BlackRock Shares Rise as GIP Approaches $40B Deal for Data Center Operator

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Oct 03 2025

0mins

Should l Buy META?

Source: TipRanks

GIP's Acquisition Bid: Global Infrastructure Partners (GIP) is nearing a $40 billion acquisition of Aligned Data Center, which specializes in AI infrastructure, while also pursuing a $38 billion deal for utility giant AES Corp.

Market Reactions and Investments: BlackRock's stock saw a slight increase amid the news, as major tech companies continue to invest heavily in AI infrastructure, raising concerns about a potential AI bubble.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy META?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on META

Wall Street analysts forecast META stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for META is 824.71 USD with a low forecast of 655.15 USD and a high forecast of 1117 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

44 Analyst Rating

37 Buy

6 Hold

1 Sell

Strong Buy

Current: 661.460

Low

655.15

Averages

824.71

High

1117

Current: 661.460

Low

655.15

Averages

824.71

High

1117

About META

Meta Platforms, Inc. is building human connections, powered by artificial intelligence and immersive technologies. The Company's products enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) and mixed reality (MR) headsets, augmented reality (AR), and wearables. It also helps people discover and learn about what is going on in the world around them, enabling people to share their experiences, ideas, photos, videos, and other content with audiences ranging from their closest family members and friends to the public at large. The Company's segments include Family of Apps (FoA) and Reality Labs (RL). FoA segment includes Facebook, Instagram, Messenger, WhatsApp and Threads. RL segment includes its virtual, augmented, and mixed reality related consumer hardware, software and content. Its product offerings in VR include its Meta Quest devices, as well as software and content available through the Meta Horizon Store.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

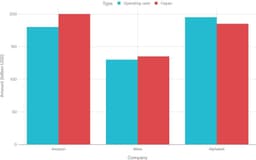

- Massive Investment Plans: The four tech giants are projected to collectively spend $625 billion on new data centers and AI infrastructure by 2026, with Alphabet at $185 billion, Amazon at $200 billion, Meta at $135 billion, and Microsoft at $105 billion, indicating fierce competition in the AI market.

- Market Reaction: Despite the large investment figures, analysts are skeptical about the positive impact on profits, as evidenced by Microsoft's stock plummeting 11% in a single day last week, reflecting concerns over slowing growth in its cloud computing segment.

- Investor Opportunities: The Global X Data Center and Digital Infrastructure ETF (DTCR) is seen as a great way for investors to capitalize on the rapidly growing AI spending trend, currently managing $1.1 billion in assets and yielding a 13.3% return in 2026.

- Optimistic Market Outlook: Grand View Research estimates that the data center construction market will grow from $241 billion in 2024 to $456 billion by 2030, with a compound annual growth rate of 11.8%, highlighting the accelerating trend in AI infrastructure development.

See More

- Massive User Base: Alphabet boasts six products and services with at least 2 billion users each, while Meta's social media platforms have a staggering 3.58 billion daily active users, creating powerful network effects that enhance their competitive advantages in the market.

- Strong Financial Position: In Q4 2025, Alphabet and Meta reported impressive operating margins of 32% and 41%, respectively, with Alphabet holding $127 billion in cash and cash equivalents, and Meta $78 billion, providing a safety net against economic downturns.

- Attractive Valuations: Despite being dominant players, both companies' stocks are reasonably valued, with Alphabet's price-to-earnings ratio around 30 and Meta's at 28, making them appealing for investors expecting continued profit growth.

- Investment Recommendation: Investors with $5,000 can consider purchasing 7 shares of Alphabet and 4 shares of Meta, creating a portfolio that leverages the growth potential of both companies while providing relative safety amid fluctuations in the digital advertising sector.

See More

- Surge in Capital Expenditure: The four major tech giants are projected to collectively invest $625 billion in new data centers and AI infrastructure by 2026, although the uncertain returns may negatively impact shareholder profits.

- Individual Company Struggles: Microsoft's quarterly results revealed slowing revenue growth from its Azure cloud computing unit, leading to an 11% drop in its stock price in a single day, marking the largest decline since March 2020, reflecting market concerns over its spending plans.

- Data Center Market Outlook: According to Grand View Research, the data center construction market is expected to grow from $241 billion in 2024 to $456 billion by 2030, with a compound annual growth rate of 11.8%, indicating strong demand for infrastructure investment.

- Investment Opportunity Analysis: Despite fierce competition among the four giants for AI customers, investing in the Global X Data Center and Digital Infrastructure ETF (DTCR) may be an effective way to capitalize on this rapidly growing trend, as the ETF currently manages $1.1 billion in assets and has delivered a 41.3% return over the past 52 weeks.

See More

- Early AI Investment Cycle: Wedbush analyst Dan Ives highlights that the artificial intelligence investment cycle is still in its early stages, currently around year three of a projected ten-year cycle, with significant capital spending from Big Tech and governments expected to reshape technology leadership and drive growth in related ETFs.

- Software Stock Sell-off Overstated: Ives has re-added Salesforce and ServiceNow to his list of top 30 AI-focused stocks, asserting that concerns about permanent damage to traditional software business models are exaggerated, as enterprises are unlikely to quickly abandon existing software ecosystems, which could support inflows into enterprise software-heavy ETFs.

- Multiplier Effect of AI Chip Investment: Ives notes that for every dollar spent on Nvidia GPU chips, there is an estimated $8 to $10 increase in broader technology ecosystem investment, indicating a favorable dynamic for diversified technology ETFs that capture multiple aspects of the AI value chain amid the ongoing AI revolution.

- Diversified ETF Opportunities: The report emphasizes investment areas in AI development such as data infrastructure, cybersecurity, and autonomous vehicles, suggesting that ETF investors should focus on these sector opportunities to achieve diversification and manage stock-specific volatility as AI continues to gain momentum.

See More

- Funding Shortages: Amazon expects to generate about $180 billion in operating cash this year against a capital spending plan of $200 billion, resulting in a $20 billion shortfall, marking the company's first entry into deficit territory which could impact future investment capabilities.

- Meta's Cash Flow Crisis: Meta anticipates operating cash flow of approximately $130 billion, while its capital spending guidance peaks at $135 billion, indicating significant financial pressure in building AI systems that may lead to depletion of cash reserves.

- Increased Debt Financing: Oracle raised $25 billion in bonds to support a $300 billion infrastructure deal with OpenAI, while Meta raised $30 billion last year, with tech companies expected to issue $337 billion in investment-grade bonds this year, reflecting the industry's urgent need for funding.

- Infrastructure Investment Risks: Big Tech firms are heavily investing in data centers and power facilities, yet the irreversibility of these infrastructures poses substantial financial risks, especially if AI demand does not grow as anticipated, potentially leading to massive depreciation and debt burdens.

See More

- Legal Action Intensifies: New Mexico has filed a lawsuit against Meta, alleging the company failed to protect apps like Facebook and Instagram from online predators targeting child users, which could lead to significant legal repercussions for Meta.

- Serious Allegations: Attorney General Raúl Torrez claims that Meta is accused of “steering and connecting users, including children, to sexually explicit and exploitative materials,” which not only affects virtual spaces but may also lead to real-world child exploitation.

- Industry-Wide Implications: Experts have noted that this case resembles lawsuits against “Big Tobacco” in the 1990s, potentially having far-reaching effects on Meta and the broader social media industry, especially as public concern over social media safety grows.

- Witness Testimony Scheduled: Meta CEO Mark Zuckerberg and Instagram head Adam Mosseri are scheduled to testify in the upcoming trial, highlighting the high stakes and potential public impact of this case.

See More