EXCLUSIVE: VOLT ETF Taps $7 Trillion Electrification Boom Fueled By AI Power Demand

Surge in Power Demand: The U.S. is facing a significant increase in power demand driven by advancements in AI and aging infrastructure, with projections indicating a potential 40 gigawatt shortfall by 2030. This has led to a $7 trillion investment opportunity in the electrification sector.

Introduction of VOLT ETF: The Tema Electrification ETF (VOLT) has been launched as the first fund focusing on the infrastructure needed for modern technology, covering areas such as power generation, transmission, and electrification services, while also highlighting the energy-intensive nature of digital asset mining like Bitcoin.

Trade with 70% Backtested Accuracy

Analyst Views on GE

About GE

About the author

Energy Supercycle Impact: GE Vernova is benefiting from a significant energy supercycle, which is driving growth and opportunities in the energy sector.

Market Positioning: The company is strategically positioned to capitalize on the increasing demand for energy solutions, enhancing its market presence.

Innovation and Technology: GE Vernova is focusing on innovative technologies to improve energy efficiency and sustainability in its operations.

Future Prospects: The outlook for GE Vernova remains positive as it continues to adapt to changing energy market dynamics and consumer needs.

- Dow Index Milestone: The Dow Jones Industrial Average has surpassed 50,000 for the first time, marking a significant recovery in the U.S. stock market, reflecting increased investor confidence in economic recovery, which may lead to more capital inflows into equities.

- Buying Opportunities: Stocks like JPMorgan, Apple, and Boeing have entered buy zones, indicating that the performance of these large companies has attracted investor interest, potentially driving their stock prices higher and enhancing market vitality.

- Nasdaq Divergence: While the Nasdaq remains below key support levels, some AI-related stocks are reviving, indicating a potential rebound in tech stocks that may provide new investment opportunities for investors.

- Market Sentiment Improvement: The overall market sentiment is improving, as optimistic expectations for future economic growth may encourage more capital to flow into the stock market, thereby driving further increases in the overall market.

- Dividend Declaration: GE Aerospace's Board of Directors has declared a dividend of $0.47 per share, payable on April 27, 2026, to shareholders of record as of March 9, 2026, reflecting the company's commitment to shareholder returns.

- Record Date: The ex-dividend date is set for March 9, 2026, meaning investors holding shares before this date will qualify for the dividend, thereby enhancing the attractiveness of the stock to investors.

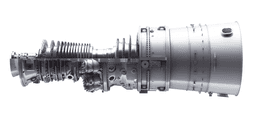

- Company Overview: GE Aerospace is a global leader in aerospace propulsion, services, and systems, with an installed base of approximately 50,000 commercial and 30,000 military aircraft engines, showcasing its strong position in the aviation industry.

- Employee Count: With around 57,000 employees and over a century of innovation and learning, GE Aerospace is committed to inventing the future of flight, enhancing travel experiences, and ensuring safe returns home.

- Dividend Declaration: GE Aerospace's Board of Directors has declared a $0.47 per share dividend, payable on April 27, 2026, to shareholders of record as of March 9, 2026, reflecting the company's commitment to returning value to its shareholders.

- Record Date: The ex-dividend date is set for March 9, 2026, meaning investors holding shares at the close of business on this date will qualify for the dividend, enhancing the attractiveness of the stock to potential investors.

- Company Overview: GE Aerospace is a global leader in aerospace propulsion, services, and systems, with an installed base of approximately 50,000 commercial and 30,000 military aircraft engines, showcasing its strong market position and capabilities in the aviation sector.

- Employee Strength: With around 57,000 employees and over a century of innovation and learning, GE Aerospace is dedicated to inventing the future of flight, enhancing travel experiences, and ensuring safe returns home.

- Dividend Announcement: GEA Aerospace has declared a dividend of $0.47 per share.

- Financial Implications: This dividend declaration reflects the company's financial performance and commitment to returning value to shareholders.