Top Real Estate Firms with Strong EPS Revisions: DLR and PLD Rated A+

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 16 2026

0mins

Should l Buy CCI?

Source: seekingalpha

- EPS Revision Grades: Digital Realty Trust (DLR) and Prologis (PLD) both received an A+ rating from analysts, indicating strong confidence in their near-term performance, which may attract more investor interest.

- Market Confidence Boost: Weyerhaeuser (WY) and Crown Castle (CCI) also earned an A rating, suggesting that market expectations for their earnings are improving, potentially driving their stock prices higher.

- Investor Attention: Simon Property Group (SPG) and Host Hotels & Resorts (HST) received A ratings as well, reflecting analysts' optimistic outlook on their future performance, which could draw more institutional investors' attention.

- Overall Trend: Kimco Realty (KIM), Public Storage (PSA), and Welltower (WELL) all achieved A ratings, indicating a positive trend across the real estate sector, potentially providing more investment opportunities for investors.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy CCI?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on CCI

Wall Street analysts forecast CCI stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for CCI is 107.78 USD with a low forecast of 93.00 USD and a high forecast of 127.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

11 Analyst Rating

8 Buy

3 Hold

0 Sell

Moderate Buy

Current: 78.370

Low

93.00

Averages

107.78

High

127.00

Current: 78.370

Low

93.00

Averages

107.78

High

127.00

About CCI

Crown Castle Inc. owns, operates and leases more than 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every United States market. Its core business is providing access, including space or capacity, to its shared communications infrastructure via long-term tenant contracts in various forms, including lease, license, sublease and service agreements in the United States. Its segments include Towers and Fiber, which includes both small cells and fiber solutions. The Towers segment provides access, including space or capacity, to the Company's more than 40,000 towers throughout the United States. The Towers segment also provides ancillary services relating to the Company's towers, consisting of site development services and installation services. The Fiber segment consists of communications infrastructure offerings of small cells and fiber solutions.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Tech Sector Decline: Qualcomm's (QCOM) forecast of weaker-than-expected Q2 revenue led to an over 8% drop in its stock, triggering a sell-off across the tech sector, with the Nasdaq 100 index hitting a 2.5-month low, indicating waning investor confidence in technology stocks.

- Weak Labor Market Signals: Challenger's report revealed a staggering 117.8% year-over-year increase in job cuts for January, totaling 108,435, the highest for January since 2009, while initial jobless claims rose by 22,000 to 231,000, highlighting vulnerabilities in the US labor market that could hinder economic recovery.

- Bitcoin Plunge: Bitcoin (^BTCUSD) plummeted over 12% to a 1.25-year low, reflecting deepening negative momentum in the cryptocurrency market, with approximately $2 billion flowing out of Bitcoin ETFs in the past month, signaling a decline in investor confidence.

- Earnings Season Impact: Despite 150 S&P 500 companies set to report earnings this week, market focus on economic data intensifies, with S&P 500 earnings expected to grow by 8.4% in Q4, yet overall market sentiment remains suppressed by recent economic weakness.

See More

- Dividend Safety Overview: The latest assessment reveals that Crown Castle (CCI), Healthpeak Properties (DOC), and Ford Motor (F) all received an F grade for dividend safety, indicating significant challenges in maintaining dividend payments, which could impact investor confidence.

- Sector Distribution: These low-rated stocks span multiple sectors, including Telecom Tower REITs, Health Care REITs, automobile manufacturers, and retail, suggesting a widespread weakness in dividend sustainability among large companies across various market conditions.

- Market Performance Variance: Despite their low dividend safety grades, the one-month performance of these stocks varies significantly; for instance, The Gap (GAP) has seen gains exceeding 15%, while Las Vegas Sands (LVS) has declined over 11%, indicating differing market reactions to these companies.

- Rating Standards Explained: The dividend safety grade is a comprehensive measure of a company's ability to sustain and protect its dividend payments, rated from A+ to F, with D+ or below considered a sell, reflecting market concerns about the future profitability of these firms.

See More

- Technology Sector Decline: Qualcomm (QCOM) forecasts Q2 revenue between $10.2 billion and $11.0 billion, below the consensus of $11.18 billion, leading to an over 8% drop in its stock and exacerbating the overall decline in the Nasdaq 100 index, heightening market panic.

