Medline's IPO Raises $6.3 Billion, Valuation Reaches $35.5 Billion

- IPO Financing Scale: Medline's IPO successfully raised $6.3 billion at a price of $29 per share, significantly enhancing the company's capital structure, with plans to use the proceeds to pay down $16.5 billion in debt, thereby improving financial health.

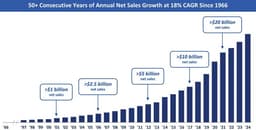

- Sales Growth Momentum: Since its founding in 1966, Medline has achieved an average annual sales growth of 18%, with projections indicating sales will reach $30 billion by 2026, demonstrating strong growth potential in the medical supply market, particularly given the resilience of healthcare demand amid economic uncertainties.

- Market Competitive Advantage: With 335,000 products and 33 manufacturing facilities, Medline offers next-day delivery to 95% of U.S. customers, leveraging its private label products to enhance margins and solidify its leadership position in the medical product supply chain.

- Superior Financial Performance: Medline boasts a gross margin of approximately 27.4%, significantly higher than key competitors, and is projected to generate $1.5 billion in free cash flow in 2025, showcasing its profitability and cash flow generation capabilities, further enhancing its investment appeal.

Trade with 70% Backtested Accuracy

Analyst Views on MDLN

About MDLN

About the author

Jennifer Garner's Characters: Garner is known for her roles as Sidney Bristow in Alias and Elektra in Marvel films, where she faced tough adversaries.

Current Challenge: The actress is now dealing with the challenges posed by unpredictable investors in her entrepreneurial ventures.

Entrepreneurial Success: Despite the challenges, Garner appears to be successfully navigating the investment landscape.

Transition from Acting to Business: Garner's shift from acting to entrepreneurship highlights her versatility and determination in facing new challenges.

Amazon's Spending Forecast: Amazon's recent spending forecast has surprised the markets, contrasting sharply with the prevailing risk-averse sentiment among investors.

Concerns Over AI Investments: This situation raises concerns about whether the current enthusiasm for artificial intelligence investments may mirror the speculative excesses seen during the dot-com bubble.

Upcoming IPOs: Three new IPOs are set to launch today, attracting investor attention.

Key Players: The companies involved in these IPOs include SpaceX, OpenAI, and Anthropic.

Market Anticipation: Investors are particularly eager for these IPOs as they await significant developments later this year.

Investment Climate: The current market environment is buzzing with excitement over these high-profile companies entering the public market.

- Revenue and Profit Growth: Symbotic reported a 26% revenue increase and a 72% rise in gross profit for fiscal year 2025, indicating significant progress towards profitability, which is likely to attract more investor interest.

- Strong Financial Position: By the end of 2025, Symbotic's cash reserves reached $1.3 billion, with a backlog of $22.5 billion, nearly ten times its 2025 revenue, showcasing robust potential for future growth.

- Customer Base Expansion: The signing of a new customer agreement with medical supplies giant Medline signifies the successful application of Symbotic's AI automation technology across industries, enhancing its market competitiveness.

- Strategic Acquisitions and Partnerships: Symbotic's acquisition of Walmart's advanced systems and robotics business, along with a nearly $11 billion contract for its Exol project with SoftBank, is expected to drive sustained growth for the company in the coming years.

- Significant Performance Growth: Symbotic achieved a remarkable 150.9% stock price increase in 2025, with a 26% revenue rise and a 72% gross profit surge, indicating substantial progress towards profitability and setting the stage for continued momentum in 2026.

- Massive Backlog: As of 2025, Symbotic's backlog reached $22.5 billion, nearly ten times its revenue for the year, providing robust support for future revenue growth and reflecting strong market demand for its automation solutions.

- Customer Base Expansion: The signing of a new agreement with medical supplies giant Medline marks a successful diversification of Symbotic's business beyond retail, demonstrating the scalability of its AI-powered automation technology across different industries.

- Strategic Acquisitions and Partnerships: Symbotic's acquisition of Walmart's advanced systems and robotics business, along with the launch of the nearly $11 billion warehouse-as-a-service project Exol in partnership with SoftBank, are poised to drive significant growth for the company in the future.

- IPO Financing Scale: Medline's IPO successfully raised $6.3 billion at a price of $29 per share, significantly enhancing the company's capital structure, with plans to use the proceeds to pay down $16.5 billion in debt, thereby improving financial health.

- Sales Growth Momentum: Since its founding in 1966, Medline has achieved an average annual sales growth of 18%, with projections indicating sales will reach $30 billion by 2026, demonstrating strong growth potential in the medical supply market, particularly given the resilience of healthcare demand amid economic uncertainties.

- Market Competitive Advantage: With 335,000 products and 33 manufacturing facilities, Medline offers next-day delivery to 95% of U.S. customers, leveraging its private label products to enhance margins and solidify its leadership position in the medical product supply chain.

- Superior Financial Performance: Medline boasts a gross margin of approximately 27.4%, significantly higher than key competitors, and is projected to generate $1.5 billion in free cash flow in 2025, showcasing its profitability and cash flow generation capabilities, further enhancing its investment appeal.