What's Going On With Howmet Aerospace Stock?

Stock Performance and Analyst Ratings: Howmet Aerospace Inc. has experienced a positive stock trend, with shares rising over 4% recently, supported by strong aerospace demand and operational efficiency. Analysts from RBC Capital and Truist Securities have reiterated their favorable ratings and increased price forecasts for the stock.

Financial Outlook and CEO Compensation: The company reported a revenue increase of 6.5% year-over-year in Q1, raising its full-year revenue outlook and EPS guidance. Additionally, CEO John C. Plant received a significant retention grant, maintaining his base salary and bonus eligibility unchanged.

Trade with 70% Backtested Accuracy

Analyst Views on ITA

No data

About the author

- Defense Stocks Performance: Defense stocks have seen a recent increase in value, attracting investor attention.

- Smart Money Insight: Investors are advised to monitor the actions of institutional investors, referred to as "smart money," for better investment decisions.

- Defense Stocks Potential: The article discusses whether defense stocks can provide both dividends and growth driven by capital spending.

- Income Investors' Interest: Income investors are particularly focused on the performance of defense stocks in terms of returns and growth opportunities.

- Earnings Announcement: Lockheed Martin's earnings report is scheduled for Thursday.

- Stock Performance: The company's shares have shown recent improvement but still underperform compared to industry peers over the past year.

Military Spending and Defense Contractors: President Trump's focus on increasing military capabilities benefits defense contractors, provided that this growth translates into higher cash flow and earnings.

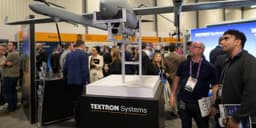

Textron's Performance: Recent financial results from Textron indicate that the anticipated benefits of military spending do not always materialize as expected.

- Emerging Trend: Investors in the global defense industry are now considering the trend of deconsolidation alongside the impact of recent policy changes.

- Impact of Policy Changes: Several dramatic policy changes are influencing investor sentiment and strategies within the defense sector.

- Industry Dynamics: The shift towards deconsolidation suggests a potential restructuring of companies within the defense industry.

- Investor Considerations: Investors must navigate both the implications of policy changes and the emerging trend of deconsolidation in their decision-making processes.

Emerging Trend: Investors in the global defense industry are now considering the trend of deconsolidation alongside the impact of recent policy changes.

Impact of Policy Changes: Several dramatic policy changes are influencing investor sentiment and strategies within the defense sector.

Focus on Deconsolidation: Deconsolidation is becoming a significant factor for investors as they navigate the evolving landscape of the defense industry.

Investor Considerations: The combination of policy shifts and deconsolidation trends presents new challenges and opportunities for investors in the defense market.