- Weak Labor Market Signals: Challenger's report shows January job cuts surged 117.8% year-on-year to 108,435, marking the highest level since 2009, indicating fragility in the US labor market and increasing investor concerns about economic outlook.

- Bitcoin Price Crash: Bitcoin (^BTCUSD) is down more than 7% today, hitting a 1.25-year low and falling about 45% from its October record high, reflecting negative sentiment in the cryptocurrency market and a trend of capital outflows.

- Impact of Earnings Season: Despite 150 S&P 500 companies set to report earnings this week and 81% of the 237 companies that have reported exceeding expectations, market concerns over future economic data continue to suppress stock performance, with S&P earnings growth expected to reach 8.4% in Q4.

See More

- Technology Sector Decline: Qualcomm (QCOM) forecasts Q2 revenue between $10.2 billion and $11.0 billion, below the consensus of $11.18 billion, leading to a more than 9% drop in its stock and triggering a sell-off across the chip sector, exacerbating market anxiety.

- Weak Labor Market Signals: Challenger reports a staggering 117.8% year-over-year increase in job cuts for January, totaling 108,435, the highest since 2009, while initial jobless claims rose by 22,000 to 231,000, indicating a weakening labor market that could impact consumer confidence and spending.

- Fed Policy Implications: Fed Governor Lisa Cook supports the decision to hold interest rates steady, emphasizing the need to maintain credibility after nearly five years of above-target inflation, which may influence future monetary policy directions.

- Bitcoin Market Turmoil: Bitcoin (^BTCUSD) is down over 3% today, hitting a 1.25-year low and falling approximately 45% from its October record high, with about $5 billion pulled from Bitcoin ETFs over the past three months, reflecting waning market confidence in cryptocurrencies.

See More

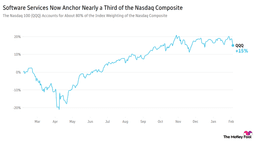

- Nasdaq Decline: The Nasdaq index fell 1.5% yesterday amid growing fears of AI disruption, with SaaS stocks particularly hard hit, as the S&P 500 software and services index has dropped nearly 13% over the past six sessions, indicating a waning confidence in the tech sector.

- Earnings Impact on GOOG and QCOM: Alphabet's stock fell as much as 7% after hours but recovered slightly before market open, with 2026 capex expected to be double last year's $91 billion, reflecting an aggressive investment strategy that may impact short-term stock performance; Qualcomm dropped nearly 10% pre-market due to CEO warnings about memory supply and pricing constraints.

- Quantum Stocks Hit Hard: IonQ's stock fell 8.14% yesterday following a short-seller report claiming most of its revenue comes from acquired non-quantum computing businesses, raising doubts about the commercial viability of the quantum sector, with competitors D-Wave Quantum and Rigetti Computing also closing over 5% lower.

- Amazon's Strong Performance: Amazon has outperformed the S&P 500 by 69% since January 2023, and despite concerns over holiday season performance and cloud growth, its strong quarterly results demonstrate resilience in the market, with investors looking forward to future strategic updates.

See More

- Performance Exceeds Expectations: Crown Castle reported full-year 2025 results exceeding the midpoint across key metrics, with CEO Christian Hillabrant emphasizing operational execution despite challenges from the DISH contract termination, achieving 4.9% organic growth reflecting ongoing customer demand for 5G networks.

- Restructuring Plan Implementation: The company announced a 20% reduction in its tower and corporate workforce, aiming to cut down to approximately 1,250 employees, which is expected to deliver an annualized operating cost reduction of $65 million, thereby simplifying its business structure and enhancing efficiency.

- Legal Recovery Actions: Crown Castle has terminated its agreement with DISH and is seeking to recover over $3.5 billion in outstanding payments, with management stating they will enforce legal rights to protect contract value, although this process may take a year or longer.

- Cautious Future Outlook: The company projects a 3.5% organic growth rate for 2026, with management warning that the termination of the DISH contract and $220 million in customer churn will significantly impact revenues, while still planning to maintain a $4.25 per share dividend, demonstrating a commitment to shareholder value.

See More