Zacks Industry Outlook Spotlights Air Products and Chemicals, Albemarle, and Avient

Industry Challenges: The Zacks Chemicals Diversified industry is facing demand headwinds due to lower consumer spending, particularly in the building & construction and consumer electronics markets, exacerbated by inflation and economic slowdowns in Europe and China.

Strategic Responses: Companies like Air Products, Albemarle, and Avient are implementing cost-cutting measures, improving operational efficiency, and raising prices to maintain margins amid these challenges.

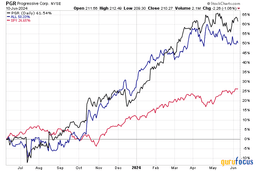

Market Performance: The Chemicals Diversified industry has underperformed compared to the S&P 500 and the broader Basic Materials sector, with a significant decline in stock value over the past year.

Stock Recommendations: Analysts suggest keeping an eye on Air Products, Albemarle, and Avient, highlighting their strategic initiatives and potential for earnings growth despite current market difficulties.

Trade with 70% Backtested Accuracy

Analyst Views on APD

About APD

About the author

- Analyst Rating Upgrade: DA Davidson analyst Griffin Bryan maintained a Buy rating on Almonty Industries and raised the price target from $12 to $18, indicating confidence in the company's future growth potential.

- Strong Stock Performance: Almonty Industries' stock has surged approximately 39% over the past month, reaching a 52-week high of $13.82, reflecting market recognition of its potential value.

- High RSI Value: The Relative Strength Index (RSI) for Almonty Industries stands at 74.1, suggesting that the stock may be overbought, prompting investors to exercise caution.

- Recent Price Fluctuation: Despite the positive analyst outlook, Almonty Industries' shares fell 0.2% to close at $13.36 on Wednesday, indicating the complexity of market sentiment.

- Significant Revenue Growth: Air Products reported first-quarter revenue of $3.103 billion, a 6% increase from $2.932 billion year-over-year, surpassing analyst expectations of $3.051 billion, indicating strong performance in the industrial gases sector.

- Adjusted EPS Increase: The adjusted EPS reached $3.16, up 10% year-over-year, exceeding the top end of company guidance and the analyst estimate of $3.04, reflecting enhanced profitability and operational efficiency.

- Stable Capital Expenditure Plans: The company anticipates fiscal 2026 capital expenditures of approximately $4.0 billion, reaffirming its commitment to future growth while confirming adjusted EPS guidance between $12.85 and $13.15, showcasing confidence in earnings growth.

- Analyst Rating Adjustments: Analysts from JP Morgan and Wells Fargo raised their price targets from $260 and $250 to $280 and $270 respectively, reflecting optimistic market expectations for the company's future performance and further solidifying investor confidence.

- Stock Index Declines: The S&P 500 index fell by 0.43%, the Dow Jones Industrial Average dropped by 0.36%, and the Nasdaq 100 decreased by 1.28%, reflecting cautious investor sentiment following President Trump's nomination of Kevin Warsh as the new Fed Chair, which raised concerns about future monetary policy.

- Producer Prices Rise: The US December Producer Price Index (PPI) increased by 0.5% month-over-month and 3.0% year-over-year, both exceeding market expectations, indicating heightened inflationary pressures that could influence the Fed's policy decisions moving forward.

- Mining Stocks Plummet: Mining stocks faced significant sell-offs as gold and silver prices dropped sharply, with Coeur Mining and Hecla Mining declining over 17% and 15%, respectively, reflecting a pessimistic outlook on precious metals amid rising dollar strength.

- Positive Earnings Outlook: Despite the overall market decline, 102 S&P 500 companies are set to report earnings this week, with 77% of the 143 companies that have reported so far exceeding expectations, indicating resilience in corporate profitability, with S&P earnings growth projected to reach 8.4% in Q4.

- Earnings Growth: Air Products reported a 12% year-over-year increase in adjusted operating income for Q1 2026, with earnings per share reaching $3.16, demonstrating effective strategies in productivity enhancement despite a weak economic backdrop.

- Project Optimization Strategy: The CEO emphasized a continued focus on the core industrial gas business, implementing project cancellations, headcount optimization, and asset rationalization to enhance performance, which is expected to drive future earnings growth.

- Sustained Shareholder Returns: The company announced a dividend increase, marking the 44th consecutive year of raising dividends, reflecting its commitment to shareholder returns while returning nearly $400 million in cash to shareholders in the quarter.

- Stable Outlook: Despite ongoing helium demand pressures, management maintained its fiscal year EPS guidance of $12.85 to $13.15, anticipating growth primarily through pricing actions and productivity improvements.

- Inflation Data Impact: The US December Producer Price Index (PPI) rose 0.5% month-over-month and 3.0% year-over-year, exceeding expectations, indicating heightened inflationary pressures that could lead the Fed to maintain high interest rates, negatively impacting the stock market.

- Fed Chair Nomination: President Trump nominated Kevin Warsh as the next Fed Chair, with markets perceiving him as cautious towards rate cuts, which pushed the 10-year Treasury yield to a one-week high of 4.277%, exacerbating downward pressure on stocks.

- Earnings Outlook: With 102 S&P 500 companies set to report earnings this week, 77% of the 143 companies that have reported so far have beaten expectations, demonstrating corporate earnings resilience that may provide support for the market.

- Government Shutdown Risk: Trump reached a tentative deal with Senate Democrats to avert a government shutdown, but the House will take 72 hours to vote, and if unresolved quickly, it could negatively affect market sentiment in the short term.

- Inflation Data Surprises: The US December Producer Price Index (PPI) rose 0.5% month-over-month and 3.0% year-over-year, exceeding expectations of 0.2% and 2.8%, indicating heightened inflationary pressures that could influence Fed policy decisions.

- Fed Chair Nomination Impact: President Trump nominated Kevin Warsh as the next Fed Chair, with markets perceiving him as more hawkish, leading to a rise in the 10-year T-note yield to a one-week high of 4.277%, further exacerbating downward pressure on stocks.

- Strong Earnings Reports: With 102 S&P 500 companies set to report earnings this week, 77% of the 143 companies that have reported so far have beaten expectations, and S&P earnings growth is projected to reach 8.4% in Q4, showcasing corporate resilience amid market volatility.

- Government Shutdown Risk Eases: Trump reached a tentative deal with Senate Democrats to avert a government shutdown, which, while requiring a 72-hour House vote, is expected to have minimal impact on federal operations if resolved quickly.