D-Wave Quantum's Bold Move to Redefine Future

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 23h ago

0mins

Should l Buy QBTS?

Source: Fool

- Market Volatility Opportunity: D-Wave Quantum's stock surged 20.39% on January 27, 2026, reflecting strong market confidence in its future potential, which could yield significant returns for investors.

- Risks and Challenges: Despite the optimistic outlook, D-Wave faces market volatility and technological risks that may impact its short-term performance, necessitating careful risk-reward assessments by investors.

- Future Development Path: The video analyzes D-Wave Quantum's future trajectory, emphasizing that the combination of technological innovation and market demand will be crucial for driving the company's growth.

- Investor Strategy Recommendations: For investors willing to embrace volatility, D-Wave Quantum's strategic adjustments may offer substantial returns, suggesting close monitoring of market dynamics to seize investment opportunities.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy QBTS?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on QBTS

Wall Street analysts forecast QBTS stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for QBTS is 40.67 USD with a low forecast of 35.00 USD and a high forecast of 48.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

13 Analyst Rating

13 Buy

0 Hold

0 Sell

Strong Buy

Current: 17.210

Low

35.00

Averages

40.67

High

48.00

Current: 17.210

Low

35.00

Averages

40.67

High

48.00

About QBTS

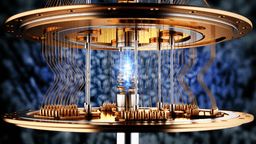

D-Wave Quantum Inc. is a quantum computing company, which is engaged in the development and delivery of quantum computing systems, software, and services. The Company builds and delivers systems, cloud services, application development tools, and professional services to support the end-to-end quantum computing journey for enterprises and developers. The Company's products include Cloud Platform, Systems, Professional Services, and others. Under its Cloud Platform, the Leap quantum cloud service delivers immediate, real-time access to its quantum computers and hybrid solvers services. Under its Systems, the Advantage quantum system is a quantum computer designed for business. It also offers quantum applications to a range of customers, including resource scheduling, factory scheduling, industrial construction design, drug discovery, and others. It offers solutions across workforce scheduling, production scheduling, vehicle routing, resource optimization, and cargo loading.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Minimal Revenue: D-Wave reported only $3.7 million in sales for the third quarter against a staggering net loss of $140 million, highlighting a significant gap between revenue and losses, indicating severe challenges in achieving profitability.

- Bleak Market Outlook: Despite the optimistic outlook for quantum computing, industry giants like Alphabet suggest that substantial commercial sales may still be 5 to 10 years away, implying that D-Wave's investment returns could be delayed significantly.

- Rising Operating Costs: D-Wave's operating expenses surged by 40% in the third quarter to $30.4 million, and while the company has $836 million in cash reserves, the rapid increase in spending could quickly deplete these funds, adding financial pressure.

- Valuation Risks: With a price-to-sales (P/S) ratio of 280, significantly higher than the tech sector's average of 9, D-Wave's high valuation amidst minimal sales and substantial losses indicates that investors are facing considerable risks.

See More

- Stock Performance: D-Wave Quantum's stock surged over 250% in the past 12 months, although it has fallen from an October 52-week high of $46.75, reflecting strong investor interest in quantum computing technology.

- Acquisition and Market Expansion: On January 7, 2026, D-Wave announced the acquisition of Quantum Circuits, combining their distinct quantum technologies, which is expected to expand its total addressable market and enhance its competitive edge in the quantum computing sector.

- Key Contract Signing: Following the acquisition completion on January 20, D-Wave sold a quantum computer to Florida Atlantic University for $20 million and is collaborating with the institution to develop a quantum computing center, further solidifying its market position.

- Financial Challenges: Despite a 235% year-over-year revenue growth to $21.8 million in the first three quarters of 2025, operating expenses soared to $84.1 million, resulting in a $65.5 million operating loss, indicating significant challenges in achieving long-term profitability.

See More

- IonQ's Market Leadership: IonQ (IONQ) has seen a 14.98% increase, with a current price of $4.56 and a market cap of $12 billion, leveraging its unique trapped ion qubit technology to significantly reduce error rates, which, despite slower processing speeds, positions it well for launching a commercially viable product and enhancing its competitive edge.

- D-Wave's Unique Strategy: D-Wave Quantum (QBTS) has risen by 20.19%, with a current price of $3.48 and a market cap of $7.7 billion, focusing on quantum annealing technology to address optimization problems, which may carve out a niche market opportunity despite competition from general-purpose quantum computers.

- High-Risk, High-Reward Investment Landscape: While both IonQ and D-Wave have the potential for substantial returns, the intense competition in the quantum computing sector poses risks of bankruptcy or acquisition for many firms, necessitating careful risk-reward assessments by investors.

- Alternative Quantum Computing ETF: For investors wary of individual stock risks, considering a quantum computing ETF could provide broad exposure to nearly all publicly traded companies in the sector, offering potentially significant returns as useful quantum computing systems are developed, albeit likely lower than direct investments in IonQ or D-Wave.

See More

- Stock Recovery: D-Wave Quantum (NYSE: QBTS) saw its share price surge over 20% on Friday, yet it remains down 53.5% from its peak, indicating ongoing market volatility and interest in quantum computing.

- Market Confidence Boost: Amazon's announcement of a $200 billion investment in AI data center infrastructure this year has restored confidence in AI-related stocks, which in turn has fueled the rebound of D-Wave and other quantum computing stocks.

- Commercialization Opportunities: D-Wave's annealing quantum technology is creating commercialization opportunities, and its investments in gate-model technology could lead to significant growth in the long term, despite the speculative nature of its outlook.

- Investment Risk Advisory: While D-Wave may offer long-term investors the potential for multibagger returns, it also carries substantial risks, prompting analysts to advise caution, especially since D-Wave was not included in the list of top recommended stocks for investment.

See More

- Market Volatility Opportunity: D-Wave Quantum's stock surged 20.39% on January 27, 2026, reflecting strong market confidence in its future potential, which could yield significant returns for investors.

- Risks and Challenges: Despite the optimistic outlook, D-Wave faces market volatility and technological risks that may impact its short-term performance, necessitating careful risk-reward assessments by investors.

- Future Development Path: The video analyzes D-Wave Quantum's future trajectory, emphasizing that the combination of technological innovation and market demand will be crucial for driving the company's growth.

- Investor Strategy Recommendations: For investors willing to embrace volatility, D-Wave Quantum's strategic adjustments may offer substantial returns, suggesting close monitoring of market dynamics to seize investment opportunities.

See More

- Stock Surge: As of February 4, 2026, Rigetti Computing's share price has skyrocketed by 1,420% over the past 15 months, trailing D-Wave Quantum's 1,910% increase but significantly outperforming IonQ's 770% rise, reflecting strong investor confidence in the quantum computing sector.

- Market Expectations: Investors widely believe that quantum computing will disrupt various industries, including encryption, genetic analysis, and financial forecasting, with Rigetti aiming to offer a comprehensive suite of quantum computing solutions from hardware manufacturing to cloud services to attract deep-pocketed enterprise clients.

- Profitability Challenges: Despite its impressive stock performance, Rigetti faces significant unprofitability, with a staggering valuation ratio of 757 times sales, making it appear unreasonable compared to its market peers, indicating potential overvaluation risks.

- Future Outlook: While the stock may experience volatility due to market sentiment in the short term, the company's ongoing losses and reliance on stock issuance to sustain operations suggest a looming risk of price correction within the next one to two years.

See More