Two of Four Companies Exceed EPS Projections This Week: Earnings Update

Stock Market Overview: The stock market opened mixed after record highs, with the Dow Jones reaching 46,000, influenced by a higher-than-expected consumer inflation report and jobless claims data.

Earnings Reports: Among the four S&P 500 companies reporting earnings, two exceeded EPS estimates, while three surpassed revenue expectations, with notable performances from Kroger and Adobe, and weaker results from Synopsys and Oracle.

Upcoming Earnings: Several companies, including Dave & Buster’s and General Mills, are set to report earnings next week, with a focus on various sectors.

Market Sentiment: Investor sentiment remains positive, driven by recent economic data and earnings reports, despite some companies facing challenges in meeting expectations.

Trade with 70% Backtested Accuracy

Analyst Views on PLAY

About PLAY

About the author

- Investment Foundation: NNN REIT focuses on single-tenant properties, primarily investing in retail and service sectors with nearly 3,700 properties across 50 states, ensuring a stable income stream and low volatility, thereby enhancing investor confidence.

- High Dividend Yield: Currently, NNN REIT offers a dividend yield exceeding 5.5%, significantly higher than the REIT sector average of 4.4% and the S&P 500's 1.1%, making it a preferred choice for passive income investors and further enhancing its investment appeal.

- Financial Stability: NNN REIT holds a BBB+/Baa1 bond rating with a weighted average debt maturity of 10.7 years and $1.4 billion in liquidity, showcasing strong financial flexibility that supports future investments and dividend growth.

- Sustained Growth Potential: The company plans to invest $850 million to $950 million in the coming years, aiming to partially finance this through $170 million to $200 million in property sales, supporting mid-single-digit annual earnings per share growth and ensuring continued dividend increases.

- Market Performance: The S&P 500 index fell by 0.06%, the Dow Jones Industrial Average decreased by 0.17%, and the Nasdaq 100 dropped by 0.07%, reflecting market uncertainty regarding future interest rate policies.

- Rising Bond Yields: The 10-year Treasury yield rose by 6 basis points to 4.23%, reaching a 4.5-month high, as President Trump's reluctance to nominate Hassett intensified market concerns about potential rate hikes.

- Manufacturing Data: December manufacturing production unexpectedly increased by 0.2%, surpassing expectations of a 0.1% decline, indicating economic resilience that could influence the Fed's policy direction.

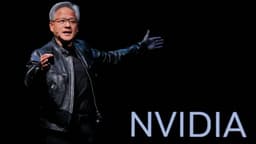

- Tech Stock Volatility: Chipmakers surged on renewed optimism for AI spending after TSMC raised its 2026 capital expenditure forecast, while power suppliers fell due to pressure from Trump's policy initiatives.

- Chip Stocks Rally: Chip manufacturers and data storage companies see stock prices rise due to optimism around AI spending, with Micron Technology (MU) leading gains in the S&P 500 and Nasdaq 100, up over 7% after TSMC raised its 2026 capital expenditure forecast.

- Manufacturing Strength: US manufacturing production unexpectedly rose by 0.2% in December, surpassing expectations of a 0.1% decline, while November's figure was revised up to 0.3%, indicating economic resilience that boosts market confidence.

- Positive Earnings Season: In the first full week of Q4 earnings season, 89% of the 28 S&P 500 companies that reported exceeded expectations, with Bloomberg Intelligence forecasting an 8.4% earnings growth for the S&P 500 in Q4, further enhancing market optimism.

- Interest Rate Impact: Despite the stock market's gains, the 10-year T-note yield has risen to 4.19%, limiting upside potential for stocks, with the market pricing only a 5% chance of a 25 bp rate cut at the upcoming FOMC meeting on January 27-28.

- Rating Upgrade: Deutsche Bank upgraded Coupang from hold to buy, citing the company's strong resilience against regulatory scrutiny, particularly after facing a record antitrust fine in June 2024, which has not diminished its market position.

- Biotech Outlook: Goldman Sachs upgraded BioNTech from neutral to buy, highlighting the company's strategic suite of oncology programs targeting a potential market exceeding $100 billion, with key data expected to unlock in 2026, positioning it for leadership in emerging product cycles.

- Market Challenges: Barclays downgraded HP from equal weight to underweight, noting that the company faces significant long-term challenges in both PCs and printing, which will likely keep the stock under pressure in 2026 despite its current inexpensive valuation and lack of catalysts.

- EV Market Positioning: Macquarie upgraded Nio from market perform to outperform, asserting that the company is well-positioned to navigate the current headwinds in the Chinese electric vehicle market, thereby maintaining its competitive edge.

Photronics Performance: Photronics saw a significant increase of over 37% in its stock price due to better-than-expected fiscal fourth-quarter results and optimistic first-quarter earnings guidance.

Maplebear Challenges: Maplebear's stock dropped 6% following Amazon's expansion of its same-day perishable grocery delivery service, which directly competes with Instacart.

United Natural Foods Outlook: United Natural Foods' shares fell more than 7% after it projected low single-digit average net sales growth through 2028.

Dave & Buster's and GE Vernova Gains: Dave & Buster's shares surged 15.5% despite missing earnings expectations, while GE Vernova's stock jumped 14% after positive revenue trends and a dividend increase.