Strategy Shares Rolls The Dice With Monopoly ETF For Market Giants

Launch of the Monopoly ETF: Strategy Shares and Rareview Capital LLC introduced the Monopoly ETF (MPLY) on May 16, focusing on companies with monopolistic attributes such as established brand dominance and high entry barriers, aiming for a defensive investment strategy in volatile markets.

Investment Approach and Goals: MPLY seeks to provide reliable returns by investing in firms with sustainable competitive advantages, positioning itself as a core solution for equity portfolios while emphasizing long-term growth over short-term trends.

Trade with 70% Backtested Accuracy

Analyst Views on MPLY

No data

About the author

Monopoly ETFs Overview: The rise of monopoly-themed ETFs, such as the newly launched Strategy Shares Monopoly ETF (MPLY), reflects investor interest in companies with dominant market positions and strong pricing power, which often leads to higher margins and economic rents.

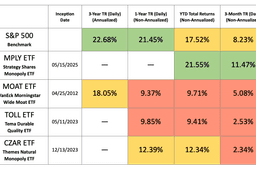

Performance Comparison: MPLY has outperformed the S&P 500 with a YTD return of +21.55% since its launch in May 2025, while the older VanEck Morningstar Wide Moat ETF (MOAT) has struggled, underperforming the S&P 500 with a 10-year annualized return of 14.47%.

Investment Strategies: MPLY focuses on large-cap stocks with monopolistic attributes without the constraints of a value strategy, while MOAT attempts to prioritize value, which has led to missed opportunities in high-performing stocks like Nvidia and Apple.

Market Dynamics: The changing stock market landscape, particularly the dominance of the "Magnificent 7" tech stocks, has rendered MOAT's value-focused approach less effective, highlighting the potential advantages of MPLY's more straightforward monopoly investment strategy.

Launch of the Monopoly ETF: Strategy Shares and Rareview Capital LLC introduced the Monopoly ETF (MPLY) on May 16, focusing on companies with monopolistic attributes such as established brand dominance and high entry barriers, aiming for a defensive investment strategy in volatile markets.

Investment Approach and Goals: MPLY seeks to provide reliable returns by investing in firms with sustainable competitive advantages, positioning itself as a core solution for equity portfolios while emphasizing long-term growth over short-term trends.