Siemens Energy boss says there can be no energy transition without China

- Europe's Energy Sector Reliance on China: CEO of Siemens Energy highlights the heavy reliance of Europe's energy sector on Chinese supplies, particularly in wind turbine manufacturing.

- Global Trade Tensions with China: The U.S. and EU are increasing tariffs on Chinese products like electric vehicles to protect local industries from unfair competition.

- EU Investigation on Chinese Wind Turbine Makers: The EU is investigating whether Chinese wind turbine makers benefit from subsidies that undercut Western companies like Vestas, Nordex, and GE Vernova.

- Challenges in Diversifying Supply Chains: Wind turbine production heavily depends on Chinese materials like rare earths and permanent magnets, making it difficult for the sector to diversify sources without significantly higher costs.

- Siemens Energy's Strategic Changes: Siemens Energy announced changes in its wind turbine division, including reducing market competition in regions like Latin America and Africa due to pressure from cheaper Chinese competitors.

Trade with 70% Backtested Accuracy

Analyst Views on GEV

About GEV

About the author

- Market Performance Rebound: The S&P 500 rose approximately 0.5%, the Nasdaq increased by 1%, and the Dow Jones Industrial Average held above 50,000, indicating a positive market sentiment and a recovery in investor confidence.

- Strong Tech Stock Recovery: The portfolio's Magnificent Seven stocks, including Alphabet, Microsoft, Nvidia, and Meta, rebounded after recent declines, suggesting renewed confidence in the tech sector that could drive future investment inflows.

- Rising Capital Expenditure Expectations: Bank of America's updated capex tracker revealed a 14% quarter-over-quarter and 66% year-over-year increase in global hyperscale capex to $148 billion in Q4, exceeding expectations by $7 billion, reflecting optimism for future investments.

- Upcoming Earnings Reports: On Semiconductor and Vornado Realty Trust are set to release earnings after the bell, with the market closely watching these reports to assess industry health, while several companies, including Coca-Cola and Spotify, will report before Tuesday's open, further influencing market sentiment.

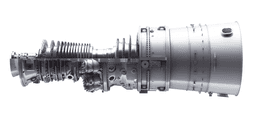

Energy Supercycle Impact: GE Vernova is benefiting from a significant energy supercycle, which is driving growth and opportunities in the energy sector.

Market Positioning: The company is strategically positioned to capitalize on the increasing demand for energy solutions, enhancing its market presence.

Innovation and Technology: GE Vernova is focusing on innovative technologies to improve energy efficiency and sustainability in its operations.

Future Prospects: The outlook for GE Vernova remains positive as it continues to adapt to changing energy market dynamics and consumer needs.

- Turbine Reservation Agreement: GE Vernova has entered into a gas turbine and generator reservation agreement with Maxim Power Corp., requiring a non-refundable deposit to secure the 7HA.02 turbine for delivery by 2030, contributing up to $60 million to the Prairie Lights Power project in Alberta.

- Strong Short-Term Trend: GE Vernova's stock is currently trading 12.1% above its 20-day simple moving average and 23.4% above its 100-day SMA, indicating a robust short-term trend, with shares increasing by 102.43% over the past 12 months.

- Financial Update Forecast: GE Vernova is set to provide its financial update on April 22, 2026, with an EPS estimate of $1.93 and revenue expected to reach $9.22 billion, reflecting significant growth compared to last year and highlighting the company's strong growth potential in the electric power sector.

- Optimistic Analyst Ratings: The stock carries a “Buy” rating with an average price target of $782.24, with RBC Capital and Goldman Sachs raising their targets, indicating analysts' confidence in the company's future growth prospects.

Projected Spending: MAXIM POWER CORP anticipates total project spending of up to $60 million during 2026.

Financial Outlook: The projected spending reflects the company's strategic planning and investment in future projects.

Agreement Overview: MAXIM Power Corp has entered into a gas turbine and generator reservation agreement, indicating a strategic move in energy production.

Project Update: The agreement is linked to the Prairie Lights Power Project, which is expected to enhance energy generation capabilities.

- Dow Index Milestone: The Dow Jones Industrial Average has surpassed 50,000 for the first time, marking a significant recovery in the U.S. stock market, reflecting increased investor confidence in economic recovery, which may lead to more capital inflows into equities.

- Buying Opportunities: Stocks like JPMorgan, Apple, and Boeing have entered buy zones, indicating that the performance of these large companies has attracted investor interest, potentially driving their stock prices higher and enhancing market vitality.

- Nasdaq Divergence: While the Nasdaq remains below key support levels, some AI-related stocks are reviving, indicating a potential rebound in tech stocks that may provide new investment opportunities for investors.

- Market Sentiment Improvement: The overall market sentiment is improving, as optimistic expectations for future economic growth may encourage more capital to flow into the stock market, thereby driving further increases in the overall market.