SoftBank's Nvidia Exit Dulls Wall Street Before Opening; Mixed Performance in Asia, Gains in Europe

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Nov 11 2025

0mins

Should l Buy ORCL?

Source: Yahoo Finance

Market Reaction: Wall Street futures showed a slight decline ahead of the market opening on Tuesday.

SoftBank Disclosure: The drop in futures follows a disclosure from Japan's tech-financier SoftBank.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy ORCL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on ORCL

Wall Street analysts forecast ORCL stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for ORCL is 309.59 USD with a low forecast of 180.00 USD and a high forecast of 400.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

34 Analyst Rating

25 Buy

9 Hold

0 Sell

Moderate Buy

Current: 142.820

Low

180.00

Averages

309.59

High

400.00

Current: 142.820

Low

180.00

Averages

309.59

High

400.00

About ORCL

Oracle Corporation offers integrated suites of applications plus secure, autonomous infrastructure in the Oracle Cloud. The Company operates through three businesses: cloud and license, hardware and service. Its cloud and license business is engaged in the sale, marketing and delivery of its enterprise applications and infrastructure technologies through cloud and on-premise deployment models including its cloud services and license support offerings, and its cloud license and on-premise license offerings. Its hardware business provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management and other hardware-related software to support diverse IT environments. Its services business provides services to customers and partners to help maximize the performance of their investments in Oracle applications and infrastructure technologies.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Infrastructure Migration: The five hospitals improved their electronic health record system's performance by migrating to OCI, achieving a 71% reduction in page load times and a 46% decrease in login response times, significantly enhancing clinician efficiency and patient care quality.

- Enhanced Data Security: With the migration to OCI, the hospitals have achieved higher data security and real-time patient information delivery, ensuring continuity of care and overall system resilience, which supports a better patient experience.

- AI Technology Pilot: TSSO is piloting the Oracle Health Clinical AI Agent with select physicians, which can automatically generate draft clinical notes, reducing administrative burdens on doctors and allowing them to focus more on patient care, with plans to expand to more physicians in 2026.

- Strategic Vision Realization: TSSO is committed to providing people-centered care, and the migration to OCI lays the groundwork for this vision, supporting smarter healthcare decisions and a better patient-focused experience.

See More

- Massive Funding Round: Databricks announced it has successfully raised $5 billion in funding and secured $2 billion in new debt capacity, achieving a valuation of $134 billion, reflecting strong market confidence in its growth potential.

- Significant Revenue Growth: The company reported annualized revenue exceeding $5.4 billion for the January quarter, marking a 65% year-over-year increase, while also delivering free cash flow over the past year, indicating the sustainability and profitability of its business model.

- IPO Readiness: CEO Ali Ghodsi stated that Databricks is prepared to go public when the time is right, a declaration that could attract more investor interest, especially against the backdrop of active tech IPOs.

- AI Revenue Contribution: Databricks' AI products now generate $1.4 billion in annualized revenue, showcasing strong market demand in the intersection of data analytics and AI, further solidifying its position in a competitive landscape.

See More

- Executive Change: Workday CEO Carl Eschenbach has stepped down immediately, with co-founder Aneel Bhusri taking over; Bhusri's extensive leadership history from 2009 to 2024 indicates a significant shift in the company's direction.

- Market Pressure: Software stocks are under pressure as investors worry about AI's disruptive potential, with Workday's shares dropping 17% last year and over 20% year-to-date, reflecting diminished market confidence in the company's future.

- Job Cuts and Investment: To bolster its investment in technology, Workday cut approximately 1,750 jobs last year; despite Eschenbach's statement highlighting achievements in operational discipline and AI groundwork, the market's reaction remains negative.

- Industry Transformation: Bhusri stated that AI represents a transformation larger than SaaS, which will define the next generation of market leaders, indicating that the company will face new strategic challenges and opportunities ahead.

See More

- Leadership Change: Workday announced the immediate resignation of CEO Carl Eschenbach, with co-founder Aneel Bhusri stepping back into the role, having previously served as CEO from 2009 to 2020, which may significantly influence the company's strategic direction.

- Market Pressure Intensifies: Workday's stock has dropped 17% over the past year and more than 20% year-to-date, reflecting investor concerns about the potential impact of artificial intelligence on the software sector, indicating a lack of confidence in the company's future performance.

- Job Cuts and Investment: Last year, Workday cut approximately 1,750 jobs to bolster its investment in technology, a move that may negatively affect employee morale in the short term but could enhance the company's competitiveness in AI in the long run.

- Industry Outlook: Bhusri stated that AI represents a greater transformation than SaaS, indicating a strategic focus on leveraging AI technology to shape future market leaders, which could significantly impact Workday's market positioning and competitive strategy.

See More

- Microsoft Downgrade: Melius Research downgraded Microsoft from buy to hold, citing that CEO Satya Nadella has lost the AI narrative and that the stock appears overpriced based on new free cash flow estimates, which may undermine investor confidence.

- Eli Lilly Acquires Orna: Eli Lilly announced the acquisition of biotech firm Orna Therapeutics for up to $2.4 billion, leading to a premarket surge in Eli Lilly and rival Novo Nordisk shares, indicating a positive market response towards biotech investments.

- Kroger's New CEO: Kroger's stock advanced nearly 7% in premarket trading after reports indicated that former Walmart executive Greg Foran will be appointed as the new CEO, having previously led Walmart's U.S. division for six years, suggesting a strategic shift for Kroger.

- Robinhood Upgrade: Wolfe Research upgraded Robinhood from hold to buy, despite the stock's recent decline amid a major cryptocurrency sell-off, as analysts believe its future potential remains strong, which could attract renewed investor interest.

See More

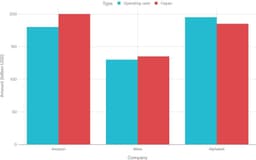

- Funding Shortages: Amazon expects to generate about $180 billion in operating cash this year against a capital spending plan of $200 billion, resulting in a $20 billion shortfall, marking the company's first entry into deficit territory which could impact future investment capabilities.

- Meta's Cash Flow Crisis: Meta anticipates operating cash flow of approximately $130 billion, while its capital spending guidance peaks at $135 billion, indicating significant financial pressure in building AI systems that may lead to depletion of cash reserves.

- Increased Debt Financing: Oracle raised $25 billion in bonds to support a $300 billion infrastructure deal with OpenAI, while Meta raised $30 billion last year, with tech companies expected to issue $337 billion in investment-grade bonds this year, reflecting the industry's urgent need for funding.

- Infrastructure Investment Risks: Big Tech firms are heavily investing in data centers and power facilities, yet the irreversibility of these infrastructures poses substantial financial risks, especially if AI demand does not grow as anticipated, potentially leading to massive depreciation and debt burdens.

See More