Weak China Sales Hit Estee Lauder's Q4, CEO To Retire

Fourth Quarter Results: Estee Lauder reported a 7% year-over-year sales growth to $3.87 billion, surpassing analyst expectations, but faced an operating loss of $233 million and a decline in organic net sales in the Americas. The company anticipates a challenging fiscal 2025 with adjusted EPS outlook significantly below consensus.

Leadership Changes and Future Outlook: CEO Fabrizio Freda will retire at the end of FY25, with succession planning underway. The company aims to improve performance across markets despite ongoing softness in the prestige beauty segment in China, focusing on Skin Care and high-end Fragrance growth strategies.

Trade with 70% Backtested Accuracy

Analyst Views on KLXY

No data

About the author

Black Friday Sales Performance: U.S. Black Friday sales exceeded expectations with a 6% year-over-year increase, particularly driven by a 21% growth in luxury apparel and accessories.

Impact on Consumer Stocks: Companies like Tapestry, Capri Holdings, and Ralph Lauren may benefit from the ongoing trend of strong luxury spending, which is influenced by higher prices.

Luxury Market Resilience: Despite economic uncertainty, U.S. luxury sales in 2025 are projected to grow by around 6% year-over-year, although traditional goods face challenges due to price sensitivity.

Luxury Retail Trends: Luxury retail visitation has declined by about 4% year-over-year, indicating a pullback from aspirational buyers amid high prices and inflation.

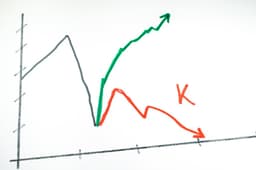

K-shaped Economy: The U.S. economy is experiencing a K-shaped recovery, where luxury spending is increasing while mass-market consumption declines, reflecting a growing wealth gap.

Luxury Spending Growth: Bank of America reports a 4% year-over-year increase in U.S. luxury spending for October, with jewelry spending seeing a significant rise from 10% to 16%.

Consumer Sentiment Decline: The University of Michigan's Consumer Survey indicates a drop in consumer sentiment to its lowest level since June 2022, highlighting the struggles of average Americans amid rising inequality.

Investor Confidence in Luxury: The Kraneshares Global Luxury Index ETF has seen a rise, indicating investor confidence in premium brands, as the wealthiest Americans continue to dominate stock ownership and luxury consumption.

Luxury Market Adaptation: Luxury brands in China are adjusting their strategies to cope with slowing economic growth and changing consumer behaviors, as highlighted at the Business of Luxury Summit in Hong Kong. Despite a GDP growth decline to 4.8%, there remains a strong demand for premium goods, particularly in lower-tier cities.

Experiential Retail Strategies: Brands like Louis Vuitton are focusing on experiential retail, exemplified by their ship-shaped store in Shanghai, which attracts affluent tourists from various provinces, indicating a shift in luxury spending patterns away from local consumers.

Psychological Consumption Slowdown: Panelists at the summit noted that the slowdown in luxury consumption is more psychological than structural, with the potential for continued spending as consumer confidence rebounds.

Emerging Markets for Luxury: Younger consumers in lower-tier cities are increasingly engaging with luxury brands, often through local names, marking a generational shift in how luxury is perceived and consumed in China.

Gen Z's Impact on Luxury: Gen Z is reshaping the luxury market by prioritizing sustainability, digital culture, and affordable prestige over traditional logos and heritage brands, as highlighted by a Reuters survey.

ETF Performance Comparison: The KraneShares Global Luxury Index ETF (KLXY) has shown better performance with an 11.5% return since its September 2023 debut, while the Themes European Luxury ETF (FINE) has remained flat and lost 3.6% over the past year, indicating KLXY's broader appeal to Gen Z's preferences.

Financial Performance: Ralph Lauren Corp reported an 8% year-on-year sales growth to $1.70 billion for Q4 FY25, exceeding analyst expectations, with adjusted EPS of $2.27 also surpassing estimates. The company generated $1.24 billion in operating cash flow and announced a 10% increase in its quarterly cash dividend.

Future Outlook: For FY26, Ralph Lauren anticipates low-single digit revenue growth, primarily in the first half of the fiscal year, while maintaining a focus on managing macroeconomic uncertainties and leveraging its diversified supply chain.

Tapestry, Inc. Performance: Tapestry, Inc., a luxury fashion house with a market cap of $15.4 billion, has seen its stock soar 79.1% over the past year, significantly outperforming competitors and the broader luxury index, driven by successful strategies to attract younger consumers.

Merger Termination Impact: Following the termination of its planned $8.5 billion merger with Capri Holdings due to antitrust objections, TPR shares surged over 12%, leading gains in the S&P 500, while analysts maintain a "Moderate Buy" consensus rating for the stock.