BioHarvest Sciences Stock Drops 15% Following Announcement of $17.4 Million Public Offering

Stock Performance: BioHarvest Sciences Inc. (BHST) shares fell 14.75% to $6.68 following the announcement of a public offering of 2.5 million shares priced at $7.00 each.

Funding Goals: The company aims to raise approximately $17.4 million to support various initiatives, including research and development, marketing, and debt reduction.

Offering Details: BioHarvest has granted underwriters a 30-day option to purchase an additional 372,750 shares at the offering price, with the offering expected to close around November 10, 2025.

Trading Activity: On the day of the announcement, BHST opened at $7.81, with a trading volume significantly higher than average, and its 52-week stock range is noted as $3.12 - $9.74.

Trade with 70% Backtested Accuracy

Analyst Views on BHST

No data

About BHST

About the author

Quarterly Performance: BioHarvest Sciences Inc. reported a quarterly loss of $0.14 per share, matching the Zacks Consensus Estimate, and showing an improvement from a loss of $0.16 per share a year ago. The company also posted revenues of $9.07 million, slightly missing expectations.

Stock Outlook: The stock has gained approximately 27.8% since the beginning of the year, outperforming the S&P 500's 16.5% increase. However, the future performance will depend on management's commentary and earnings estimate revisions.

Earnings Estimates: The current consensus EPS estimate for the upcoming quarter is -$0.09 on revenues of $10.58 million, while the fiscal year estimate is -$0.59 on $36.09 million in revenues. The stock currently holds a Zacks Rank #3 (Hold), indicating expected performance in line with the market.

Industry Context: The Medical - Biomedical and Genetics industry, to which BioHarvest belongs, is ranked in the top 35% of Zacks industries, suggesting a favorable outlook compared to lower-ranked sectors.

Stock Performance: BioHarvest Sciences Inc. (BHST) shares fell 14.75% to $6.68 following the announcement of a public offering of 2.5 million shares priced at $7.00 each.

Funding Goals: The company aims to raise approximately $17.4 million to support various initiatives, including research and development, marketing, and debt reduction.

Offering Details: BioHarvest has granted underwriters a 30-day option to purchase an additional 372,750 shares at the offering price, with the offering expected to close around November 10, 2025.

Trading Activity: On the day of the announcement, BHST opened at $7.81, with a trading volume significantly higher than average, and its 52-week stock range is noted as $3.12 - $9.74.

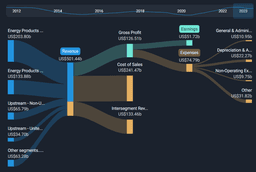

Company Performance: BioHarvest Sciences reported a revenue of US$8.52 million, a 41% increase from the previous quarter, but also experienced a net loss of US$4.08 million, widening by 494%. The earnings per share missed analyst estimates significantly.

Future Outlook: Revenue is projected to grow at an average rate of 33% annually over the next three years, contrasting with the Personal Products industry's forecasted growth of only 4.6%. However, there are two warning signs for investors to consider.

Financial Performance: BioHarvest Sciences Inc. reported a 41% revenue increase in Q2 2025, reaching $8.5 million, primarily driven by its VINIA capsule business and new product launches, despite a widened net loss of $4.0 million due to non-cash expenses.

Growth Initiatives: The company is expanding its user base and launching new products, including the VINIA Daily Chews, while also advancing CDMO projects, with expectations for continued revenue growth and potential breakeven adjusted EBITDA by Q4 2025.

Financial Performance: BioHarvest Sciences reported a 47% year-over-year revenue increase to $7.9 million in Q1 2025, driven by the VINIA product line, while also improving gross margins and reducing net loss compared to the previous year.

Product Expansion and CDMO Progress: The company plans to launch new VINIA products targeting younger consumers and is advancing its CDMO initiatives, including a successful Stage 1 completion of a contract with a Nasdaq-listed pharmaceutical client, enhancing its growth prospects.

BioHarvest's Olive Cell Compound: BioHarvest Sciences Inc. announced positive 'in vitro' test results for its new olive cell compound, which reduces fat accumulation in human liver cells, attributed to high levels of Verbascoside.

Future Plans and Growth: The company plans to launch the Olive Cell product as a nutraceutical in 2026, while also expanding production capacity by four times with a new facility expected to be operational in late 2026.