High-End Purchases Surge on Black Friday

Black Friday Sales Performance: U.S. Black Friday sales exceeded expectations with a 6% year-over-year increase, particularly driven by a 21% growth in luxury apparel and accessories.

Impact on Consumer Stocks: Companies like Tapestry, Capri Holdings, and Ralph Lauren may benefit from the ongoing trend of strong luxury spending, which is influenced by higher prices.

Luxury Market Resilience: Despite economic uncertainty, U.S. luxury sales in 2025 are projected to grow by around 6% year-over-year, although traditional goods face challenges due to price sensitivity.

Luxury Retail Trends: Luxury retail visitation has declined by about 4% year-over-year, indicating a pullback from aspirational buyers amid high prices and inflation.

Trade with 70% Backtested Accuracy

Analyst Views on KLXY

No data

About the author

Black Friday Sales Performance: U.S. Black Friday sales exceeded expectations with a 6% year-over-year increase, particularly driven by a 21% growth in luxury apparel and accessories.

Impact on Consumer Stocks: Companies like Tapestry, Capri Holdings, and Ralph Lauren may benefit from the ongoing trend of strong luxury spending, which is influenced by higher prices.

Luxury Market Resilience: Despite economic uncertainty, U.S. luxury sales in 2025 are projected to grow by around 6% year-over-year, although traditional goods face challenges due to price sensitivity.

Luxury Retail Trends: Luxury retail visitation has declined by about 4% year-over-year, indicating a pullback from aspirational buyers amid high prices and inflation.

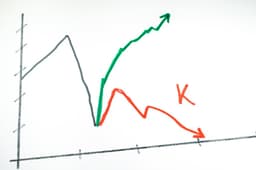

K-shaped Economy: The U.S. economy is experiencing a K-shaped recovery, where luxury spending is increasing while mass-market consumption declines, reflecting a growing wealth gap.

Luxury Spending Growth: Bank of America reports a 4% year-over-year increase in U.S. luxury spending for October, with jewelry spending seeing a significant rise from 10% to 16%.

Consumer Sentiment Decline: The University of Michigan's Consumer Survey indicates a drop in consumer sentiment to its lowest level since June 2022, highlighting the struggles of average Americans amid rising inequality.

Investor Confidence in Luxury: The Kraneshares Global Luxury Index ETF has seen a rise, indicating investor confidence in premium brands, as the wealthiest Americans continue to dominate stock ownership and luxury consumption.

Luxury Market Adaptation: Luxury brands in China are adjusting their strategies to cope with slowing economic growth and changing consumer behaviors, as highlighted at the Business of Luxury Summit in Hong Kong. Despite a GDP growth decline to 4.8%, there remains a strong demand for premium goods, particularly in lower-tier cities.

Experiential Retail Strategies: Brands like Louis Vuitton are focusing on experiential retail, exemplified by their ship-shaped store in Shanghai, which attracts affluent tourists from various provinces, indicating a shift in luxury spending patterns away from local consumers.

Psychological Consumption Slowdown: Panelists at the summit noted that the slowdown in luxury consumption is more psychological than structural, with the potential for continued spending as consumer confidence rebounds.

Emerging Markets for Luxury: Younger consumers in lower-tier cities are increasingly engaging with luxury brands, often through local names, marking a generational shift in how luxury is perceived and consumed in China.

Gen Z's Impact on Luxury: Gen Z is reshaping the luxury market by prioritizing sustainability, digital culture, and affordable prestige over traditional logos and heritage brands, as highlighted by a Reuters survey.

ETF Performance Comparison: The KraneShares Global Luxury Index ETF (KLXY) has shown better performance with an 11.5% return since its September 2023 debut, while the Themes European Luxury ETF (FINE) has remained flat and lost 3.6% over the past year, indicating KLXY's broader appeal to Gen Z's preferences.

Financial Performance: Ralph Lauren Corp reported an 8% year-on-year sales growth to $1.70 billion for Q4 FY25, exceeding analyst expectations, with adjusted EPS of $2.27 also surpassing estimates. The company generated $1.24 billion in operating cash flow and announced a 10% increase in its quarterly cash dividend.

Future Outlook: For FY26, Ralph Lauren anticipates low-single digit revenue growth, primarily in the first half of the fiscal year, while maintaining a focus on managing macroeconomic uncertainties and leveraging its diversified supply chain.

Tapestry, Inc. Performance: Tapestry, Inc., a luxury fashion house with a market cap of $15.4 billion, has seen its stock soar 79.1% over the past year, significantly outperforming competitors and the broader luxury index, driven by successful strategies to attract younger consumers.

Merger Termination Impact: Following the termination of its planned $8.5 billion merger with Capri Holdings due to antitrust objections, TPR shares surged over 12%, leading gains in the S&P 500, while analysts maintain a "Moderate Buy" consensus rating for the stock.