GE Vernova and Siemens Energy reportedly negotiating to provide gas turbines for Syria's reconstruction efforts.

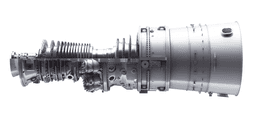

Project Overview: GE Vernova and Siemens Energy are negotiating to supply gas turbines for a $7 billion project aimed at rebuilding Syria's power sector, which has been heavily damaged by war.

Contract Details: Syria has signed a deal to construct four combined-cycle gas turbine power plants with a total capacity of 4,000 megawatts, along with a 1,000-MW solar component, but specific budget details for the turbines are not disclosed.

Potential Impact: If successful, Siemens Energy and GE Vernova would be among the first Western companies to engage in Syria's power sector reconstruction following the lifting of most U.S. sanctions on Damascus earlier this year.

Market Context: The negotiations come amid mixed financial results for GE Vernova, which is also focusing on expanding its electrification segment and targeting significant revenue growth by 2028.

Trade with 70% Backtested Accuracy

Analyst Views on GEV

About GEV

About the author

- Performance Rebound: GE Vernova's stock has surged 12.9% in 2026 and over 100% in the past year, indicating a robust performance in the clean energy transition and reflecting market confidence in its future growth.

- Order Surge: Gas turbine orders increased from 33 GW in 2024 to 40 GW in 2025, with customers willing to pay upfront for future production slots, demonstrating strong demand for gas turbine equipment.

- Optimistic Outlook: CEO Scott Strazik stated during the earnings call that they expect to reach approximately 100 GW under contract in 2026, showcasing confidence in future performance, particularly in high-margin service revenue growth.

- Diversified Growth: In addition to gas turbines, GE Vernova shows strong growth potential in electrification and wind power segments, with EBITDA expected to double from $5.3 billion in 2026 to $11.2 billion by 2028, further solidifying its market position.

- Market Performance Rebound: The S&P 500 rose approximately 0.5%, the Nasdaq increased by 1%, and the Dow Jones Industrial Average held above 50,000, indicating a positive market sentiment and a recovery in investor confidence.

- Strong Tech Stock Recovery: The portfolio's Magnificent Seven stocks, including Alphabet, Microsoft, Nvidia, and Meta, rebounded after recent declines, suggesting renewed confidence in the tech sector that could drive future investment inflows.

- Rising Capital Expenditure Expectations: Bank of America's updated capex tracker revealed a 14% quarter-over-quarter and 66% year-over-year increase in global hyperscale capex to $148 billion in Q4, exceeding expectations by $7 billion, reflecting optimism for future investments.

- Upcoming Earnings Reports: On Semiconductor and Vornado Realty Trust are set to release earnings after the bell, with the market closely watching these reports to assess industry health, while several companies, including Coca-Cola and Spotify, will report before Tuesday's open, further influencing market sentiment.

Energy Supercycle Impact: GE Vernova is benefiting from a significant energy supercycle, which is driving growth and opportunities in the energy sector.

Market Positioning: The company is strategically positioned to capitalize on the increasing demand for energy solutions, enhancing its market presence.

Innovation and Technology: GE Vernova is focusing on innovative technologies to improve energy efficiency and sustainability in its operations.

Future Prospects: The outlook for GE Vernova remains positive as it continues to adapt to changing energy market dynamics and consumer needs.

- Turbine Reservation Agreement: GE Vernova has entered into a gas turbine and generator reservation agreement with Maxim Power Corp., requiring a non-refundable deposit to secure the 7HA.02 turbine for delivery by 2030, contributing up to $60 million to the Prairie Lights Power project in Alberta.

- Strong Short-Term Trend: GE Vernova's stock is currently trading 12.1% above its 20-day simple moving average and 23.4% above its 100-day SMA, indicating a robust short-term trend, with shares increasing by 102.43% over the past 12 months.

- Financial Update Forecast: GE Vernova is set to provide its financial update on April 22, 2026, with an EPS estimate of $1.93 and revenue expected to reach $9.22 billion, reflecting significant growth compared to last year and highlighting the company's strong growth potential in the electric power sector.

- Optimistic Analyst Ratings: The stock carries a “Buy” rating with an average price target of $782.24, with RBC Capital and Goldman Sachs raising their targets, indicating analysts' confidence in the company's future growth prospects.

Projected Spending: MAXIM POWER CORP anticipates total project spending of up to $60 million during 2026.

Financial Outlook: The projected spending reflects the company's strategic planning and investment in future projects.

Agreement Overview: MAXIM Power Corp has entered into a gas turbine and generator reservation agreement, indicating a strategic move in energy production.

Project Update: The agreement is linked to the Prairie Lights Power Project, which is expected to enhance energy generation capabilities.