Anterix (ATEX) Announces Q2 Loss While Exceeding Revenue Projections

Earnings Performance: Anterix (ATEX) reported a quarterly loss of $0.14 per share, significantly better than the expected loss of $0.65, marking a 78.46% earnings surprise. The company has surpassed consensus EPS estimates in all four of the last quarters.

Revenue Insights: The company generated revenues of $1.55 million for the quarter, matching the previous year's figure and exceeding the Zacks Consensus Estimate by 9.30%. However, it has only topped revenue estimates once in the last four quarters.

Stock Outlook: Anterix shares have declined by 41.3% year-to-date, contrasting with the S&P 500's 16.4% gain. The current Zacks Rank for the stock is #4 (Sell), indicating expectations of underperformance in the near future.

Industry Context: The Communication - Infrastructure industry, to which Anterix belongs, is currently ranked in the top 16% of Zacks industries, suggesting that broader industry trends could influence Anterix's stock performance moving forward.

Trade with 70% Backtested Accuracy

Analyst Views on ATEX

About ATEX

About the author

- Earnings Call Announcement: Anterix has announced a conference call scheduled for February 12, 2026, at 9:00 a.m. ET, where senior management will discuss the third quarter fiscal 2026 results, which is expected to attract investor attention and impact stock performance.

- Pre-Release Insights: A press release detailing the financial results will be issued after market close on February 11, 2026, providing critical financial metrics and performance indicators that will help investors assess the company's financial health.

- Participation Instructions: Interested participants must pre-register to obtain a dial-in number and unique PIN, with a recommendation to join at least 10 minutes early to ensure smooth participation in the Q&A session, enhancing investor engagement.

- Live Webcast and Replay: The call will be webcast live on Anterix's Investor Relations website, and a replay will be available afterward, ensuring that investors who cannot attend live can still access the information discussed.

- Rebranding Initiative: Anterix unveiled its new brand identity at DISTRIBUTECH 2026, aiming to enhance operational efficiency and customer service quality by integrating its 900 MHz spectrum foundation with deployment solutions to expedite the transition from design to deployment.

- Industry Collaboration: The event featured over 125 technology companies and utility leaders showcasing how Anterix's 900 MHz private wireless networks unify real-time data and intelligent control, thereby enhancing grid resilience and operational capabilities.

- Live Demonstrations: Anterix will demonstrate its TowerX™ and CatalyX® technologies at the event, which help utilities streamline site readiness, reduce device activation time, and improve responses to extreme weather events, ensuring infrastructure safety and reliability.

- Future Outlook: Anterix's CMO Heather Martin emphasized that connectivity is crucial for grid modernization, and the new brand identity symbolizes the company's ongoing momentum in driving digital transformation and enhancing service value for utilities.

- Spectrum Purchase Agreement: The agreement between Anterix and CPS Energy enables the latter to deploy a 900 MHz private wireless broadband network, significantly enhancing grid operations' resilience and reliability, thereby accelerating the digital transformation of utility infrastructure.

- Modern Network Implementation: CPS Energy plans to utilize the 900 MHz spectrum to implement a state-of-the-art private wireless network that supports advanced field automation, faster outage detection and restoration, and enhances real-time situational awareness, ensuring safe integration of new technologies.

- Industry Trend: This transaction positions CPS Energy as the first utility to advance under the Anterix Accelerator funding program, highlighting a growing trend of utilities investing in 900 MHz private wireless spectrum, reflecting a national shift towards secure, utility-controlled broadband networks.

- Impact in Texas: Collaborating with other Anterix partners, over 93% of Texas counties will benefit from 900 MHz private wireless networks, enhancing interoperability and response capabilities across service territories, thus driving modernization and security of the electric grid.

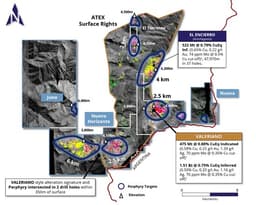

- Land Package Expansion: ATEX Resources has strategically increased its land package by over 8,600 hectares through staking and public auction, raising its total area in the Valeriano project from 16,500 hectares to 25,000 hectares, significantly enhancing its exploration potential in the region.

- Target Confirmation: The newly identified Pachuy and Chollay targets share similar characteristics with the Valeriano project, with historical exploration indicating high-grade mineralization found within 350 meters at the Pachuy target, suggesting the potential for multiple copper deposits and increasing the likelihood of future exploration success.

- Exploration Plans Initiated: ATEX is set to commence geophysical surveys at these two new targets and plans to advance drilling activities in the coming months, aiming to accelerate the development of these targets and further solidify its market position in Chile.

- Strategic Implications: This expansion not only enhances ATEX's resource potential in the Valeriano district but also provides a stronger competitive edge in the rapidly growing copper-gold market, which is expected to drive future mineral production and revenue growth.

- Earnings Upgrades: As earnings season approaches, analysts have positively revised earnings expectations for communication services companies, with Angel Studios (ANGX) receiving an A+ EPS Revision Grade, indicating growing market confidence in its near-term performance.

- Strong Small-Cap Performance: EverQuote (EVER), Grindr (GRND), and ZoomInfo Technologies (GTM) also achieved A+ EPS Revision Grades, suggesting that these mid- and small-cap communication services firms possess robust growth potential, likely attracting increased investor interest.

- Increased Market Confidence: IHS Holding (IHS), JOYY (JOYY), and Manchester United (MANU) also received A+ EPS Revision Grades, reflecting analysts' optimistic outlook on their profitability and market performance, which may drive their stock prices higher.

- Positive Industry Outlook: Turkcell Iletisim Hizmetleri (TKC), Uniti Group (UNIT), and Anterix (ATEX) also excelled in EPS Revision Grades, highlighting the growth potential within the communication services sector, presenting investment opportunities for investors to consider.

Earnings Performance: Anterix (ATEX) reported a quarterly loss of $0.14 per share, significantly better than the expected loss of $0.65, marking a 78.46% earnings surprise. The company has surpassed consensus EPS estimates in all four of the last quarters.

Revenue Insights: The company generated revenues of $1.55 million for the quarter, matching the previous year's figure and exceeding the Zacks Consensus Estimate by 9.30%. However, it has only topped revenue estimates once in the last four quarters.

Stock Outlook: Anterix shares have declined by 41.3% year-to-date, contrasting with the S&P 500's 16.4% gain. The current Zacks Rank for the stock is #4 (Sell), indicating expectations of underperformance in the near future.

Industry Context: The Communication - Infrastructure industry, to which Anterix belongs, is currently ranked in the top 16% of Zacks industries, suggesting that broader industry trends could influence Anterix's stock performance moving forward.