Netflix Faces Uncertainty Over Warner Asset Acquisition

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1 hour ago

0mins

Should l Buy NFLX?

Source: Fool

- Acquisition Overview: On December 5, 2025, Netflix announced a cash-and-stock deal to acquire Warner assets, including HBO and HBO Max, valued at $27.75 per share, totaling nearly $83 billion, despite competition from Paramount's $30 all-cash offer.

- Shareholder Vote and Regulatory Review: Netflix expects a shareholder vote for the deal approval by April 2026, with regulatory filings underway in the U.S. and Europe, indicating a lengthy and uncertain approval process that could take 12 to 18 months post-agreement.

- Intellectual Property Value: The acquisition would provide Netflix with valuable intellectual properties like the Harry Potter franchise and Game of Thrones assets, although associated debt obligations are estimated between $50 billion and $61 billion, which may take years to justify profitability.

- Market Reaction and Risks: If the deal is not approved, Netflix shareholders might benefit in the short term from saving billions, but the complexity and potential financial strain of the acquisition could lead to increased stock price volatility in the long run.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy NFLX?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on NFLX

Wall Street analysts forecast NFLX stock price to rise

38 Analyst Rating

27 Buy

10 Hold

1 Sell

Moderate Buy

Current: 77.000

Low

92.00

Averages

114.18

High

150.00

Current: 77.000

Low

92.00

Averages

114.18

High

150.00

About NFLX

Netflix, Inc. is a provider of entertainment services. The Company acquires, licenses and produces content, including original programming. It provides paid memberships in over 190 countries offering television (TV) series, films and games across a variety of genres and languages. It allows members to play, pause and resume watching as much as they want, anytime, anywhere, and can change their plans at any time. The Company offers members the ability to receive streaming content through a host of Internet-connected devices, including TVs, digital video players, TV set-top boxes and mobile devices. It is engaged in scaling its streaming service, such as introducing games and advertising on its service, as well as offering live programming. It is developing technology and utilizing third-party cloud computing, technology and other services. The Company is also engaged in scaling its own studio operations to produce original content.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Value Confirmation: The acquisition deal between Netflix and Warner Bros. Discovery (WBD) provides a clear value path for WBD shareholders, with expectations for shareholder support at the special meeting on March 20, 2026, as recommended by the board.

- Clear Regulatory Approval Path: Netflix and WBD have submitted their Hart-Scott-Rodino (HSR) filings and are actively collaborating with global competition authorities to ensure a smooth transaction process, demonstrating a higher level of certainty compared to PSKY.

- Industry Growth Potential: This transaction is set to expand production capacity and increase investment in original content, which is expected to create long-term job opportunities and further drive overall growth in the entertainment industry.

- Competitive Comparison: PSKY's financing challenges and rapid deleveraging plans pose significant risks to the entertainment sector, while Netflix's strong cash flow supports its all-cash transaction structure, ensuring a healthy balance sheet and flexibility for future strategic priorities.

See More

- Acquisition Overview: On December 5, 2025, Netflix announced a cash-and-stock deal to acquire Warner assets, including HBO and HBO Max, valued at $27.75 per share, totaling nearly $83 billion, despite competition from Paramount's $30 all-cash offer.

- Shareholder Vote and Regulatory Review: Netflix expects a shareholder vote for the deal approval by April 2026, with regulatory filings underway in the U.S. and Europe, indicating a lengthy and uncertain approval process that could take 12 to 18 months post-agreement.

- Intellectual Property Value: The acquisition would provide Netflix with valuable intellectual properties like the Harry Potter franchise and Game of Thrones assets, although associated debt obligations are estimated between $50 billion and $61 billion, which may take years to justify profitability.

- Market Reaction and Risks: If the deal is not approved, Netflix shareholders might benefit in the short term from saving billions, but the complexity and potential financial strain of the acquisition could lead to increased stock price volatility in the long run.

See More

- Investment Opportunity Analysis: The video discusses ten companies with significant upside potential, spanning various industries, aimed at providing long-term investors with diversified options to achieve capital appreciation in the future.

- Industry Diversity: The selected companies come from different sectors, reflecting a broad range of market opportunities, allowing investors to choose based on their risk preferences and investment strategies to optimize their portfolios.

- Market Timing: The stock prices mentioned are based on trading data from February 13, 2026, providing a temporal reference for investors to assess the current market environment and potential investment timing.

- Subscription and Offers: Viewers are encouraged to subscribe to the channel and click on the special offer link, indicating the creator's intention to enhance viewers' investment decision-making capabilities by providing more content and resources.

See More

- Investment Potential Analysis: The video discusses 10 companies across various industries that could offer significant upside for long-term investors, emphasizing the importance of a diversified portfolio in the current market environment.

- Historical Return Comparison: Using Netflix and Nvidia as examples, which were recommended in 2004 and 2005 respectively, a $1,000 investment at that time would now be worth $415,256 and $1,133,904, showcasing the analysis team's stock-picking ability and its impact on future investments.

- Superior Market Performance: Stock Advisor boasts an average total return of 889%, significantly outperforming the S&P 500's 193%, indicating the team's success in identifying high-potential stocks, which attracts more investors to their recommendations.

- Community Investment Philosophy: The video highlights the importance of an investing community built by individual investors for individual investors, encouraging viewers to stay updated on the latest investment advice to achieve better returns in future markets.

See More

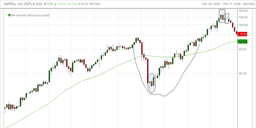

Market Cycles: Markets operate in cycles, indicating that trends and leadership positions are temporary.

Leadership Rotation: Leadership within markets rotates, consolidates, and eventually reemerges over time.

See More

- Amazon Stock Rebound: Amazon shares rose over 1% yesterday, breaking a nine-day losing streak that saw an 18% drop and over $450 billion in market cap erased, despite skepticism surrounding its $200 billion capital expenditure plan.

- Billionaire Investor Moves: Berkshire Hathaway disclosed in a regulatory filing that it reduced its Apple stake in Q4 while establishing a position in the New York Times, leading to a more than 3% increase in the media company's shares during extended trading, indicating investor interest in the media sector.

- Netflix Financing Plan: Netflix secured $59 billion in financing from Wall Street banks to support its $72 billion acquisition of Warner Bros. Discovery, marking one of the largest loans in history and highlighting the consolidation trend in the streaming industry.

- Meta-Nvidia Partnership Expansion: Meta announced an expansion of its partnership with Nvidia to utilize its AI chips for data center development and to enhance networking technology and AI features on WhatsApp, although financial terms were not disclosed, this signifies a deepening collaboration between the two tech giants.

See More