GRAND OLE OPRY TO CELEBRATE 100th ANNIVERSARY NIGHT WITH STAR-PACKED GLOBAL LIVESTREAM FRI., NOV. 28

100th Anniversary Celebration: The Grand Ole Opry will celebrate its 100th anniversary on November 28, 2025, with a global livestream of two star-studded shows featuring over 25 Opry members, including both long-serving and recent inductees.

Legacy and Impact: Since its inaugural broadcast in 1925, the Opry has grown to include more than 200 members and has hosted over 15,000 broadcasts, becoming a cornerstone of country music and a platform for countless artists across generations.

Trade with 70% Backtested Accuracy

Analyst Views on RHP

About RHP

About the author

Market Volatility Concerns: Investors are increasingly worried about potential volatility in the stock market due to rising gold and silver prices, alongside fears of international sell-offs of U.S. assets, prompting a shift towards more defensive investment strategies.

Ryman Hospitality Properties: Ryman Hospitality, focused on large hotel and resort investments, is noted for its strong dividend yield of 5.07% and a solid cash position, making it an attractive option for investors seeking dividend income.

Black Hills Corporation's Stability: Black Hills Corporation, a regulated utility company, offers reliable electric and natural gas services, with a dividend yield of 3.71% and a sustainable payout ratio, positioning it as a defensive investment in uncertain markets.

Essential Utilities Merger: Essential Utilities is set to merge with American Water Works, creating one of the largest U.S. water service firms, with expectations of significant earnings growth and a dividend yield of 3.55%, enhancing its appeal to investors.

- Earnings Release Schedule: Ryman Hospitality Properties will announce its Q4 2025 earnings after market close on February 23, 2026, which is expected to provide key financial data for investors to assess future growth potential.

- Conference Call Details: Management will hold a conference call at 10 a.m. ET on February 24, 2026, allowing investors to dial in at 800-225-9448 to discuss quarterly results, enhancing transparency and communication with shareholders.

- Replay Service: The conference call will be available for replay until March 3, 2026, by dialing 800-688-9445, ensuring that investors who cannot participate live can still access important information, thereby improving information accessibility.

- Webcast Availability: The call will also be webcast on the company's Investor Relations website, further broadening the channels through which investors can obtain information, reflecting the company's commitment to investor relations.

- Earnings Release Schedule: Ryman Hospitality Properties will announce its Q4 2025 earnings results after market close on February 23, 2026, which is expected to provide key financial data for investors to assess the company's market performance.

- Conference Call Details: Management will hold a conference call at 10 a.m. ET on February 24, 2026, to discuss quarterly results, allowing investors to dial in at 800-225-9448, thereby enhancing transparency and investor confidence.

- Replay Availability: The conference call will be available for replay until March 3, 2026, by dialing 800-688-9445, ensuring that investors who cannot participate live can still access important information.

- Webcast Accessibility: The call will also be webcast on the company's Investor Relations website, further expanding the reach of information dissemination and improving interaction between the company and its investors.

Earnings Release Announcement: Ryman Hospitality Properties, Inc. will release its fourth quarter 2025 earnings results on February 23, 2026, after market close, followed by a conference call on February 24, 2026, at 10 a.m. ET.

Conference Call Participation: Interested participants can join the conference call by dialing 800-225-9448 with conference ID: RHPQ425, and a replay will be available until March 3, 2026.

Company Overview: Ryman Hospitality Properties specializes in upscale convention center resorts and entertainment experiences, owning several major properties including Gaylord hotels and a controlling interest in Opry Entertainment Group.

Investor Relations Contacts: Key contacts for investor relations include Mark Fioravanti (CEO), Jennifer Hutcheson (CFO), and Sarah Martin (VP, Investor Relations), with their respective contact information provided for inquiries.

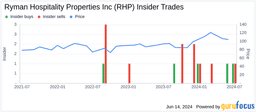

52 Week Range: RHP's stock has a 52-week low of $76.27 and a high of $118.74, with the last trade recorded at $94.99.

Dividend Stocks: The article mentions a link to find 9 other dividend stocks that have recently crossed above their 200-day moving average.

Author's Views: The opinions expressed in the article are solely those of the author and do not necessarily represent Nasdaq, Inc.

Market Insights: The information provided offers insights into RHP's stock performance and market trends related to dividend stocks.

- Dividend Announcement: Ryman Hospitality Properties has declared a fourth-quarter cash dividend of $1.20 per share, to be paid on January 15, 2026, reflecting the company's confidence in its future cash flow.

- Shareholder Returns: This dividend payment will benefit shareholders of record as of December 31, 2025, enhancing the company's appeal among investors and potentially increasing shareholder loyalty.

- Financial Stability: The company's consistent dividend payments indicate robust financial health, demonstrating its ability to maintain profitability amid economic fluctuations, which could bolster market confidence in its long-term investment value.

- Market Positioning: As a leading lodging and hospitality REIT, RHP's dividend policy helps solidify its leadership in the upscale convention center and entertainment experience market, attracting more investor interest in its growth potential.