Initial Week of GSAT Options Trading for July 2026

Put Contract Overview: The $55.00 put contract for GSAT has a bid of $9.30, allowing investors to potentially buy shares at a cost basis of $45.70, which is a 7% discount from the current price of $58.94. There is a 67% chance the contract may expire worthless, offering a potential 16.91% return on cash commitment.

Call Contract Overview: The $60.00 call contract has a bid of $11.60, and if shares are purchased at $58.94 and the call is sold, it could yield a total return of 21.48% if the stock is called away by July 2026. There is a 38% chance this contract may also expire worthless, providing a potential 19.68% additional return.

Volatility Insights: The implied volatility for the put contract is 77%, while the call contract has an implied volatility of 73%. The actual trailing twelve-month volatility is calculated at 73%.

YieldBoost Concept: Both the put and call contracts offer a "YieldBoost," with the put potentially yielding 26.27% annualized and the call yielding 30.57% annualized if they expire worthless.

Trade with 70% Backtested Accuracy

Analyst Views on GSAT

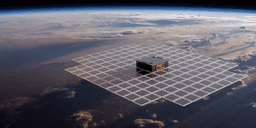

About GSAT

About the author

- Network Capability Enhancement: Globalstar announced a partnership with Boingo Wireless to integrate XCOM RAN into its private network infrastructure, aiming to enhance connectivity at critical locations such as airports and hospitals, thereby improving customer experience and addressing increasing security demands.

- Successful Technical Validation: Following a technical evaluation, Boingo confirmed that XCOM RAN delivers reliable private connectivity across multiple frequency bands and deployment models, showcasing its robust performance in high-traffic environments and further solidifying its market leadership.

- Innovative Private Network Architecture: The Supercell architecture of XCOM RAN not only increases network capacity by four times but also simplifies the deployment process, reducing the need for site surveys, enabling rapid and seamless integration in industrial environments, and enhancing operational efficiency.

- Industry Recognition and Future Outlook: Boingo's private networks recently won the 2025 TeckNexus Private Network Leadership Awards, highlighting their transformative connectivity capabilities in high-traffic environments, and they will continue to collaborate with Globalstar to promote the widespread adoption of private 5G solutions.

- Broad User Coverage: According to an FCC report, SpaceX's first-generation service covers over 400 million people, with more than 6 million customers accessing it monthly, demonstrating its strong market appeal and user base.

- Intensifying Competition: The FCC noted that AST SpaceMobile plans to deploy 45 to 60 satellites and initiate commercial direct-to-device services in 2026, indicating that market competition is accelerating and SpaceX needs to strengthen its market position.

- Technology Upgrade Plans: SpaceX aims to launch its second-generation Starlink system in 2027, which is expected to significantly enhance its direct-to-device service capabilities, thereby strengthening its competitive edge against traditional providers like Verizon and AT&T.

- Market Sentiment Shifts: While retail sentiment on SpaceX remains in the 'bearish' territory, AST SpaceMobile's sentiment stays 'bullish', highlighting significant differences in investor expectations across different companies.

- Contract Awarded: AST SpaceMobile has been awarded a contract for the MDA's SHIELD program, enabling participation in the development, testing, and maintenance of critical defense systems, thereby enhancing U.S. national security.

- Technology Utilization: The company will leverage its low-Earth orbit satellite network to provide secure communications, sensing, and command-and-control capabilities, improving the responsiveness and operational resilience of missile defense systems.

- Market Competition: AST SpaceMobile faces competition from Globalstar and Viasat, both of which are also providing secure satellite communication solutions for the U.S. military, highlighting the importance of commercial space in national security.

- Stock Performance: AST SpaceMobile's shares have skyrocketed 457.1% over the past year, significantly outpacing the industry's 29.8% growth, reflecting strong market confidence in its future prospects.

- Stock Performance: AST SpaceMobile's stock experienced an increase early Friday, building on gains from the previous day.

- Investor Sentiment: There is growing excitement among investors regarding the company's potential expansion into the defense sector.

- Stock Volatility: Globalstar shares surged 5% on Tuesday after Clear Street raised its price target to $71, but the stock fell 9.6% on Wednesday, indicating market concerns about its future prospects.

- Contract Advantage: Clear Street noted that Globalstar's contract with Apple de-risks the company; however, Scotiabank cautioned investors to consider its competitive disadvantages against SpaceX's Starlink.

- Market Competition: SpaceX launches over 3,000 satellites annually, while Globalstar has only 24 in orbit, a disparity that could significantly impact its market share and profitability.

- Profit Outlook: Globalstar has only turned a profit once in the past decade and is not expected to be profitable again until 2027, raising investor doubts about its long-term sustainability.

- Stock Volatility: Globalstar's shares surged 5% after Clear Street raised its price target to $71, but subsequently plummeted 9.6% due to negative reports regarding rival AST SpaceMobile, indicating significant market sentiment fluctuations.

- Competitive Pressure: Analysts highlight that Globalstar lags behind SpaceX's Starlink in terms of satellite count and brand recognition, with Starlink launching over 3,000 satellites annually compared to Globalstar's approximately 24, which may hinder its market competitiveness.

- Uncertain Profit Outlook: Having only achieved full-year profitability once in the past decade, Globalstar is not expected to return to profitability until 2027, raising investor concerns about its future earnings potential, especially in a competitive landscape.

- Investment Recommendations: While Clear Street views Globalstar's contract with Apple as a risk mitigator, other analysts express caution regarding its future performance, as the Motley Fool's analyst team did not include it in their recommended stocks, reflecting market skepticism about its prospects.