% core sales growth in 2026, indicating robust performance in the dental products market.

- Technology Sector Decline: Qualcomm (QCOM) forecasts Q2 revenue between $10.2 billion and $11.0 billion, below the consensus of $11.18 billion, leading to an over 8% drop in its stock and exacerbating the overall decline in the Nasdaq 100 index, heightening market panic.

- Weak Labor Market Signals: Challenger's report shows January job cuts surged 117.8% year-on-year to 108,435, marking the highest level since 2009, indicating fragility in the US labor market and increasing investor concerns about economic outlook.

- Bitcoin Price Crash: Bitcoin (^BTCUSD) is down more than 7% today, hitting a 1.25-year low and falling about 45% from its October record high, reflecting negative sentiment in the cryptocurrency market and a trend of capital outflows.

- Impact of Earnings Season: Despite 150 S&P 500 companies set to report earnings this week and 81% of the 237 companies that have reported exceeding expectations, market concerns over future economic data continue to suppress stock performance, with S&P earnings growth expected to reach 8.4% in Q4.