Stocks Experience Significant Shift: Potential Surprises Ahead.

Market Overview: The stock market is experiencing significant underlying tensions that may not be immediately apparent from surface-level observations.

Dow Performance: The Dow Jones Industrial Average (DJIA) closed 0.3% higher for the week, marking a notable moment as it briefly surpassed the 48,000 threshold for the first time.

Value Stocks Surge: There was a notable rush into value stocks that contributed to the DJIA's rise, indicating a shift in investor sentiment.

Caution Advised: Despite the positive closing, the overall market dynamics suggest that investors should remain cautious about potential volatility ahead.

Trade with 70% Backtested Accuracy

Analyst Views on DJIA

No data

About the author

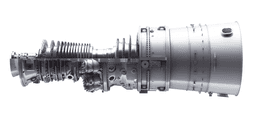

Energy Supercycle Impact: GE Vernova is benefiting from a significant energy supercycle, which is driving growth and opportunities in the energy sector.

Market Positioning: The company is strategically positioned to capitalize on the increasing demand for energy solutions, enhancing its market presence.

Innovation and Technology: GE Vernova is focusing on innovative technologies to improve energy efficiency and sustainability in its operations.

Future Prospects: The outlook for GE Vernova remains positive as it continues to adapt to changing energy market dynamics and consumer needs.

Market Opening: U.S. stock markets are set to open in two hours.

Dynatrace Inc. Performance: Dynatrace Inc. (DT) saw a 13.9% increase in pre-market trading.

Kroger Co. Performance: Kroger Co. (KR) experienced a 5.0% rise in pre-market trading.

Overall Market Sentiment: The pre-market gains indicate positive sentiment among investors for these companies.

- Stock Performance: Shares of Cleveland-Cliffs, a steel maker, experienced a decline early Monday following a disappointing conclusion to 2025.

- Future Outlook: Despite the recent downturn, expectations for the current year are more optimistic, suggesting potential improvement.

Stock Market Outlook: The Super Bowl Indicator suggests a positive year for the stock market, particularly following the Seattle Seahawks' victory.

Investor Sentiment: Even skeptics of the Super Bowl Indicator can find reasons for optimism as the market approaches a significant January jobs report.

- Stock Market Trends: Stock futures were declining on Monday as investors expressed concerns about the sustainability of a recent relief rally.

- Investor Sentiment: There is a prevailing uncertainty among investors regarding the market's ability to maintain upward momentum following last week's gains.