J.P. Morgan Downgrades PTC to Underweight Amid Market Weakness

PTC Inc. saw a decline of 4.05% in regular trading, hitting a 20-day low amid broader market weakness, with the Nasdaq-100 down 1.35% and the S&P 500 down 0.72%.

The downgrade from J.P. Morgan to Underweight, with a reduced price target from $205 to $162, reflects concerns over PTC's strategic focus on legacy CAD and PLM, which limits growth opportunities. Analysts highlighted intensified competition from Siemens and Dassault, as well as PTC's slow transition to cloud solutions, which could further impact its market position.

This downgrade may lead to increased scrutiny from investors as PTC prepares for its upcoming Q1 earnings report on February 4, where expectations for EPS and revenue growth remain high despite the recent negative sentiment.

Trade with 70% Backtested Accuracy

Analyst Views on PTC

About PTC

About the author

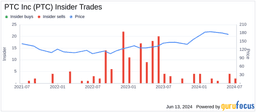

Share Sale Announcement: Kristian Talvitie plans to sell 28,196 shares of PTC Inc. on February 6, with a total market value of approximately $4.39 million.

Reduction in Shareholding: Talvitie has reduced his shareholding in PTC Inc. by 54,949 shares since December 5, 2025, with a total value of around $9.52 million.

- Strong Financial Performance: PTC reported a constant currency ARR of $2.341 billion in Q1, reflecting a 9% year-over-year growth, while including Kepware and ThingWorx, the ARR reached $2.5 billion, up 8.4%, indicating robust market growth and solid cash flow performance.

- Share Repurchase Program: The company repurchased $200 million of common stock in Q1 and plans to increase buybacks to $250 million in Q2, aiming to reduce the diluted share count to approximately 119 million shares, thereby enhancing shareholder value and market confidence.

- Accelerating Strategic Transformation: Management emphasized that PTC is at a strategic inflection point with accelerating product roadmap releases and record deferred ARR under contract, showcasing the company's strong demand capture capabilities under its Intelligent Product Lifecycle vision.

- Optimistic Future Outlook: CFO DiRico reaffirmed fiscal 2026 ARR growth guidance of 7.5%-9.5% and projected Q2 free cash flow between $310 million and $315 million, reflecting the company's confidence in future performance and ongoing financial health.

- Earnings Announcement: PTC is set to release its Q1 earnings report on February 4, with consensus EPS estimates at $1.56, reflecting a 41.8% year-over-year increase, which could further solidify its profitability in the industry.

- Revenue Expectations: The anticipated revenue of $634.33 million represents a 12.3% year-over-year growth, indicating that the company is maintaining strong performance in a continuously growing market, potentially attracting more investor interest.

- Historical Performance: Over the past two years, PTC has achieved a 100% accuracy rate in EPS estimates and an 88% accuracy rate in revenue estimates, showcasing its strong forecasting capabilities and enhancing market confidence in its future performance.

- Estimate Revision Dynamics: In the last three months, EPS estimates have seen 8 upward revisions and 4 downward revisions, while revenue estimates experienced 5 upward and 7 downward revisions, reflecting varying market perceptions of PTC's future performance, which may influence investor decisions.

- Surge in Natural Gas Demand: The massive snowstorm has led to a significant rise in natural gas demand, drawing attention to midstream companies like Targa Resources, whose stock is nearing all-time highs, reflecting market interest in energy infrastructure.

- Strong Performance by Targa Resources: Targa Resources reported a record adjusted EBITDA of $1.27 billion for Q3 2025, a 19% year-over-year increase, with net income reaching $478.4 million, showcasing robust growth in the natural gas transmission sector.

- Devon Energy Merger Talks: Devon Energy achieved an oil production average of 390,000 barrels per day in Q3 2025 and is in discussions to merge with Coterra Energy, potentially creating a $57 billion independent U.S. shale producer, indicating a trend towards industry consolidation.

- Corteva Raises Guidance: Corteva has raised its full-year 2025 EBITDA guidance to between $3.8 billion and $3.9 billion, representing a 14% growth, highlighting strong performance and renewed market confidence in the agricultural sector.

- Autodesk Upgrade: J.P. Morgan upgraded Autodesk from Neutral to Overweight with a price target of $319, highlighting its leadership in design and BIM software, rapid adoption of cloud and AI technologies, and positioning to capture larger market share in high-growth areas like data centers and infrastructure.

- PTC Downgrade: PTC's rating was downgraded to Underweight with a price target reduced from $205 to $162, as analysts noted its strategic narrowing and focus on legacy CAD and PLM, which diminishes growth options and exposes the company to risks as customer needs evolve.

- Accelerated Technological Change: Analysts emphasized Autodesk's forefront position in AI integration, enabling design optimization, rapid data access, and predictive modeling that streamline workflows and reduce project timelines, with customer feedback indicating a trend towards standardization on Autodesk for design and compliance needs.

- Intensified Market Competition: PTC faces strong competition from Siemens and Dassault in the PLM space, with analysts noting that its desktop-heavy CAD business and slow cloud evolution further weaken its competitive position, while customer dissatisfaction with reduced flexibility may lead them to explore alternative vendors.

Market Volatility: Last week saw increased volatility in equities, with the S&P 500 ending slightly up and the Nasdaq Composite slightly down after a steady interest rate announcement by the Federal Open Market Committee.

Microsoft's Earnings Impact: Microsoft experienced a significant drop of 10% in its stock value, resulting in a loss of $357 billion in market capitalization following a disappointing earnings report.

Silver Market Collapse: The silver market faced a dramatic decline, falling 31% in a single day, attributed to the nomination of hawkish Kevin Warsh as the next Fed Chair and a prior 50% increase in value this year.

Overall Economic Sentiment: The combination of these events reflects a turbulent economic sentiment, with investors reacting to both corporate earnings and shifts in monetary policy.