Why WaFd Shares Are Trading Higher By 6%; Here Are 20 Stocks Moving Premarket

WaFd, Inc. Earnings Report: WaFd, Inc. shares rose 6.4% in pre-market trading after reporting a second-quarter GAAP EPS of 65 cents, exceeding estimates of 58 cents, with sales of $179.79 million surpassing expectations of $157.81 million.

Pre-Market Stock Movements: Several stocks experienced significant changes in pre-market trading, with notable gainers including Sharps Technology (up 73.6%) and Classover Holdings (up 61.2%), while Culp, Inc. saw a sharp decline of 56.2%.

Trade with 70% Backtested Accuracy

Analyst Views on MMA

About MMA

About the author

- Resource Estimate Completion: Midnight Sun Mining has completed its maiden Mineral Resource Estimate for the Kazhiba Main Copper Deposit in Zambia, revealing 2.33 million tonnes of indicated resources at a grade of 1.41% copper, establishing a solid foundation for future funding and project advancement.

- Significant Economic Potential: The deposit's copper grade is well above economic thresholds, with an average depth of only about 30 meters, and is expected to achieve up to 95% recovery through low-cost heap leaching, enhancing the project's economic viability.

- Strategic Location: The Kazhiba Main Copper Deposit is located just 6.8 kilometers from First Quantum's Kansanshi Mine, benefiting from proximity to existing infrastructure, which will help reduce transportation and operational costs, further strengthening the project's competitiveness.

- Future Development Plans: The company aims to convert Kazhiba Main into a non-dilutive funding source to advance its flagship Dumbwa Project, with immediate plans to engage key counterparties to drive the commercialization process.

- Strategic Partnership: MMA.INC has signed a Strategic Memorandum of Understanding with decentralized finance platform WLFI to collaboratively design and issue the MMA.INC utility token, integrating WLFI's USD1 stablecoin as the foundational layer of its on-chain ecosystem, which is expected to enhance engagement and incentives for the global martial arts community.

- Ecosystem Development: The partnership will encompass token architecture, on-chain economic modeling, and stablecoin reserve design, aiming to create one of the world's first large-scale utility Web3 economies, thereby boosting MMA.INC's competitiveness in the digital finance sector.

- Market Activation Plans: MMA.INC and WLFI will jointly conduct co-branded marketing campaigns targeting MMA fighters, gyms, and fan networks, which is anticipated to significantly expand the user base and enhance brand influence.

- Advisory Board Inclusion: WLFI will join MMA.INC's Strategic Advisory Board to guide token economics, compliance, and long-term stability, further strengthening MMA.INC's governance capabilities within its blockchain ecosystem.

- Strategic Partnership: MMA.INC has signed a Strategic Memorandum of Understanding with decentralized finance platform WLFI to collaboratively design and issue the MMA.INC utility token, integrating WLFI's USD1 stablecoin as the foundational layer to engage and incentivize the global martial arts community.

- Ecosystem Development: This collaboration aims to create one of the world's first large-scale Web3 economies in sports, encompassing token architecture, economic modeling, and stablecoin reserve design, thereby enhancing interaction among fans, coaches, and gyms through blockchain technology.

- Market Activation: MMA.INC and WLFI will jointly execute co-branded marketing campaigns to implement stablecoin-enabled payments and rewards, which will significantly boost user engagement and loyalty across MMA's global network.

- Advisory Board Inclusion: WLFI will join MMA.INC's Strategic Advisory Board to guide token economics, compliance, and long-term sustainability, ensuring the ecosystem's growth and stability over time.

- Funding Scale: MMA.INC has entered into agreements with accredited investors to issue 4,285,714 shares of Series A Preferred Stock at $0.70 per share, raising approximately $3 million, which will enhance the company's capital structure to support future expansion.

- Strategic Partnership: The offering, led by American Ventures LLC with participation from Donald Trump Jr., reflects market confidence in MMA.INC's Web3 ecosystem strategy, further advancing its collaboration with UFC GYM.

- Market Expansion Plans: The company intends to use the proceeds to advance platform expansion, particularly capitalizing on the rapid growth of its gym software platform BJJLink, aiming to enhance engagement across the global community of fighters, gyms, and fans.

- Future Financing Potential: The Equity Purchase Agreement with American Ventures allows for the purchase of up to $20 million in ordinary shares under certain conditions, indicating flexibility for future financing and potential growth opportunities.

- Funding Scale: MMA.INC has entered into agreements to issue 4,285,714 shares of Series A Preferred Stock at $0.70 per share, expected to raise approximately $3 million, thereby strengthening the company's capital base to support future expansion.

- Strategic Partnership: The offering, led by American Ventures LLC with participation from Donald Trump Jr., reflects confidence in MMA.INC's platform expansion and Web3 ecosystem strategy, which is anticipated to accelerate collaboration with UFC GYM.

- Market Potential: The company intends to use the proceeds to advance the rapid growth of its gym software platform BJJLink, further solidifying its influence within the global martial arts community and enhancing user engagement and market share.

- Future Developments: The equity purchase agreement with American Ventures allows for the potential purchase of up to $20 million in ordinary shares, indicating a sustained investment interest in the company's long-term growth potential.

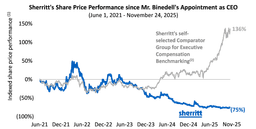

Pala's Call for Leadership Change: Pala Assets Holdings Limited is demanding the replacement of Sherritt International's CEO Leon Binedell and former Lead Independent Director Shelley Brown due to years of underperformance and shareholder value destruction.

Concerns Over Governance Failures: Pala criticizes Sherritt's Board for failing to address core management issues and operational failures, emphasizing that recent governance changes are merely cosmetic and do not resolve the underlying problems.

Urgent Need for Action: Pala has requisitioned a special meeting to nominate new board members, believing that immediate leadership changes are essential to halt ongoing value destruction and restore operational performance.

Shareholder Support for Change: There is significant backing from Sherritt's shareholders for a new CEO and a credible turnaround plan, with many expressing frustration over the current management's inability to improve the company's financial and operational standing.