CNBC Daily Open: The U.S. Jobs Report is Subjective in Its Interpretation

U.S. Jobs Report Analysis: The November jobs report presents mixed signals, with a higher unemployment rate and job shrinkage in October contrasting with job growth exceeding estimates in November, leading to ambivalence in market reactions.

Market Reactions: Major U.S. indexes showed mixed performance, with the S&P 500 and Dow Jones declining while the Nasdaq gained slightly, reflecting uncertainty in economic conditions.

Investment Talks: Amazon is reportedly in discussions to invest $10 billion in OpenAI, which would include an agreement for OpenAI to utilize Amazon's AI chips.

Global Market Developments: Chinese stocks had varied debuts, with MetaX Integrated Circuits soaring 700% while Hashkey's crypto exchange saw a modest rise, and Trump labeled the Venezuelan government as a 'terrorist organization' while imposing a blockade on oil tankers.

Trade with 70% Backtested Accuracy

Analyst Views on AMZN

About AMZN

About the author

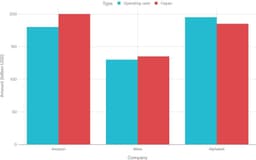

- Earnings Growth: Amazon's Q4 revenue surged 14% to $213 billion, with operating income rising 18% to $25 billion, showcasing broad growth across retail, advertising, and cloud sectors, yet this strong performance failed to reassure investors.

- Capital Expenditure Forecast: CEO Andy Jassy announced a staggering $200 billion in expected capital expenditures for 2026, significantly exceeding Wall Street's forecast of $150 billion, which raised investor concerns and triggered a sell-off.

- Market Reaction: The stock price of Amazon plummeted 12% over the past week due to worries about future spending, reflecting a cautious investor sentiment despite robust demand in AI and cloud computing sectors.

- Investor Confidence Shaken: Although Amazon enjoys strong demand across various sectors, the aggressive expansion plans have unsettled investors, leading to a decline in market confidence that could impact short-term stock performance.

- Funding Shortages: Amazon expects to generate about $180 billion in operating cash this year against a capital spending plan of $200 billion, resulting in a $20 billion shortfall, marking the company's first entry into deficit territory which could impact future investment capabilities.

- Meta's Cash Flow Crisis: Meta anticipates operating cash flow of approximately $130 billion, while its capital spending guidance peaks at $135 billion, indicating significant financial pressure in building AI systems that may lead to depletion of cash reserves.

- Increased Debt Financing: Oracle raised $25 billion in bonds to support a $300 billion infrastructure deal with OpenAI, while Meta raised $30 billion last year, with tech companies expected to issue $337 billion in investment-grade bonds this year, reflecting the industry's urgent need for funding.

- Infrastructure Investment Risks: Big Tech firms are heavily investing in data centers and power facilities, yet the irreversibility of these infrastructures poses substantial financial risks, especially if AI demand does not grow as anticipated, potentially leading to massive depreciation and debt burdens.

- User Growth Rebound: OpenAI CEO Sam Altman revealed in an internal message that ChatGPT's monthly growth rate has exceeded 10%, indicating a recovery in user growth amidst fierce competition from Anthropic, which enhances market confidence.

- Codex Product Surge: Altman noted that OpenAI's coding product Codex grew approximately 50% in just one week, which not only boosts its market share but also demonstrates the company's increasing competitiveness in the AI coding tools sector.

- Ad Testing Launch: OpenAI plans to test ads within ChatGPT, and despite facing criticism from Anthropic, Altman emphasized that the ads will be clearly labeled and will not affect user experience, with expectations that ad revenue will account for less than half of the company's long-term income.

- Funding Plan Advancement: OpenAI is pursuing a potential $100 billion fundraising round, with Altman and CFO Sarah Friar highlighting the company's strong performance in both consumer and enterprise markets during private meetings, and funding discussions are expected to accelerate over the next two weeks.

- Market Surge: The Dow Jones Industrial Average surged over 1,200 points on Friday, surpassing the 50,000 mark for the first time, closing the week up 2.5%, indicating a strong recovery in market sentiment despite earlier tech stock sell-offs.

- Bitcoin Rebound: Bitcoin rebounded above $70,000 on Friday, recovering from a sharp drop that nearly brought it below $60,000, reflecting a renewed confidence in the cryptocurrency market, although it remains over 50% off its all-time high.

- Super Bowl Advertising Boom: During the Super Bowl, NBC's average price for a 30-second ad reached $8 million, with some slots exceeding $10 million, highlighting strong demand in the advertising market, particularly from AI companies.

- Legal Battle Between Hims and Novo: Novo Nordisk is suing Hims & Hers over alleged copycat versions of its Wegovy obesity drug, leading Hims to announce the withdrawal of its product, which caused its shares to drop over 20% before the market opened.

- Surge in IPO Proceeds: Goldman Sachs projects that U.S. IPO proceeds will reach a record $160 billion in 2026, quadrupling from 2025, indicating strong economic recovery and robust equity markets.

- Doubling of IPO Count: The number of IPOs is expected to double to 120 in 2026, driven by a recovering economy, rising equity prices, and favorable financial conditions, with software and healthcare sectors leading the charge.

- Large Company Listings: Goldman Sachs notes that 2026 IPOs will be dominated by large private company listings, with proceeds estimated between $80 billion and $200 billion, although recent selloffs in software stocks highlight valuation risks.

- Signs of Market Activity: Approximately $5 billion has already been raised through IPOs in 2026, including notable companies like AI equipment manufacturer Forgent Power and biopharmaceutical firm Eikon Therapeutics, reflecting a strong market rebound.

- Value Score Increase: According to Benzinga Edge Stock Rankings, PDD's value score surged to 89.66, placing it in the top 10% of stocks globally, despite a year-to-date stock price decline of approximately 9.09%, indicating market recognition of its fundamentals.

- Strong Fundamentals: Although the stock price has retreated to around $105.23, PDD's growth score stands at 83.80, reflecting consistent revenue and earnings expansion, even as short-term momentum has cooled to a score of 17.20, suggesting ongoing market confidence in its future growth.

- External Pressure Impact: The 9% year-to-date decline is largely attributed to external pressures, including a ban imposed by Texas Governor on the use of its international platform Temu and a fine of 100,000 yuan from Chinese tax authorities, highlighting challenges in the regulatory environment.

- Maintaining Competitive Edge: Despite regulatory and competitive pressures, PDD has successfully expanded into over 80 countries with its unique social commerce model and “team purchase” strategy, maintaining strong margins and continuing to be a formidable rival to Amazon.