Korean Air Places Largest Boeing Jet Order in Airline History During Trump-Lee Summit

Korean Air's Major Order: Korean Air announced a historic $50 billion order for 103 Boeing airplanes and GE Aerospace engines during South Korean President Lee Jae Myung's visit to Washington.

Details of the Aircraft Order: The order includes various models such as 787s, 777s, and 737 MAX 10 planes, with approximately 80% intended to replace existing aircraft in their fleet.

Strategic Growth Plans: CEO Cho Won-tae stated that this record-breaking order will facilitate Korean Air's expansion into more U.S. and Latin American destinations, while also integrating operations with Asiana Airlines.

Impact on U.S. Exports: The deal is expected to boost U.S. aerospace exports, with Commerce Secretary Howard Lutnick emphasizing the administration's commitment to advanced manufacturing jobs in America.

Trade with 70% Backtested Accuracy

Analyst Views on GE

About GE

About the author

- Dividend Stock Appeal: Christopher Buchbinder from Capital Group highlights the attractiveness of dividend stocks, particularly those rated investment grade with a long history of income payments, which has allowed the CGDV fund to outperform the S&P 500 in down markets.

- Tech Sector Allocation: As of January 31, 26.8% of CGDV's assets are allocated to information technology, particularly semiconductor companies, reflecting the team's confidence in a sustainable AI investment cycle, with expectations that AI will dramatically change lives over the next 5-10 years.

- Energy Sector Opportunities: Although energy comprises only 6.4% of CGDV's portfolio, Buchbinder sees an upcycle in the oil field services sector over the next few years, particularly with Halliburton's collaboration with VoltaGrid to manufacture power systems for AI data centers, indicating long-term growth potential.

- Healthcare Investment: CGDV's largest healthcare holding is Eli Lilly at 3.86%, with Buchbinder believing that the long-term trend of GLP-1 drugs will transform the healthcare landscape in the U.S., positioning Eli Lilly as the market leader while awaiting FDA approval for its oral GLP-1 drug.

- New Thematic Investing Trend: The Tuttle Capital UFO Disclosure ETF (BATS:UFOD) is pushing thematic investing into unprecedented territory by betting on companies that could benefit from government acknowledgment of non-human intelligence, attracting increasing investor interest.

- Strong Market Response: The ETF's stock price has reached record levels, driven by heightened mainstream discussion of UFOs following U.S. Congressional hearings and testimonies from former intelligence officials, indicating a robust market appetite for this theme.

- Unique Investment Strategy: The fund's strategy revolves around a hypothetical 'Disclosure Day,' anticipating increased government expenditures in defense, new energy, and advanced materials, should such an acknowledgment occur, which investors view as a significant opportunity.

- Conventional Holdings Structure: Despite its eye-catching theme, the actual holdings of the UFOD ETF remain relatively traditional, with an expense ratio of 0.99%, reflecting a balance between pursuing emerging investment themes and maintaining investment stability.

Energy Supercycle Impact: GE Vernova is benefiting from a significant energy supercycle, which is driving growth and opportunities in the energy sector.

Market Positioning: The company is strategically positioned to capitalize on the increasing demand for energy solutions, enhancing its market presence.

Innovation and Technology: GE Vernova is focusing on innovative technologies to improve energy efficiency and sustainability in its operations.

Future Prospects: The outlook for GE Vernova remains positive as it continues to adapt to changing energy market dynamics and consumer needs.

- Dow Index Milestone: The Dow Jones Industrial Average has surpassed 50,000 for the first time, marking a significant recovery in the U.S. stock market, reflecting increased investor confidence in economic recovery, which may lead to more capital inflows into equities.

- Buying Opportunities: Stocks like JPMorgan, Apple, and Boeing have entered buy zones, indicating that the performance of these large companies has attracted investor interest, potentially driving their stock prices higher and enhancing market vitality.

- Nasdaq Divergence: While the Nasdaq remains below key support levels, some AI-related stocks are reviving, indicating a potential rebound in tech stocks that may provide new investment opportunities for investors.

- Market Sentiment Improvement: The overall market sentiment is improving, as optimistic expectations for future economic growth may encourage more capital to flow into the stock market, thereby driving further increases in the overall market.

- Dividend Declaration: GE Aerospace's Board of Directors has declared a dividend of $0.47 per share, payable on April 27, 2026, to shareholders of record as of March 9, 2026, reflecting the company's commitment to shareholder returns.

- Record Date: The ex-dividend date is set for March 9, 2026, meaning investors holding shares before this date will qualify for the dividend, thereby enhancing the attractiveness of the stock to investors.

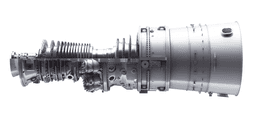

- Company Overview: GE Aerospace is a global leader in aerospace propulsion, services, and systems, with an installed base of approximately 50,000 commercial and 30,000 military aircraft engines, showcasing its strong position in the aviation industry.

- Employee Count: With around 57,000 employees and over a century of innovation and learning, GE Aerospace is committed to inventing the future of flight, enhancing travel experiences, and ensuring safe returns home.

- Dividend Declaration: GE Aerospace's Board of Directors has declared a $0.47 per share dividend, payable on April 27, 2026, to shareholders of record as of March 9, 2026, reflecting the company's commitment to returning value to its shareholders.

- Record Date: The ex-dividend date is set for March 9, 2026, meaning investors holding shares at the close of business on this date will qualify for the dividend, enhancing the attractiveness of the stock to potential investors.

- Company Overview: GE Aerospace is a global leader in aerospace propulsion, services, and systems, with an installed base of approximately 50,000 commercial and 30,000 military aircraft engines, showcasing its strong market position and capabilities in the aviation sector.

- Employee Strength: With around 57,000 employees and over a century of innovation and learning, GE Aerospace is dedicated to inventing the future of flight, enhancing travel experiences, and ensuring safe returns home.