ProCap Acquisition Corp Announces the Separate Trading of its Class A Ordinary Shares and Warrants, Commencing July 11, 2025

Unit Trading Announcement: ProCap Acquisition Corp will allow holders of its initial public offering units to separately trade Class A ordinary shares and redeemable warrants starting July 11, 2025, with trading symbols "PCAP" for shares and "PCAPW" for warrants on the Nasdaq Global Market.

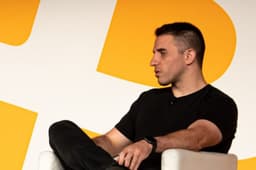

Company Overview: ProCap Acquisition Corp is a blank check company focused on merging or acquiring businesses, particularly in the financial technology sector, led by CEO Anthony Pompliano and CFO Catalina Abbey.

Trade with 70% Backtested Accuracy

Analyst Views on PCAPU

No data

About the author

Unit Trading Announcement: ProCap Acquisition Corp will allow holders of its initial public offering units to separately trade Class A ordinary shares and redeemable warrants starting July 11, 2025, with trading symbols "PCAP" for shares and "PCAPW" for warrants on the Nasdaq Global Market.

Company Overview: ProCap Acquisition Corp is a blank check company focused on merging or acquiring businesses, particularly in the financial technology sector, led by CEO Anthony Pompliano and CFO Catalina Abbey.

Public Companies Increasing Bitcoin Holdings: Public companies acquired approximately 131,000 BTC in Q2 2025, an 18% increase, outpacing ETFs which added around 111,000 BTC (8% rise), indicating a growing corporate interest in direct Bitcoin accumulation for long-term value enhancement.

Market Dynamics and Future Trends: The shift towards corporate Bitcoin holdings is influenced by a favorable regulatory environment under the Trump administration, with notable companies like GameStop and ProCap entering the Bitcoin treasury trend; however, analysts suggest that as more firms adopt this strategy, its unique appeal may decline over time.

Corporate Treasuries vs. ETFs: Corporate treasuries have outpaced ETFs in bitcoin purchases for three consecutive quarters, with public companies acquiring approximately 131,000 bitcoins in Q2, while ETFs added around 111,000 bitcoins. This trend reflects a shift towards companies accumulating bitcoin to enhance shareholder value rather than just speculative investment.

Future of Bitcoin Treasury Strategy: Experts predict that the current wave of companies adopting bitcoin treasury strategies may diminish over the next decade as market saturation occurs and bitcoin becomes more normalized, potentially leading to fewer firms actively pursuing this approach.

Pompliano's Warning on U.S. Economy: Anthony Pompliano asserts that the likelihood of a balanced U.S. budget is nearly zero, predicting that dollar debasement will continue to inflate asset prices, especially following weak demand for Treasury bonds and recent credit rating downgrades.

Market Reactions and Broader Concerns: The sell-off in long-dated bonds has led to declines in major stock indexes and a weakened U.S. dollar, with increasing concerns over government spending and inflation as prominent figures like Warren Buffett echo similar warnings about the depreciating dollar.

Pompliano's New SPAC: Entrepreneur Anthony Pompliano has launched a new SPAC, Pro Cap Acquisition, targeting the financial services sector with a potential focus on cryptocurrency, having raised $220 million in an upsized offering.

Market Strategy and Management: Pompliano aims to merge with cash flow-positive companies while leveraging his media presence; he is joined by Brent Saunders as a special advisor, emphasizing the importance of reputation and shareholder value in the SPAC's operations.

Public Companies and Bitcoin Holdings: Public companies increased their bitcoin holdings by 18% in the second quarter, surpassing ETFs for the third consecutive quarter, as they adopt strategies to enhance shareholder value through bitcoin treasury management.

Future of Bitcoin Treasury Strategy: Analysts predict that the trend of companies committing to bitcoin treasury strategies may decline over the next decade due to market saturation and normalization of bitcoin, potentially leading to a shift in how companies manage their treasury assets.