Major Stocks Including New Mountain Finance, Texas Instruments, and Analog Devices Decline in Monday's Pre-Market Trading

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Sep 15 2025

0mins

Should l Buy GDS?

Source: Benzinga

U.S. Stock Futures: U.S. stock futures rose this morning, with the Dow futures increasing by over 50 points, while several stocks, including New Mountain Finance Corporation, experienced significant declines in pre-market trading.

Stock Movements: New Mountain Finance shares fell 4.4% after a downgrade by B of A Securities, while other stocks like Kindly MD and aTyr Pharma saw sharp declines of 37.1% and 19.7%, respectively, following previous gains.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GDS?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GDS

Wall Street analysts forecast GDS stock price to fall

8 Analyst Rating

8 Buy

0 Hold

0 Sell

Strong Buy

Current: 46.840

Low

6.29

Averages

43.76

High

67.12

Current: 46.840

Low

6.29

Averages

43.76

High

67.12

About GDS

GDS Holdings Ltd is a holding company mainly engaged in the development and operation of high-performance data centers. The Company’s main businesses include the planning and sourcing of new data centers, developing facilities, as well as providing customers with colocation and managed services, which include managed hosting services and managed cloud services. The Company also provides certain other services, including consulting services. The colocation services primarily comprise the provision of critical facilities space, customer-available power, racks and cooling. The suite of managed hosting services includes business continuity and disaster recovery solutions, network management services, data storage services, system security services, operating system services, database services and server middleware services.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Analyst Target Increase: J.P. Morgan analyst Gokul Hariharan raised GDS Holdings' price target from $40 to $55, indicating an 18% upside potential, reflecting market optimism about the company's future performance.

- Stock Price Surge: Following the bullish rating from the analyst, GDS Holdings' stock price surged by 7.77%, demonstrating positive investor sentiment and further solidifying its position among mid-cap AI stocks.

- Capital Markets Update: On February 6, GDS Holdings filed a Form 6-K with the U.S. SEC regarding transaction documents for a $300 million private placement of convertible preferred shares, showcasing the company's ability to attract institutional investors.

- Enhanced Financial Flexibility: By raising capital through convertible preferred equity, GDS Holdings has improved its financial flexibility to support day-to-day operations and growth plans, while also demonstrating its commitment to regulatory standards in both the U.S. and Hong Kong.

See More

- Overseas Opportunities: Beeneet Kothari, founder of Tekne Capital Management, suggests that the best tech investment opportunities are currently found outside the U.S.

- Investor Mindset: The article highlights a common instinct among investors to focus on U.S. technology stocks, contrasting it with Kothari's perspective on global markets.

See More

- Equity Buyback Transaction: GDS Holdings agreed to repurchase ordinary shares from DayOne Data Centers for $385 million, with the buyback price matching DayOne's recent convertible preferred share issue price, demonstrating the company's agility in capital management.

- Significant Investment Return: This buyback allows GDS to recover nearly 95% of its invested capital, achieving a return of approximately 6.5 times, indicating successful management and capital efficiency in high-risk investments.

- Future Strategic Deployment: GDS plans to redeploy the proceeds from the buyback into new projects within its core China operations, aiming to generate strong returns as it expands its data center platform and further solidifies its market position.

- Financial Outlook Reaffirmed: On November 19, GDS reiterated its fiscal 2025 total revenue guidance of 11.29 billion to 11.59 billion yuan, adjusted EBITDA guidance of 5.19 billion to 5.39 billion yuan, and capital expenditure of 2.7 billion yuan, reflecting the company's confidence in future growth.

See More

- Share Buyback Agreement: GDS has entered into a definitive agreement with DayOne Data Centers to repurchase ordinary shares for approximately $385 million, matching the price of its recently announced Series C convertible preferred share issuance, reflecting the company's focus on investment returns.

- Investment Recovery Multiple: The transaction allows GDS to recycle about 95% of its principal investment, achieving a nearly 6.5x multiple on invested capital, indicating high efficiency and profitability in capital operations.

- Retained Minority Stake: Post-transaction, GDS will retain a minority stake valued at over $2.2 billion based on Series C pricing, which not only strengthens the company's balance sheet but also provides flexibility for future capital operations.

- Reinvestment Strategy: GDS plans to reallocate the proceeds from this buyback transaction towards new investment opportunities in its core China data center business, aiming for attractive return potential and further solidifying its market position.

See More

- Share Buyback Agreement: GDS Holdings has entered into a definitive agreement with Singapore's DayOne Data Centers to repurchase ordinary shares valued at $385 million, with the buyback price matching DayOne's recently announced $2 billion Series C convertible preferred share issuance, reflecting confidence in the investment's value.

- Investment Return Multiple: The buyback will allow GDS to recycle approximately 95% of its principal investment, achieving a return multiple of nearly 6.5 times, indicating significant success in its investment strategy within the high-performance data center sector and enhancing financial flexibility.

- Remaining Equity Value: The remaining equity interest of GDS in DayOne is valued at over $2.2 billion based on the new preferred share issuance price, equivalent to $11.18 per GDS American Depositary Share, showcasing market recognition of its future growth potential.

- Reinvestment Strategy: GDS intends to reallocate the proceeds from the buyback to invest in compelling new business opportunities within its core operations in China, aiming to capitalize on attractive return potential and further solidify its market position.

See More

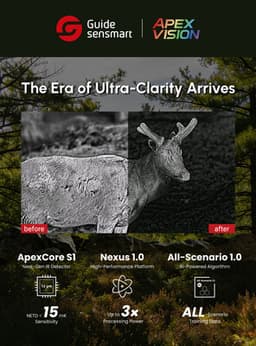

- Technological Innovation: Guide Sensmart's launch of the ApexVision thermal imaging technology at CES 2026 integrates the high-sensitivity ApexCore S1 detector and Nexus 1.0 processing platform, successfully overcoming challenges like low contrast and motion blur in complex environments, thereby significantly enhancing the clarity and precision of thermal imaging devices.

- Market Response: The live demonstrations of ApexVision at the show attracted strong attention from industry analysts and media, with professional visitors praising its reliable 'what-you-see-is-what-you-get' clarity, which is expected to directly enhance operational efficiency and decision-making confidence, indicating strong market demand for this technology.

- Wide Applications: The ApexVision technology not only improves the stability and accuracy of thermography tools (e.g., E3S and H6S thermal cameras) but also enables outdoor hunting optics (e.g., TD650LS monocular) to clearly identify wildlife in complete darkness, showcasing its broad applicability across various scenarios.

- Strategic Significance: This technology launch marks a significant breakthrough for Guide Sensmart in the thermal imaging sector, advancing the industry into the Ultra-Clarity Era and promising to provide users with safer and more efficient solutions, thereby further solidifying its market leadership.

See More