HC Wainwright & Co. Confirms Buy Rating for Northern Dynasty Minerals (NAK)

Analyst Recommendation: HC Wainwright & Co. has reiterated a Buy recommendation for Northern Dynasty Minerals (NYSEAM:NAK) as of December 19, 2025, despite a projected average one-year price target of $0.58/share, indicating a 73.45% downside from its recent closing price of $2.20/share.

Fund Sentiment: There has been a 5.49% increase in the number of funds reporting positions in Northern Dynasty Minerals, with total shares owned by institutions rising by 50.56% to 103,964K shares over the last three months.

Shareholder Activity: Notable changes in shareholder allocations include Kopernik Global Investors increasing its stake by 9.21%, while MIRAE ASSET GLOBAL ETFS HOLDINGS decreased its allocation by 63.51%. COPX - Global X Copper Miners ETF significantly increased its holdings by 508.16%.

Market Outlook: The put/call ratio for NAK is at 0.22, suggesting a bullish outlook among investors, despite the overall negative price target forecast.

Trade with 70% Backtested Accuracy

Analyst Views on NAK

About NAK

About the author

- Clinical Trial Results: Sarepta Therapeutics reported significant three-year results from the EMBARK study, showing that patients treated with Elevidys demonstrated statistically significant efficacy in motor function assessments, leading to a 9.8% stock price increase to $23.20, indicating enhanced competitiveness in Duchenne muscular dystrophy treatment.

- Positive Market Reaction: Following the release of favorable clinical data, there was a surge in demand for Sarepta's shares, reflecting investor optimism about the biopharmaceutical sector's outlook, which may attract more capital into the industry.

- Industry Impact: Sarepta's success could inspire other biopharmaceutical companies to increase investments in rare disease research and development, thereby fostering innovation and growth across the sector.

- Investor Confidence Boost: The success story of Sarepta may bolster investor confidence in biotech stocks, particularly as market conditions continue to favor increased focus on the healthcare sector.

Analyst Recommendation: HC Wainwright & Co. has reiterated a Buy recommendation for Northern Dynasty Minerals (NYSEAM:NAK) as of December 19, 2025, despite a projected average one-year price target of $0.58/share, indicating a 73.45% downside from its recent closing price of $2.20/share.

Fund Sentiment: There has been a 5.49% increase in the number of funds reporting positions in Northern Dynasty Minerals, with total shares owned by institutions rising by 50.56% to 103,964K shares over the last three months.

Shareholder Activity: Notable changes in shareholder allocations include Kopernik Global Investors increasing its stake by 9.21%, while MIRAE ASSET GLOBAL ETFS HOLDINGS decreased its allocation by 63.51%. COPX - Global X Copper Miners ETF significantly increased its holdings by 508.16%.

Market Outlook: The put/call ratio for NAK is at 0.22, suggesting a bullish outlook among investors, despite the overall negative price target forecast.

Northern Dynasty Minerals' Share Performance: The company's shares have surged over 200% in the past year, with a recent 30-day return of 16.33% and a 90-day return of 150%, indicating strong bullish momentum despite a recent pullback to CA$2.85.

Valuation Concerns: Northern Dynasty's price-to-book ratio stands at 26.1 times, significantly higher than its peers, suggesting that the market is heavily pricing in the future potential of the Pebble project despite the lack of current revenue and profitability.

Risks and Uncertainties: The company faces significant permitting uncertainties and ongoing cash burn, which could lead to a rapid decline in share value if regulatory setbacks or funding issues arise.

Investment Opportunities: The article encourages investors to explore other high-growth stocks with strong insider ownership and highlights various sectors, including healthcare AI and dividend stocks, for potential investment opportunities.

Stock Performance: Northern Dynasty Minerals has experienced a 35% drop in stock price over the past month, but remains up nearly 90% over the last three months, with a year-to-date return of 151% and a 12-month total shareholder return of 277%.

Valuation Concerns: The company's price-to-book ratio stands at 33.3x, significantly higher than industry peers, indicating potential overvaluation, especially as the company is currently unprofitable with minimal revenue.

Investment Risks: Ongoing losses and lack of revenue growth present significant risks that could challenge the optimistic valuation narrative surrounding Northern Dynasty Minerals.

Research Opportunities: Investors are encouraged to explore various investment opportunities, including AI penny stocks, high-yield dividend stocks, and undervalued stocks based on cash flows, to diversify their portfolios.

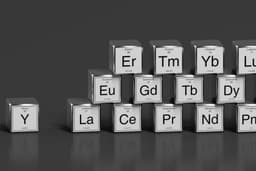

Market Reaction to China’s Export Controls: Rare earth and critical mineral stocks fell sharply due to expectations that China may pause its export control measures, with significant declines in companies like MP Materials and USA Rare Earth.

U.S.-China Trade Deal Developments: Treasury Secretary Scott Bessent announced that a trade deal has been drafted between the U.S. and China, potentially averting the threat of 100% tariffs on Chinese imports set for November 1.

Temporary Easing of Export Restrictions: Reports indicate that Chinese regulators may temporarily ease enforcement of export restrictions, leading to a pullback in rare-earth mining stocks, although this may not resolve underlying tensions in resource management.

Future Market Implications: While a pause in China's export controls may alleviate immediate market concerns, ongoing demand for EVs and renewable energy could strain supply chains, benefiting domestic producers as the U.S. invests in mining and processing initiatives.

Investment Update: Northern Dynasty Minerals received a $12 million payment, completing a $60 million investment under its royalty agreement.

Royalty Agreement Details: The maximum royalty rates are now in effect, allowing the royalty holder to receive 10% of payable gold and 30% of payable silver production from the Pebble project.

Company Strategy: The investment program was initiated to enhance liquidity without issuing equity at low prices, a decision that has proven beneficial as the share price has increased over five times since the agreement began in 2022.

Legal Proceedings: Northern Dynasty is preparing for a court case and is seeking a summary judgment after negotiations with the EPA have stalled.