Xcel Energy Reports Q4 Earnings and 2026 Guidance

- Earnings Performance: Xcel Energy reported a Q4 GAAP EPS of $0.95, aligning with expectations, while revenue reached $3.56 billion, reflecting a 14.1% year-over-year increase but missing estimates by $220 million, indicating challenges in revenue growth.

- Future Earnings Guidance: The company projects ongoing earnings for 2026 to be between $4.04 and $4.16 per share, providing investors with a forward-looking profitability outlook, although current performance fell short of market expectations.

- Dividend Appeal: Xcel Energy is positioned as an upcoming Dividend Aristocrat, attracting investors seeking stable cash flows and dividend growth, thereby enhancing its investment appeal in the utilities sector.

- Strategic Partnership: Xcel Energy signed a memorandum of understanding with NextEra Energy to boost the delivery of generation resources, which will aid the company's expansion in the renewable energy sector and strengthen its competitive position in the market.

Trade with 70% Backtested Accuracy

Analyst Views on XEL

About XEL

About the author

- Rating Upgrade: UBS upgraded Xcel Energy (XEL) from Neutral to Buy with a price target increase from $81 to $89, forecasting a 9% EPS growth rate that exceeds the market's sub-7% expectations, indicating a significant undervaluation by investors.

- Data Center Load Growth: Xcel raised its high-probability data center load forecast to 4 GW from 2 GW during its year-end call, highlighting increasing investment opportunities in the data center sector, which enhances the sustainability of its future growth.

- Increased Investment Opportunities: The analyst noted that Xcel is seeing growing investment opportunities from SPP transmission and state resource plans, particularly with an expected 2.1 GW load addition in Colorado, providing robust support for future earnings growth.

- Minor Liability Resolution: Regarding the Smokehouse fire liability in Texas, the analyst expects the resolution to incur less than $100 million in costs, alleviating financial burdens on the company and further enhancing its profitability and market appeal.

Company Overview: Celen Energy Inc. is involved in the energy sector, focusing on sustainable and neutral energy solutions.

Recent Development: The company has announced plans to raise funds to buy from Neutral, indicating a strategic move to enhance its operations and offerings.

Market Impact: This fundraising initiative may influence investor confidence and market dynamics within the energy sector.

Future Prospects: The acquisition from Neutral could position Celen Energy Inc. for growth and innovation in the renewable energy market.

- Coinbase Rating Maintained: Bernstein reiterates Coinbase as outperform, noting that despite Q4 revenue missing estimates by 3% and a 28% drop in adjusted EPS to $0.66, the stock remains undervalued, indicating long-term optimism.

- Instacart's Strong Performance: Barclays maintains an overweight rating on Instacart, highlighting its rare beat-and-raise earnings report in the internet earnings cycle, suggesting a unique advantage in a competitive market that may attract more investor interest.

- Airbnb Upgraded to Buy: Deutsche Bank upgrades Airbnb from hold to buy, stating that while it faces AI disruption risks, its unique supply chain offers more insulation compared to peers, which is likely to draw more investor attention.

- CrowdStrike's Attractive Valuation: HSBC upgrades CrowdStrike from hold to buy, citing attractive current valuation and projecting a non-GAAP EPS CAGR of 38.3% over FY26-29, indicating strong growth potential.

Stock Market Trends: The stock market has seen significant growth, particularly in companies related to microchips and AI, with GE Vernova establishing itself as a major player in the industrial sector, trading near an all-time high of $800.

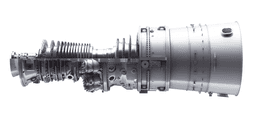

Energy Demand and Supply: The increasing demand for electricity to power AI models has strained the aging global power grid, leading utilities to revert to natural gas turbines to meet the 24/7 operational needs of data centers.

Financial Performance: GE Vernova's recent financial results highlight aggressive growth, particularly in its Power segment, with a 77% surge in orders and a significant increase in gas turbine backlogs, indicating strong future revenue potential.

Strategic Alliances and Investments: The company is expanding its manufacturing capacity and has secured strategic alliances to ensure hardware availability through the 2030s, while also focusing on profitable deals in the wind sector despite challenges in that market.

Energy Supercycle Impact: GE Vernova is benefiting from a significant energy supercycle, which is driving growth and opportunities in the energy sector.

Market Positioning: The company is strategically positioned to capitalize on the increasing demand for energy solutions, enhancing its market presence.

Innovation and Technology: GE Vernova is focusing on innovative technologies to improve energy efficiency and sustainability in its operations.

Future Prospects: The outlook for GE Vernova remains positive as it continues to adapt to changing energy market dynamics and consumer needs.