Western Digital Launches New Leveraged ETF Amid Strong Market Momentum

Western Digital Corp's stock surged by 8.36%, reaching a 52-week high, as the company benefits from a broader trend in the memory stocks sector.

The recent launch of the Tradr 2X Long WDC Daily ETF, which aims to deliver 200% of the daily performance of Western Digital, aligns with the strong positive momentum in the memory sector, attracting more professional traders. This product launch is expected to enhance market liquidity and interest in Western Digital's stock, reflecting the company's robust position in the industry.

As demand for memory chips continues to rise, Western Digital's stock is likely to see sustained interest from investors, especially with the introduction of innovative investment products that cater to high-return-seeking strategies.

Trade with 70% Backtested Accuracy

Analyst Views on WDC

About WDC

About the author

- Market Trend Analysis: The tech sector is currently experiencing strong upward momentum, particularly in the memory market, where the surge in AI demand has led to a shortage of NAND flash, making stocks like Sandisk exceptionally hot, which is expected to drive rapid revenue and gross margin growth.

- Sandisk's Strong Performance: As the only pure-play publicly traded U.S. flash memory maker, Sandisk has seen its stock price soar since its spin-off from Western Digital in February 2025, primarily benefiting from tight NAND pricing and the demand for high-performance solid-state drives, a trend expected to continue.

- Micron's Technological Edge: Micron Technology derives 80% of its revenue from DRAM, and with HBM demand growing at an annual rate of 40%, the company is working to increase capacity to meet this demand, although the complexity of HBM production has led to a DRAM industry shortage.

- Investment Recommendations: Despite Sandisk's strong current performance, it was not included in the Motley Fool's list of top investment stocks, suggesting that investors should focus on stocks with greater potential for higher returns.

- Supply-Demand Imbalance: The AI boom has created a significant shortage of DRAM, HBM, and NAND storage, with demand far outpacing supply, which is primarily controlled by a few key players, presenting a lucrative opportunity for memory designers and manufacturers.

- Micron's Revenue Surge: Micron's latest quarterly revenue reached $13.6 billion, a nearly 50% increase year-over-year, with projections for the next quarter to soar to $18.7 billion, highlighting its strong growth potential in the high-margin enterprise market.

- Western Digital Buyback: Western Digital announced a $4 billion stock buyback, signaling confidence in future growth, with its stock price surging over 50% since the beginning of 2026, reflecting strong market demand for its advanced storage solutions.

- SanDisk's Strong Performance: SanDisk reported a 31% revenue increase and a remarkable 64% rise in data center revenue, with expectations of adding over $1 billion in the next quarter, further solidifying its leadership in the NAND technology market.

- Surging Memory Demand: The AI boom has created an unprecedented demand for DRAM and HBM, leading to a significant memory shortage that presents substantial market opportunities for memory manufacturers like Micron, Western Digital, and SanDisk.

- Micron's Market Edge: Micron's revenue soared to $13.6 billion over the past year, with projections of reaching $18.7 billion in Q2, as its limited production capacity and high gross margins solidify its competitive advantage, having already sold out through 2026.

- Western Digital's Strong Performance: Western Digital's stock surged over 50% at the start of 2026, coupled with a $4 billion share buyback announcement, highlighting its leadership in high-capacity 3D NAND flash memory essential for AI and data center storage needs.

- SanDisk's Resurgence: After separating from Western Digital, SanDisk reported a 31% revenue increase and a 64% rise in data center revenue in Q2, with expectations of adding over $1 billion in revenue next quarter, showcasing strong demand and pricing power in the NAND market.

- Tech Stock Rebound: The S&P 500 rose by 1.20% and the Dow Jones Industrial Average surged by 1.48%, reaching an all-time high, driven by better-than-expected tech earnings that boosted investor confidence in the sector's recovery.

- Bitcoin Recovery: Bitcoin rebounded over 7% from a 1.25-year low, lifting cryptocurrency-exposed stocks and alleviating concerns about liquidity in the crypto market, indicating renewed investor interest in digital assets.

- Amazon Investment Concerns: Amazon's announcement of a $200 billion investment in data centers, chips, and other equipment led to a more than 9% drop in its stock, raising doubts about the long-term returns of its AI investments and potentially impacting future investor confidence.

- Earnings Season Insights: With 79% of S&P 500 companies exceeding expectations and Q4 earnings projected to grow by 8.4%, this indicates strong corporate profitability, which may provide ongoing support for the market despite economic uncertainties.

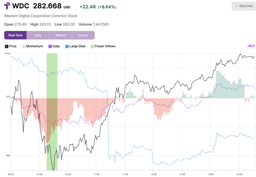

- Power Inflow Signal Overview: The Power Inflow alert, developed by TradePulse, is issued within the first two hours of trading, indicating a significant shift in order flow that suggests a strong trend toward buying activity, implying a bullish price movement for the remainder of the day.

- Real-Time Order Flow Analysis: By analyzing buying and selling trends from both retail and institutional traders, order flow analytics provide a deeper understanding of stock price behavior and market sentiment, enabling traders to make more informed decisions and enhance trading success rates.

- WDC Price Performance: At the time of the Power Inflow signal, WDC was priced at $262.53, and it reached an intraday high of $282.50 by 2:45 PM, reflecting a 7.61% increase, indicating a strong market response.

- Investment Risk Advisory: While the Power Inflow signal offers potential trading opportunities, the article emphasizes investment risks, including the possibility of principal loss, and advises investors to consult licensed financial advisors before making decisions.

- Tech Sector Decline: Qualcomm's (QCOM) forecast of weaker-than-expected Q2 revenue led to an over 8% drop in its stock, triggering a sell-off across the tech sector, with the Nasdaq 100 index hitting a 2.5-month low, indicating waning investor confidence in technology stocks.

- Weak Labor Market Signals: Challenger's report revealed a staggering 117.8% year-over-year increase in job cuts for January, totaling 108,435, the highest for January since 2009, while initial jobless claims rose by 22,000 to 231,000, highlighting vulnerabilities in the US labor market that could hinder economic recovery.

- Bitcoin Plunge: Bitcoin (^BTCUSD) plummeted over 12% to a 1.25-year low, reflecting deepening negative momentum in the cryptocurrency market, with approximately $2 billion flowing out of Bitcoin ETFs in the past month, signaling a decline in investor confidence.

- Earnings Season Impact: Despite 150 S&P 500 companies set to report earnings this week, market focus on economic data intensifies, with S&P 500 earnings expected to grow by 8.4% in Q4, yet overall market sentiment remains suppressed by recent economic weakness.