Ray-Ban maker EssilorLuxottica misses sales expectations as China slows By Reuters

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Oct 17 2024

0mins

Should l Buy META?

Source: Investing.com

EssilorLuxottica's Revenue Decline: The eyewear maker reported third quarter revenues of 6.44 billion euros, missing expectations due to a slowdown in consumer spending in China and particularly in Hong Kong.

Future Growth Expectations: Despite current challenges, EssilorLuxottica anticipates revenue growth to accelerate in the fourth quarter, bolstered by strong sales of smart Ray-Ban eyewear and confirmed long-term revenue targets.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy META?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on META

Wall Street analysts forecast META stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for META is 824.71 USD with a low forecast of 655.15 USD and a high forecast of 1117 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

44 Analyst Rating

37 Buy

6 Hold

1 Sell

Strong Buy

Current: 661.460

Low

655.15

Averages

824.71

High

1117

Current: 661.460

Low

655.15

Averages

824.71

High

1117

About META

Meta Platforms, Inc. is building human connections, powered by artificial intelligence and immersive technologies. The Company's products enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) and mixed reality (MR) headsets, augmented reality (AR), and wearables. It also helps people discover and learn about what is going on in the world around them, enabling people to share their experiences, ideas, photos, videos, and other content with audiences ranging from their closest family members and friends to the public at large. The Company's segments include Family of Apps (FoA) and Reality Labs (RL). FoA segment includes Facebook, Instagram, Messenger, WhatsApp and Threads. RL segment includes its virtual, augmented, and mixed reality related consumer hardware, software and content. Its product offerings in VR include its Meta Quest devices, as well as software and content available through the Meta Horizon Store.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

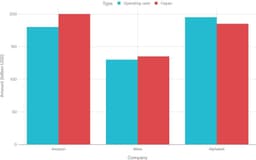

- Funding Shortages: Amazon expects to generate about $180 billion in operating cash this year against a capital spending plan of $200 billion, resulting in a $20 billion shortfall, marking the company's first entry into deficit territory which could impact future investment capabilities.

- Meta's Cash Flow Crisis: Meta anticipates operating cash flow of approximately $130 billion, while its capital spending guidance peaks at $135 billion, indicating significant financial pressure in building AI systems that may lead to depletion of cash reserves.

- Increased Debt Financing: Oracle raised $25 billion in bonds to support a $300 billion infrastructure deal with OpenAI, while Meta raised $30 billion last year, with tech companies expected to issue $337 billion in investment-grade bonds this year, reflecting the industry's urgent need for funding.

- Infrastructure Investment Risks: Big Tech firms are heavily investing in data centers and power facilities, yet the irreversibility of these infrastructures poses substantial financial risks, especially if AI demand does not grow as anticipated, potentially leading to massive depreciation and debt burdens.

See More

- Legal Action Intensifies: New Mexico has filed a lawsuit against Meta, alleging the company failed to protect apps like Facebook and Instagram from online predators targeting child users, which could lead to significant legal repercussions for Meta.

- Serious Allegations: Attorney General Raúl Torrez claims that Meta is accused of “steering and connecting users, including children, to sexually explicit and exploitative materials,” which not only affects virtual spaces but may also lead to real-world child exploitation.

- Industry-Wide Implications: Experts have noted that this case resembles lawsuits against “Big Tobacco” in the 1990s, potentially having far-reaching effects on Meta and the broader social media industry, especially as public concern over social media safety grows.

- Witness Testimony Scheduled: Meta CEO Mark Zuckerberg and Instagram head Adam Mosseri are scheduled to testify in the upcoming trial, highlighting the high stakes and potential public impact of this case.

See More

- Market Surge: The Dow Jones Industrial Average surged over 1,200 points on Friday, surpassing the 50,000 mark for the first time, closing the week up 2.5%, indicating a strong recovery in market sentiment despite earlier tech stock sell-offs.

- Bitcoin Rebound: Bitcoin rebounded above $70,000 on Friday, recovering from a sharp drop that nearly brought it below $60,000, reflecting a renewed confidence in the cryptocurrency market, although it remains over 50% off its all-time high.

- Super Bowl Advertising Boom: During the Super Bowl, NBC's average price for a 30-second ad reached $8 million, with some slots exceeding $10 million, highlighting strong demand in the advertising market, particularly from AI companies.

- Legal Battle Between Hims and Novo: Novo Nordisk is suing Hims & Hers over alleged copycat versions of its Wegovy obesity drug, leading Hims to announce the withdrawal of its product, which caused its shares to drop over 20% before the market opened.

See More

- Surge in IPO Proceeds: Goldman Sachs projects that U.S. IPO proceeds will reach a record $160 billion in 2026, quadrupling from 2025, indicating strong economic recovery and robust equity markets.

- Doubling of IPO Count: The number of IPOs is expected to double to 120 in 2026, driven by a recovering economy, rising equity prices, and favorable financial conditions, with software and healthcare sectors leading the charge.

- Large Company Listings: Goldman Sachs notes that 2026 IPOs will be dominated by large private company listings, with proceeds estimated between $80 billion and $200 billion, although recent selloffs in software stocks highlight valuation risks.

- Signs of Market Activity: Approximately $5 billion has already been raised through IPOs in 2026, including notable companies like AI equipment manufacturer Forgent Power and biopharmaceutical firm Eikon Therapeutics, reflecting a strong market rebound.

See More

- User Growth Resurgence: OpenAI CEO Sam Altman revealed in an internal message that ChatGPT's monthly growth rate has exceeded 10%, indicating a recovery in user demand that is expected to further drive the company's market share and revenue growth.

- New Model Launch: Altman stated that OpenAI plans to launch an updated ChatGPT model this week, which will enhance its product competitiveness, especially in the face of pressure from rivals like Anthropic.

- Strong Codex Performance: OpenAI's coding product Codex grew approximately 50% over the past week, demonstrating increased market acceptance and potentially eroding market share from competitors like Claude Code.

- Ad Testing Initiation: OpenAI will begin testing ads within ChatGPT on Monday; although ad revenue is expected to account for less than half of total revenue in the long term, this initiative could provide new revenue streams and enhance the company's financial stability.

See More

- Lawsuit Background: New Mexico Attorney General Raúl Torrez alleges that Meta failed to protect apps like Facebook and Instagram from online predators targeting child users, highlighting significant shortcomings in social media platforms' responsibilities towards youth safety.

- Allegations Details: The lawsuit claims that Meta steered users, including children, towards sexually explicit and exploitative content, even facilitating human trafficking, which underscores the potential dangers social media poses to young users' mental health.

- Legal Implications: This lawsuit is likened to the cases against 'Big Tobacco' in the 1990s, potentially leading to profound repercussions for Meta and the broader social media industry, especially as public concern over youth protection intensifies.

- Upcoming Trials: In addition to the New Mexico case, Meta faces another trial in California involving multiple social media platforms accused of designing defective apps that contribute to unhealthy behaviors in teens, further fueling discussions on social media accountability.

See More