MOAT Fundamental Analysis

ETF Overview: The VanEck Morningstar Wide Moat ETF (MOAT) focuses on large-cap quality stocks, primarily in the Technology sector, with a significant emphasis on Software & Programming industries.

Investment Factors Analysis: The report provides a detailed analysis of MOAT's exposure to key investing factors such as value, quality, momentum, and low volatility, scoring from 1 to 99.

Trade with 70% Backtested Accuracy

Analyst Views on MOAT

No data

About the author

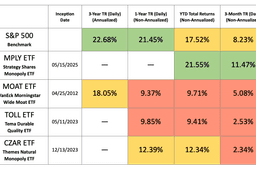

Monopoly ETFs Overview: The rise of monopoly-themed ETFs, such as the newly launched Strategy Shares Monopoly ETF (MPLY), reflects investor interest in companies with dominant market positions and strong pricing power, which often leads to higher margins and economic rents.

Performance Comparison: MPLY has outperformed the S&P 500 with a YTD return of +21.55% since its launch in May 2025, while the older VanEck Morningstar Wide Moat ETF (MOAT) has struggled, underperforming the S&P 500 with a 10-year annualized return of 14.47%.

Investment Strategies: MPLY focuses on large-cap stocks with monopolistic attributes without the constraints of a value strategy, while MOAT attempts to prioritize value, which has led to missed opportunities in high-performing stocks like Nvidia and Apple.

Market Dynamics: The changing stock market landscape, particularly the dominance of the "Magnificent 7" tech stocks, has rendered MOAT's value-focused approach less effective, highlighting the potential advantages of MPLY's more straightforward monopoly investment strategy.

52 Week Range and Share Price: MOAT's share price has a 52-week low of $75.43 and a high of $99.46, with the latest trade at $96.54, which can be analyzed against the 200-day moving average for technical insights.

ETFs Trading Dynamics: Exchange traded funds (ETFs) function like stocks but involve trading "units" that can be created or destroyed based on investor demand, impacting the underlying holdings significantly during notable inflows or outflows.

ETF Overview: The VanEck Morningstar Wide Moat ETF (MOAT) focuses on large-cap quality stocks, primarily in the Technology sector, with a significant emphasis on Software & Programming industries.

Investment Factors Analysis: The report provides a detailed analysis of MOAT's exposure to key investing factors such as value, quality, momentum, and low volatility, scoring from 1 to 99.

Current Share Price Analysis: MOAT's share price is currently at $91.64, with a 52-week low of $75.43 and a high of $99.06, indicating its performance within the trading range.

ETF Trading Dynamics: ETFs operate like stocks but involve trading "units" that can be created or destroyed based on investor demand, affecting the underlying holdings and market flows.

Current Share Price Analysis: MOAT's share price is currently at $91.68, with a 52-week low of $75.43 and a high of $99.06, indicating its performance within the trading range.

ETFs Trading Dynamics: ETFs trade like stocks but involve buying and selling units that can be created or destroyed based on investor demand, affecting the underlying holdings and market flows.

MOAT ETF Performance: The MOAT ETF has a 52-week range with a low of $75.43 and a high of $99.06, currently trading at $91.06, which can be analyzed against its 200-day moving average for technical insights.

ETF Trading Dynamics: ETFs function like stocks but involve trading "units" that can be created or destroyed based on investor demand, affecting the underlying holdings and potentially leading to significant inflows or outflows.