Peter Thiel Increases Stakes in Apple and Microsoft Amid Contrasting Moves by Buffett and Gates

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 10 2026

0mins

Should l Buy AAPL?

Source: NASDAQ.COM

- Investment Strategy Contrast: Peter Thiel's recent increase in stakes in Apple and Microsoft during Q3 stands in stark contrast to the reductions made by Buffett and the Gates Foundation, indicating his confidence in the long-term growth potential of these companies.

- Microsoft's AI Leadership: Through its partnership with OpenAI, Microsoft secured a 27% equity stake and $250 billion in Azure commitments, resulting in a 39% revenue growth in its cloud services last quarter, further solidifying its leadership in the AI services market.

- Apple's Cash Flow Performance: Apple generated $99 billion in free cash flow in 2025, primarily used for share repurchases, driving a 23% increase in earnings per share, showcasing strong competitive strength despite limited capital expenditures on AI infrastructure.

- Future Growth Expectations: Analysts anticipate double-digit earnings per share growth for both Microsoft and Apple, and despite valuation concerns, the potential for AI products and services makes them attractive investment opportunities.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AAPL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AAPL

Wall Street analysts forecast AAPL stock price to rise

32 Analyst Rating

19 Buy

11 Hold

2 Sell

Moderate Buy

Current: 261.730

Low

230.00

Averages

299.69

High

350.00

Current: 261.730

Low

230.00

Averages

299.69

High

350.00

About AAPL

Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. Its product categories include iPhone, Mac, iPad, and Wearables, Home and Accessories. Its software platforms include iOS, iPadOS, macOS, watchOS, visionOS, and tvOS. Its services include advertising, AppleCare, cloud services, digital content and payment services. The Company operates various platforms, including the App Store, that allow customers to discover and download applications and digital content, such as books, music, video, games and podcasts. It also offers digital content through subscription-based services, including Apple Arcade, Apple Fitness+, Apple Music, Apple News+, and Apple TV+. Its products include iPhone 16 Pro, iPhone 16, iPhone 15, iPhone 14, iPhone SE, MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, Mac Pro, iPad Pro, iPad Air, AirPods, AirPods Pro, AirPods Max, Apple TV, Apple Vision Pro and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Impressive Earnings: Nvidia reported record revenue of $57 billion for Q3 FY2026, marking a 62% year-over-year increase and a 22% sequential rise, with earnings per share reaching $1.30, up 67%, showcasing the company's robust performance in the AI sector.

- Surge in Data Center Sales: The data center segment generated $51.2 billion in sales, a 66% increase year-over-year, reflecting the ongoing demand for AI and cloud computing, further solidifying Nvidia's market leadership.

- Optimistic Outlook: The company anticipates fourth-quarter revenue of $65 billion, representing approximately 66% year-over-year growth, while CEO's disclosure of a $500 billion backlog suggests significant revenue growth in the coming years.

- Market Value Potential: Analysts predict Nvidia's market cap could reach $20 trillion by 2030, requiring a 332% stock price increase, with expected annual revenue growth of over 34% in the next five years laying the groundwork for this ambitious target.

See More

- Significant Revenue Growth: Nvidia reported record revenue of $57 billion for Q3 FY2026, marking a 62% year-over-year increase and a 22% sequential rise, highlighting its strong performance and sustained market demand in the AI sector.

- Surge in Data Center Sales: The data center segment generated sales of $51.2 billion, up 66% year-over-year, indicating that the widespread adoption of AI is driving Nvidia's business growth and further solidifying its market leadership.

- Optimistic Future Outlook: Nvidia anticipates fourth-quarter revenue of $65 billion for FY2026, representing approximately 66% year-over-year growth, which will lay a solid foundation for continued growth, especially against the backdrop of its $500 billion backlog.

- Strong Market Forecasts: Analysts predict Nvidia's market cap will reach $20 trillion by 2030, implying a 332% increase in stock price, reflecting confidence in its future growth potential, particularly with expected 36% annual growth in data center revenue.

See More

- Political Bias Allegations: FTC Chairman Andrew Ferguson expressed concerns in a letter to Apple CEO Tim Cook regarding allegations that Apple News systematically favors left-leaning media, which could potentially violate the FTC Act and impact consumer access to diverse information.

- User Impact: Ferguson highlighted that Apple News is widely used in the U.S., and if it indeed suppresses conservative content, it could negatively affect the diversity of information available to users, potentially leading to a decline in public trust in the platform.

- Market Reaction: The FTC's letter comes as Apple celebrates its 50th anniversary, raising concerns about the company's management of political content, which could affect its brand image and user loyalty, especially amid increasing political polarization.

- Financial Context: With a market capitalization of $4.05 trillion and record financial results, this political controversy could impact Apple's market performance and investor confidence moving forward.

See More

- Market Leader Advantage: Alphabet commands approximately 90% of the online search market, establishing a strong moat through its Chrome browser and Android OS, which reinforces its dominant position in internet access and enhances its competitive edge.

- AI Technology Competitiveness: Alphabet's Gemini AI model, trained using its proprietary TPU chips, offers a significant cost advantage over competitors like Nvidia's GPUs, thereby driving growth in its search business and showcasing its innovation in AI.

- Cloud Business Growth: Alphabet's cloud computing segment experienced a remarkable 48% year-over-year revenue growth last quarter, leveraging the cost benefits of its TPUs, with plans to increase investment in AI infrastructure to solidify its market position further.

- Key Role in Semiconductor Industry: Taiwan Semiconductor Manufacturing Company (TSMC), as the world's largest chip foundry, plays an indispensable role in the semiconductor value chain, achieving high yields at scale and ramping up investments to meet surging chip demand, positioning itself as a long-term investment opportunity.

See More

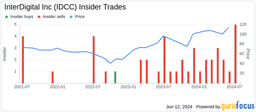

- Share Reduction Details: Bragg Financial Advisors disclosed in an SEC filing dated February 13, 2026, that it sold 33,239 shares of InterDigital (NASDAQ:IDCC), with an estimated transaction value of $11.75 million, indicating a cautious outlook on the company's future performance.

- Position Percentage Change: Following this sale, Bragg's stake in InterDigital now represents 1.42% of its 13F assets, down from 1.94%, reflecting a diminished confidence in the stock that could influence investor sentiment towards the company.

- Market Performance Analysis: As of February 12, 2026, InterDigital's shares were priced at $356.83, marking a 71.5% increase over the past year, significantly outperforming the S&P 500 by 58.63 percentage points, yet the sell-off may raise concerns about its future growth potential.

- Financial Metrics Overview: InterDigital reported $834 million in revenue and $406.64 million in net income over the past year, and while its patent licensing revenue can be volatile, the overall financial performance remains robust, with the CEO highlighting strong smartphone business performance, showcasing the company's ongoing competitive edge in technological innovation.

See More

- AI Fears Hit Financial Stocks: Concerns over a new AI-driven tax planning feature led to significant declines in Wells Fargo and Capital One, with shares dropping over 7.4% and nearly 7% respectively, highlighting investor sensitivity to potential threats in the wealth management sector, although Wells Fargo's rating upgrade on Friday provided some stabilization.

- Strong Performance in Industrials: Stocks like Eaton, Honeywell, and GE have continued their strong performance in 2026, with Eaton's shares rising over 4% last week and up 22% year-to-date, reflecting market optimism about economic recovery and driving what Jim Cramer describes as an

See More