Ultra Clean Reports Third Quarter 2025 Financial Results

Financial Performance: Ultra Clean Holdings reported third-quarter 2025 revenue of $510 million, with a gross margin of 16.1% and a net loss of $10.9 million, showing improvement from the previous quarter's loss of $162 million.

Non-GAAP Results: On a non-GAAP basis, the company achieved a gross margin of 17.0% and net income of $12.9 million, indicating a positive trend compared to the prior quarter.

Fourth Quarter Outlook: The company anticipates fourth-quarter revenue between $480 million and $530 million, with expected GAAP diluted net income per share ranging from $(0.11) to $0.09.

Company Overview: Ultra Clean Holdings specializes in providing critical subsystems and services for the semiconductor industry, focusing on high-performance computing and innovation despite market volatility.

Trade with 70% Backtested Accuracy

Analyst Views on UCTT

About UCTT

About the author

- Strong Earnings Report: Datadog reported a quarterly earnings per share of $0.59, surpassing the analyst consensus estimate of $0.56, indicating a sustained enhancement in the company's profitability and reinforcing its leadership position in the cloud monitoring market.

- Sales Exceed Expectations: The company achieved quarterly sales of $953.194 million, exceeding the analyst consensus estimate of $916.577 million, demonstrating Datadog's robust performance in customer demand and market share, which may attract more investor interest.

- Significant Stock Surge: Following the positive earnings report, Datadog's shares jumped 16.3% to $132.59 on Tuesday, reflecting market optimism regarding the company's future growth potential, which could further bolster investor confidence.

- Overall Market Performance: U.S. stocks were generally higher, with the Dow Jones gaining around 200 points on Tuesday, indicating a positive sentiment towards tech stocks, potentially providing a more favorable investment environment for companies like Datadog.

- Earnings Release Schedule: Ultra Clean Holdings plans to announce its fourth quarter and full year 2025 financial results on February 23, 2026, after market close, reflecting the company's commitment to transparency and investor communication.

- Conference Call Details: The company will host a conference call at 1:45 PM PT on the same day, accessible by dialing 1-800-836-8184 or 1-646-357-8785, indicating a desire to enhance direct engagement with investors through open dialogue.

- Replay Service Availability: A replay of the call will be accessible by dialing 1-888-660-6345 or 1-646-517-4150, ensuring that investors who cannot participate live can still access key information, thereby improving information accessibility.

- Company Background: Ultra Clean Holdings is a leading developer and supplier of critical subsystems and ultra-high purity cleaning services for the semiconductor industry, showcasing its expertise in high-precision manufacturing and design-to-delivery cycle optimization, further solidifying its market position.

- Earnings Release Schedule: Ultra Clean Holdings plans to announce its fourth quarter and full year 2025 financial results on February 23, 2026, after market close, indicating the company's commitment to transparency and investor communication.

- Conference Call Details: The company will host a conference call at 1:45 PM PT on the same day, accessible by dialing 1-800-836-8184 or 1-646-357-8785, reflecting its proactive approach to investor relations.

- Replay Service Availability: A replay of the call will be accessible by dialing 1-888-660-6345 or 1-646-517-4150 with confirmation code 91919#, providing convenience for investors unable to attend live.

- Company Background Information: Ultra Clean Holdings specializes in critical subsystems and ultra-high purity cleaning services for the semiconductor industry, showcasing its competitive edge in high-precision manufacturing and design-to-delivery cycle improvements.

- Executive Departure: Ultra Clean Holdings announced that Harjinder Bajwa will leave the company effective January 25, 2026, marking a significant shift in management that could impact the company's strategic direction and operational efficiency.

- New COO Appointment: Robert Wunar has been appointed as Chief Operating Officer effective March 23, 2026; Wunar's previous role as COO/Managing Director of Business Unit Operations at Applied Materials suggests he will bring valuable industry experience to drive company growth.

- Market Reaction: Ultra Clean Holdings' stock rose 3.23% in premarket trading to $47.19, indicating investor optimism regarding the new executive appointment, which may signal positive changes ahead for the company.

- Strategic Implications: The addition of the new COO is expected to enhance the company's focus on technological innovation and operational efficiency, thereby strengthening Ultra Clean Holdings' competitive position in the semiconductor equipment market.

- Executive Transition: Ultra Clean Holdings announced the departure of COO Harjinder Bajwa effective January 25, 2026, with Robert Wunar set to take over on March 23, 2026, which is expected to enhance the company's operational efficiency and market responsiveness.

- Extensive Experience: Wunar brings over 30 years of operations and supply chain leadership in the semiconductor capital equipment industry, having served as COO at Applied Materials, where he was responsible for revenue and profitability across multiple product lines, providing valuable industry insights to Ultra Clean.

- Strategic Execution Focus: Wunar's customer-centric leadership style emphasizes speed and agility, which is anticipated to help Ultra Clean maintain competitiveness in the upcoming semiconductor market ramp, ensuring the quality and reliability that customers expect.

- Operational Optimization: Wunar has a proven track record of driving gross-margin improvement, enhancing on-time delivery, and reducing manufacturing cycle times, which will support the company's long-term growth strategy through the development of global manufacturing and supplier capabilities.

- RF Industries Earnings Report: On January 14, RF Industries reported Q4 net sales of $22.7 million, a 23% year-over-year increase, with CEO highlighting operational leverage from strategic transformation; however, the stock's RSI at 90.9 indicates overbought conditions despite an 82% surge in five days.

- Stock Performance: RF Industries' shares rose 10% to close at $11.99 on Wednesday, with a 52-week high of $12.12, prompting caution among investors regarding potential pullback risks despite strong short-term performance.

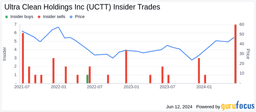

- Ultra Clean Holdings Analyst Rating: On January 20, Needham analyst Charles Shi maintained a Buy rating on Ultra Clean Holdings, raising the price target from $35 to $50, with the stock gaining 82% over the past month and an RSI of 89.8 indicating overbought status.

- Market Reaction: Ultra Clean Holdings' shares increased by 6.6% to close at $47.20 on Wednesday, nearing its 52-week high of $47.22, suggesting investors should monitor future market performance and potential adjustment risks.