RADIANT LOGISTICS TO HOST INVESTOR CALL TO DISCUSS FINANCIAL RESULTS FOR FOURTH FISCAL QUARTER AND YEAR ENDED JUNE 30, 2024

Conference Call Announcement: Radiant Logistics, Inc. will host a conference call on September 12, 2024, at 4:30 PM Eastern to discuss its financial results for the period ending June 30, 2024.

Access Information: The call is open to all interested parties and can be accessed via dial-in or webcast through Radiant's website, with replay options available from September 13 to September 26, 2024.

Trade with 70% Backtested Accuracy

Analyst Views on RLGT

About RLGT

About the author

Earnings Call Overview: Radiant Logistics, Inc. held its Q4 2025 earnings call on September 15, 2025, where CEO Bohn Crain and CFO Todd Macomber discussed the company's financial results for the fiscal year ending June 30, 2025.

Forward-Looking Statements: The call included forward-looking statements regarding the company's expectations and projections, highlighting potential risks and uncertainties that could affect future performance, as outlined in their SEC filings.

Fourth Quarter Profit: Radiant Logistics, Inc reported a profit of $7.5 million for the fourth quarter, compared to $4.4 million in the same period last year.

Revenue Growth: The company's revenue increased by 7.1% to $220.6 million, up from $206.0 million in the previous year.

Financial Performance: Radiant Logistics reported a strong fiscal year ending June 30, 2025, with adjusted EBITDA of $38.8 million, a 24.4% increase from the previous year, and net income of $4.907 million for the quarter on revenues of $220.6 million.

Acquisition Strategy: The company emphasized its focus on growth through acquisitions, including the recent purchase of Mexico-based Weport, which is expected to enhance its North American operations and support its long-term strategy amid ongoing trade volatility.

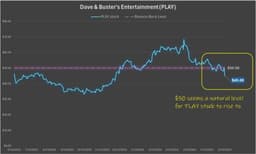

Earnings Reports: Major companies such as Hain Celestial, Radiant Logistics, Dave & Busters Entertainment, and High Tide are set to report their earnings today.

Options Activity Insights: Investors are monitoring options activity for insights into potential stock movements post-earnings, with expected moves ranging from +/- 17.34% to +/- 27.70% for the companies reporting.

Upcoming Earnings Reports: Major companies such as FedEx, Nano Dimension, General Mills, Lennar, and Darden Restaurants are set to report their earnings this week.

Options Volatility: The expected stock price movements are influenced by high options volatility leading up to earnings announcements, which typically decreases significantly after the announcements due to the resolution of uncertainty.

Stock Market Overview: The stock market opened mixed after record highs, with the Dow Jones reaching 46,000, influenced by a higher-than-expected consumer inflation report and jobless claims data.

Earnings Reports: Among the four S&P 500 companies reporting earnings, two exceeded EPS estimates, while three surpassed revenue expectations, with notable performances from Kroger and Adobe, and weaker results from Synopsys and Oracle.

Upcoming Earnings: Several companies, including Dave & Buster’s and General Mills, are set to report earnings next week, with a focus on various sectors.

Market Sentiment: Investor sentiment remains positive, driven by recent economic data and earnings reports, despite some companies facing challenges in meeting expectations.