CME Group hits 20-day low amid market strength

CME Group Inc's stock fell by 3.64% during regular trading, hitting a 20-day low. This decline occurs despite the Nasdaq-100 rising by 0.58% and the S&P 500 gaining 0.39%, indicating a disconnect between CME's performance and broader market trends.

The drop in CME's stock price can be attributed to sector rotation, as the company faces caution from investors regarding its future performance. Recent reports indicate that CME Group achieved a record average daily volume of 28.1 million contracts in 2025, reflecting strong market demand. However, the stock's current price is close to its 52-week high, suggesting that while there is confidence in CME, the market is also wary of potential pullbacks.

Investors should closely monitor CME's long-term fundamentals and market trends, especially given the recent volatility. The company's diverse product offerings across various asset classes may provide a competitive edge, but the current price fluctuations warrant careful consideration in investment strategies.

Trade with 70% Backtested Accuracy

Analyst Views on CME

About CME

About the author

- Resolution of Delays: The issue causing the delayed public publication of metal settlements has been resolved.

- Impact on Stakeholders: This resolution is expected to positively impact stakeholders awaiting the publication of these settlements.

- Extreme Price Volatility: On Thursday, spot silver prices fell by 13% to $76.97 per ounce, while futures dropped over 8%, reflecting extreme market volatility that undermines investor confidence.

- Speculative Trading Impact: Analysts indicate that recent price swings are primarily driven by speculative flows and leveraged positions rather than physical demand, suggesting unstable market sentiment that could lead to further price corrections.

- Increased Margin Requirements: The CME Group raised margin requirements following last Friday's steep sell-off, a move that may suppress speculative activity and impact market liquidity, potentially exacerbating price volatility.

- Market Comparisons: The volatility in silver prices has drawn parallels to meme stocks like GameStop from 2021, with market watchers warning that silver prices have detached from sustainable levels, which could lead to increased speculative trading and market instability.

- Own Cryptocurrency Exploration: CME Group CEO Terry Duffy confirmed during the latest earnings call that the company is exploring the potential launch of its own cryptocurrency, marking the first time CME has explicitly floated the idea of issuing a proprietary asset on a decentralized network, which could have significant implications for industry participants.

- Tokenized Cash Collaboration with Google: CME is working with Google on a 'tokenized cash' solution set to launch later this year, involving a depository bank facilitating transactions, which will provide essential infrastructure support for CME's cryptocurrency initiatives.

- Technical Breakthrough and Stock Movement: CME's stock rose by 1%, successfully breaking out from an inverse head and shoulders pattern with a target price of $320, and technical indicators show strong bullish signals, further solidifying the company's position in the crypto market.

- Record Trading Volume: CME's crypto trading volume hit records last year, with an average daily trading volume reaching $12 billion, and micro-ether and micro-bitcoin futures contracts were top performers, indicating strong growth potential for the company in the cryptocurrency finance sector.

- Strong Performance: CME Group reported an adjusted EPS of $2.77 for Q4, exceeding analyst expectations of $2.74, and rising from $2.68 in the previous quarter and $2.52 a year ago, indicating sustained profitability growth.

- Revenue Growth: The company achieved $1.65 billion in revenue for Q4, slightly above the consensus of $1.64 billion, and up from $1.54 billion in Q3 and $1.53 billion in the same quarter last year, reflecting robust market demand.

- Increased Transaction Fees: Clearing and transaction fees rose to $1.33 billion in Q4, up from $1.23 billion in both Q3 and the previous year, demonstrating heightened trading activity and engagement.

- Market Expansion Plans: CME Group aims to enhance the $80 billion in average daily margin efficiencies through initiatives like U.S. Treasury clearing, 24/7 cryptocurrency trading, and prediction markets, showcasing a proactive approach to future market opportunities.

- Volume Growth: CME Group achieved its fifth consecutive year of record trading volume in 2025, with average daily volume increasing by 6% to 28.1 million contracts, reflecting strong performance across interest rates, energy, metals, agriculture, and cryptocurrency markets.

- Significant Customer Savings: Customers' average daily margin savings reached $80 billion across six asset classes, representing an increase of approximately $20 billion over the past year, highlighting CME's success in reducing trading costs and enhancing client value.

- Innovative Product Launches: The upcoming launch of CME Securities Clearing is set to meet the SEC's U.S. Treasury clearing mandate, while over 68 million event contracts have traded in just six weeks since launch, indicating strong market acceptance and potential revenue generation from new products.

- Strong Financial Performance: In Q4 2025, CME Group reported revenue of $1.65 billion, an 8% increase year-over-year, with adjusted net income of $1 billion and adjusted diluted earnings per share of $2.77, reflecting ongoing improvements in profitability and market competitiveness.

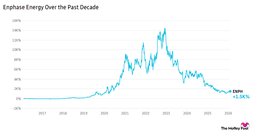

- Optimistic Earnings Outlook: Enphase Energy's stock surged over 20% in early trading despite a 24% year-over-year earnings drop to $0.71 in Q4, as the results exceeded expectations of $0.54, indicating strong market confidence in future growth.

- Strong Revenue Guidance: The company provided Q1 revenue guidance of $270-$300 million, which, while seen as a low point, reflects CEO Kothandarayanan's optimism about demand growth expected in the second half of 2026, suggesting a recovery trajectory.

- Dominance in U.S. Market: U.S. revenue accounted for 89% of total sales, driven by increased domestic solar and battery installations ahead of the expiring Section 25D tax credit, highlighting the significant impact of policy incentives on market demand.

- Stable Gross Margin: Enphase achieved a non-GAAP gross margin of 46% in Q4 despite a 5% impact from reciprocal tariffs, demonstrating resilience in cost management and profitability, which strengthens its competitive position in the renewable energy sector.